Freddie Mac 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 Freddie Mac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

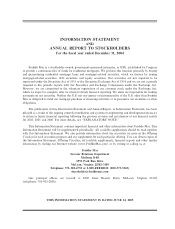

Loans Eligible for Purchase under Our Charter

Conforming Loan Limits

Our charter places a dollar amount cap on the size of the original principal balance of each single-family

mortgage loan we purchase, referred to as the conforming loan limit. The conforming loan limit is established

annually pursuant to a procedure prescribed by OFHEO. Table 1 presents a summary of the conforming loan

limits for 2005, 2004 and 2003.

Table 1 Ì Conforming Loan Limits(1)(2)

EÅective as of January 1,

2005 2004 2003

First-lien conventional, single-family mortgage loan limits:

One-family residence(3) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $359,650 $333,700 $322,700

Two-family residence ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $460,400 $427,150 $413,100

Three-family residence ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $556,500 $516,300 $499,300

Four-family residence ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $691,600 $641,650 $620,500

(1) The dollar limits shown are those eÅective January 1st through December 31st of each calendar year.

(2) The applicable conforming loan limits are 50 percent higher for mortgages secured by properties in Alaska, Guam, Hawaii and the

U.S. Virgin Islands.

(3) The conforming loan limit for second-lien mortgages on one-family residences is 50 percent of the limit for Ñrst-lien mortgages on

such residences. When both Ñrst- and second-lien mortgages are purchased, the total amount purchased may not exceed the

applicable conforming Ñrst-lien limit.

Loan-to-Value Ratios and Credit Enhancements

Conventional mortgages are mortgages that are not guaranteed or insured by any agency or instrumental-

ity of the U.S. government. Our charter prohibits us from purchasing Ñrst-lien conventional, single-family

mortgages if the unpaid principal balance at the time of purchase exceeds 80 percent of the value of the

property securing the mortgage, unless we have one or more of the following credit protections:

‚ mortgage insurance from an approved mortgage insurer that covers at least the portion of the mortgage

balance that exceeds 80 percent of the property's value;

‚ a seller's agreement to repurchase or replace (for periods and under conditions as we may determine)

any mortgage in default; or

‚ retention by the seller of at least a ten percent participation interest in the mortgages.

The loan-to-value ratio, or LTV, restriction does not apply to multifamily mortgages or to mortgages

insured by the Federal Housing Administration, or FHA, or the Rural Housing Service, or RHS, or partially

guaranteed by the Department of Veterans AÅairs, or VA.

Loan Quality

Under our charter we must limit our mortgage purchase and resecuritization activities, so far as

practicable, to mortgages that are of a quality, type and class that generally meet the purchase standards of

private institutional mortgage investors. This means the mortgage loans we purchase must be readily

marketable to institutional mortgage investors.

We design our mortgage loan underwriting guidelines to assess the creditworthiness of the borrower and

the borrower's capacity to fulÑll the obligations of the mortgage. We continuously review these guidelines to

ensure their eÅectiveness in order to address the changing needs of the marketplace so that more borrowers

can access mortgage Ñnancing. In some circumstances, we grant waivers or variances from our guidelines.

We also seek to distribute our guidelines through the most eÇcient means possible, including using Loan

Prospector», our automated underwriting service. While the ultimate responsibility for a lending decision rests

with the lender, Loan Prospector»provides our lender customers with a quick assessment of a loan's eligibility

for our purchase.

Freddie Mac

5