Eversource 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

PSNH is constructing its Clean Air Project, a sulfur dioxide and mercury scrubber at its Merrimack coal-fired generation station,

currently expected to cost $457 million. The project is expected to be under budget and completed in mid-2012. PSNH will recover all

related costs through its ES rates. PSNH has spent approximately $146.8 million on the project to date, of which $119.3 million was

capitalized in 2009. Construction of the project was approximately 34 percent complete as of December 31, 2009.

Sources and Availability of Electric Power Supply

During 2009, about 67.7 percent of PSNH’s load was met through its own generation, long-term power supply provided pursuant to

orders of the NHPUC, and contracts with third parties. The remaining 32.3 percent of PSNH's load was met by short-term (less than

one year) purchases and spot purchases in the competitive New England wholesale power market. PSNH expects to meet its load

requirements in 2010 in a similar manner.

New Hampshire’s "Electric Renewable Portfolio Standard Act" establishes renewable portfolio standards (RPS) for electricity sold in the

state and requires annual increases in the percentage of the electricity sold to retail customers having direct ties to renewable sources.

The renewable sourcing requirements began in 2008 and increase each year to reach 23.8 percent by 2025. For each MWh of energy

produced from a qualifying resource, the producer will receive one REC. Energy suppliers, like PSNH, purchase RECs from these

producers and use them to satisfy the RPS requirements. PSNH also owns renewable sources and uses internally generated RECs in

meeting its RPS obligations. To the extent that PSNH is unable to purchase sufficient RECs, it makes up the difference between the

RECs purchased and its total obligation by making an alternative compliance payment (ACP) for each REC requirement for which

PSNH is deficient. The costs of both the RECs and ACPs do not impact earnings, as these costs are recovered by PSNH through its

ES rates. For further information, see "Regulatory Developments and Rate Matters" in Item 7, Management's Discussion and Analysis

of Financial Condition and Results of Operations, in this Annual Report on Form 10-K.

WESTERN MASSACHUSETTS ELECTRIC COMPANY - DISTRIBUTION

WMECO’s distribution segment is engaged in the purchase, delivery and sale of electricity to residential, commercial and industrial

customers. At December 31, 2009, WMECO furnished retail franchise electric service to approximately 205,000 retail customers in 59

cities and towns in the western third of Massachusetts. WMECO does not own any electricity generating facilities. WMECO has

contracts with two IPPs, the output of which WMECO sells into the market.

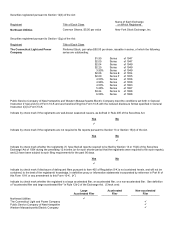

The following table shows the sources of 2009 electric franchise retail revenues based on categories of customers:

WMECO

Residential 58%

Commercial 32%

Industrial 9%

Other 1%

Total 100%

Rates

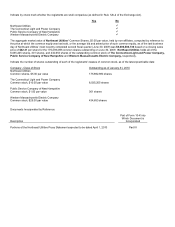

WMECO is subject to regulation by the Massachusetts Department of Public Utilities (DPU), which has jurisdiction over, among other

things, rates, accounting procedures, certain dispositions of property and plant, mergers and consolidations, issuances of long-term

securities, acquisition of securities, standards of service, management efficiency and construction and operation of distribution,

production and storage facilities. WMECO's present general rate structure consists of various rate and service classifications covering

residential, commercial and industrial services. Massachusetts utilities are entitled under state law to charge rates that are sufficient to

allow them an opportunity to cover their reasonable operation and capital costs, to attract needed capital and maintain their financial

integrity, while also protecting relevant public interests.

Under state law, all of WMECO's customers are now entitled to choose their energy suppliers, while WMECO remains their distribution

company. WMECO purchases electric power for and passes through the cost to those customers who do not choose a competitive

energy supplier (basic service). Basic service charges are adjusted and reconciled on an annual basis. Most of WMECO's residential

and smaller customers have continued to buy their power from WMECO at basic service rates. A greater proportion of large

commercial and business customers have opted for a competitive energy supplier.

WMECO recovers certain costs through various tracking mechanisms in its retail rates, including transmission costs and prudently

incurred stranded costs (a portion of which have been financed through securitization by issuing RRBs) with periodic true-up

adjustments. The last such adjustment, effective January 1, 2010, resulted in a 3.7 percent increase in customer rates.

On September 2, 2008, WMECO notified the DPU that it expects to file its next distribution rate case in mid-2010 to be effective January

1, 2011. That case will include a proposal to fully decouple distribution revenues from Kilowatt-hours (KWh) sales in compliance with

the DPU’s July 16, 2008 decision in a generic decoupling docket. We expect a decision from the DPU by the end of 2010.