Eversource 2009 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2009 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

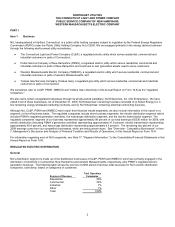

12

Year

(Millions of Dollars) 2009 2010 2011 2012 2013

2014

2010-2014

Totals

CL&P transmission $ 163 $ 136 $ 203 $ 281 $ 286 $ 155 $ 1,061

PSNH transmission 61 55 118 107 74 22 376

WMECO transmission 68 66 256 328 156 6 812

HQ tie line Project - 16 49 90 236 282 673

Subtotal transmission $ 292 $ 273 $ 626 $ 806 $ 752 $ 465 $ 2,922

CL&P distribution 283 305 313 306 305 317 1,546

PSNH distribution 99 113 111 115 121 134 594

WMECO distribution 38 33 39 36 35 36 179

Subtotal electric distribution $ 420 $ 451 $ 463 $ 457 $ 461 $ 487 $ 2,319

PSNH generation 145 187 117 82 68 26 480

WMECO generation - 20 14 7 - - 41

Subtotal generation $ 145 $ 207 $ 131 $ 89 $ 68 $ 26 $ 521

Yankee Gas distribution 60 112 104 80 82 83 461

Corporate service companies 52 48 25 22 25 14 134

Totals $ 969 $ 1,091 $ 1,349 $ 1,454 $ 1,388 $ 1,075 $ 6,357

For more information regarding NU and its subsidiaries' construction and capital improvement programs, see "Business Development

and Capital Expenditures" under Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations,

contained in this Annual Report on Form 10-K.

STATUS OF COMPETITIVE ENERGY BUSINESSES

Since 2005, we have been in the process of exiting our competitive energy businesses and are now focusing predominantly on our

regulated businesses. At December 31, 2009, our competitive businesses consisted of (i) Select Energy’s few remaining wholesale

energy marketing contracts, and NGS and its affiliates, which are winding down, and (ii) Boulos, NU Enterprises’ remaining active

electrical contracting business.

Select Energy’s wholesale energy contract with The New York Municipal Power Agency (NYMPA) and related energy supply contracts

expire in 2013. In addition to the NYMPA contract, Select Energy's only other long-term wholesale obligation is a contract to operate

and purchase the output of a generating facility in New England through mid-2012.

For more information regarding our exit from competitive businesses, see "NU Enterprises Divestitures" under Item 7, Management's

Discussion and Analysis of Financial Condition and Results of Operations, and Note 1B, "Summary of Significant Accounting Policies –

Presentation," to the Consolidated Financial Statements, in this Annual Report on Form 10-K.

FINANCING

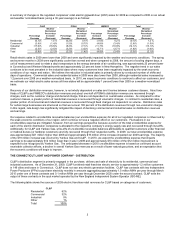

We paid common dividends of $162.4 million in 2009, compared with $129.1 million in 2008. The increase is the result of increases of

6.3 percent and 11.8 percent in our common dividend rate that took effect in the third quarter of 2008 and in the first quarter of 2009,

respectively, and a higher number of shares outstanding in the second, third and fourth quarters of 2009. On February 9, 2010, our

Board of Trustees declared a common dividend of $0.25625 per share, ($1.025 on an annual basis) payable on March 31, 2010 to

shareholders of record as of March 1, 2010 representing an increase of approximately 7.9 percent over the 2009 dividend rate.

We target paying out approximately 50 percent of consolidated earnings in the form of common dividends. Our ability to pay common

dividends is subject to approval by our Board of Trustees and our future earnings and cash flow requirements and may be limited by

certain state statutes, the leverage restrictions in our revolving credit agreement and the ability of our subsidiaries to pay common

dividends to NU. The Federal Power Act limits the payment of dividends by CL&P, PSNH and WMECO to their respective retained

earnings balances unless a higher amount is approved by FERC, and PSNH is required to reserve an additional amount of retained

earnings under its FERC hydroelectric license conditions. Relevant state statutes may impose additional limitations on the payment of

dividends by the regulated companies. CL&P, PSNH, WMECO and Yankee Gas also are parties to a revolving credit agreement that

imposes leverage restrictions.

In general, the regulated companies pay approximately 60 percent of their earnings to NU parent in the form of common dividends. In

2009, CL&P, PSNH, WMECO, and Yankee Gas paid $113.8 million, $40.8 million, $18.2 million, and $19.1 million, respectively, in

common dividends to NU parent. In 2009, NU parent made equity contributions of $147.6 million, $68.9 million, $0.9 million and

$2.7 million to CL&P, PSNH, WMECO and Yankee Gas, respectively.