Eversource 2009 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2009 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

During 2009, the NU companies issued an aggregate of $462 million of debt, as follows:

CL&P issued $250 million of first mortgage bonds on February 13, 2009 with an interest rate of 5.5 percent and maturity date

of February 1, 2019.

CL&P remarketed $62 million of Pollution Control Revenue Bonds on April 2, 2009 which it had repurchased and had been

holding since 2008. The bonds carry a coupon of 5.25 percent and are subject to a mandatory tender for purchase on April 1,

2010, at which time they will be remarketed.

PSNH issued $150 million of first mortgage bonds on December 14, 2009 with an interest rate of 4.5 percent and a maturity

date of December 1, 2019.

As a result of Lehman Brothers Commercial Bank, Inc. (LBCB) refusing to continue to fund its commitment of approximately $56 million

under our credit facilities in 2008 described below, our aggregate borrowing capacity under our credit facilities was reduced from $900

million to $844 million. This borrowing capacity, when combined with our access to other funding sources, provides us with adequate

liquidity.

NU parent has a credit facility in a nominal aggregate amount of $500 million, $482.3 million excluding the commitment of LBCB, which

expires on November 6, 2010. As of December 31, 2009, NU parent had $41 million of letters of credit (LOCs) issued for the benefit of

certain subsidiaries (primarily PSNH) and $100.3 million of borrowings outstanding under this facility. The weighted-average interest

rate on these short-term borrowings as of December 31, 2009 was 0.63 percent, which is based on a variable rate plus an applicable

margin based on NU parent's credit ratings.

The regulated companies maintain a joint credit facility in a nominal aggregate amount of $400 million, $361.8 million excluding the

commitment of LBCB, which also expires on November 6, 2010. There were no borrowings outstanding under this facility as of

December 31, 2009.

Our credit facilities and bond indentures require that NU parent and certain of its subsidiaries, including CL&P, PSNH and WMECO,

comply with certain financial and non-financial covenants as are customarily included in such agreements, including maintaining a ratio

of consolidated debt to total capitalization of no more than 65 percent. All such companies currently are, and expect to remain in

compliance with these covenants.

While we expect to renew our credit facilities in November, 2010, costs associated with the new facilities are likely to be higher than

those associated with the existing credit facilities due to market conditions.

We are planning long-term debt issuances in 2010 aggregating approximately $145 million with $95 million being issued by WMECO

and $50 million being issued by Yankee Gas. The proceeds from these financings will be used primarily to repay short-term borrowings

and fund our capital programs. On January 22, 2010, the DPUC approved WMECO’s application to issue and sell up to $150 million of

senior secured or unsecured long-term debt.

For more information regarding NU and its subsidiaries' financing, see Note 2, "Short-Term Debt," and Note 11, "Long-Term Debt," to

the Consolidated Financial Statements and "Liquidity" under Item 7, Management's Discussion and Analysis of Financial Condition and

Results of Operations in this Annual Report on Form 10-K.

NUCLEAR DECOMMISSIONING

General

CL&P, PSNH, WMECO and other New England electric utilities are stockholders in three inactive regional nuclear generation

companies, Connecticut Yankee Atomic Power Company (CYAPC), Maine Yankee Atomic Power Company (MYAPC) and Yankee

Atomic Electric Company (YAEC) (the Yankee Companies). The Yankee Companies have completed the physical decommissioning of

their respective generation facilities and are now engaged in the long-term storage of their spent nuclear fuel. Each Yankee Company

collects decommissioning and closure costs through wholesale FERC-approved rates charged under power purchase agreements with

CL&P, PSNH and WMECO and several other New England utilities. These companies in turn recover these costs from their customers

through state regulatory commission-approved retail rates. The ownership percentages of CL&P, PSNH and WMECO in the Yankee

Companies are set forth below:

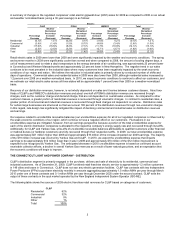

CL&P PSNH WMECO Total

CYAPC 34.5% 5.0% 9.5% 49.0%

MYAPC 12.0% 5.0% 3.0% 20.0%

YAEC 24.5% 7.0% 7.0% 38.5%

Our share of the obligations to support the Yankee Companies under FERC-approved contracts is the same as the ownership

percentages above.

For more information regarding decommissioning and nuclear assets, see "Deferred Contractual Obligations" under Item 7,

Management's Discussion and Analysis of Financial Condition and Results of Operations, in this Annual Report on Form 10-K.