Eversource 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 Combined Annual Report & Form 10-K

NORTHEAST UTILITIES

The Connecticut Light and Power Company

Public Service Company of New Hampshire

Western Massachusetts Electric Company

Table of contents

-

Page 1

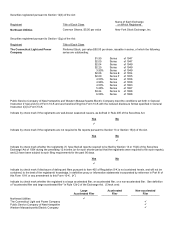

2009 Combined Annual Report & Form 10-K NORTHEAST UTILITIES The Connecticut Light and Power Company Public Service Company of New Hampshire Western Massachusetts Electric Company -

Page 2

..., WMECo Electric & Gas Operating Company Ofï¬cers CL&P - The Connecticut Light and Power Company PSNH - Public Service Company of New Hampshire WMECo - Western Massachusetts Electric Company Yankee Gas - Yankee Gas Services Company Charles W. Shivery Chairman, CL&P, PSNH, WMECo and Yankee Gas Leon... -

Page 3

...; Address; and Telephone Number I.R.S. Employer Identification No. 1-5324 NORTHEAST UTILITIES (a Massachusetts voluntary association) One Federal Street Building 111-4 Springfield, Massachusetts 01105 Telephone: (413) 785-5871 THE CONNECTICUT LIGHT AND POWER COMPANY (a Connecticut corporation... -

Page 4

... filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one): Large Accelerated Filer Northeast Utilities The Connecticut Light and Power Company Public Service Company of New Hampshire Western Massachusetts Electric Company Accelerated Filer Non-accelerated Filer No No -

Page 5

... 30, 2009. Northeast Utilities holds all of the 6,035,205 shares, 301 shares, and 434,653 shares of the outstanding common stock of The Connecticut Light and Power Company, Public Service Company of New Hampshire and Western Massachusetts Electric Company, respectively. Indicate the number of shares... -

Page 6

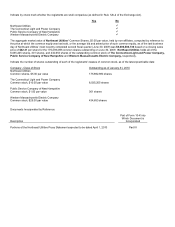

... NUSCO NU parent and other companies E. S. Boulos Company The Connecticut Light and Power Company HWP Company, formerly Holyoke Water Power Company North Atlantic Energy Service Corporation Northeast Generation Company Northeast Generation Services Company and subsidiaries Northeast Utilities and... -

Page 7

... and Load Management Contract for Differences Cost of Living Adjustment Competitive Transition Assessment Connecticut Yankee Atomic Power Company Earnings Per Share Default Energy Service Employee Stock Ownership Plan Employee Stock Purchase Plan Financial Accounting Standards Board Federally... -

Page 8

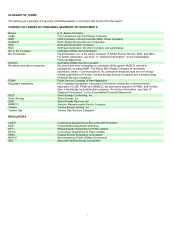

NORTHEAST UTILITIES THE CONNECTICUT LIGHT AND POWER COMPANY PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE WESTERN MASSACHUSETTS ELECTRIC COMPANY 2009 Form 10-K Annual Report Table of Contents Part I Item 1. Business Page 2 17 20 20 22 23 Item 1A. Risk Factors Item 1B. Unresolved Staff Comments Item 2. ... -

Page 9

NORTHEAST UTILITIES THE CONNECTICUT LIGHT AND POWER COMPANY PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE WESTERN MASSACHUSETTS ELECTRIC COMPANY SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 References in this Annual Report on Form 10-K to "NU," "we," "our," and "us" ... -

Page 10

... in parts of western Massachusetts; and Yankee Gas Services Company (Yankee Gas), a regulated gas utility which serves residential, commercial and industrial customers in parts of Connecticut. We sometimes refer to CL&P, PSNH, WMECO and Yankee Gas collectively in this Annual Report on Form 10-K as... -

Page 11

...natural gas prices, and an expectation that the economic conditions will begin to improve. THE CONNECTICUT LIGHT AND POWER COMPANY - DISTRIBUTION CL&P's distribution segment is primarily engaged in the purchase, delivery and sale of electricity to its residential, commercial and industrial customers... -

Page 12

... CL&P FMCC rates. Sources and Availability of Electric Power Supply As noted above, CL&P does not own any generation assets and purchases energy to serve its Standard Service and Supplier of Last Resort Service loads from a variety of competitive sources through periodic requests for proposals (RFPs... -

Page 13

... offer electricity supply at lower prices than PSNH. At December 31, 2009, approximately 28.1 percent of PSNH's customers, mostly large commercial and industrial customers, had switched to other energy suppliers. The increased level of migration has caused an increase in the ES rate, as fixed costs... -

Page 14

...Financial Condition and Results of Operations, in this Annual Report on Form 10-K. WESTERN MASSACHUSETTS ELECTRIC COMPANY - DISTRIBUTION WMECO's distribution segment is engaged in the purchase, delivery and sale of electricity to residential, commercial and industrial customers. At December 31, 2009... -

Page 15

... Developments and Rate Matters" in Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, in this Annual Report on Form 10K. WMECO is subject to service quality (SQ) metrics that measure safety, reliability and customer service. Any charges incurred for... -

Page 16

.... Yankee Gas considers such transportation arrangements adequate for its needs. REGULATED ELECTRIC TRANSMISSION General CL&P, PSNH and WMECO and most other New England utilities, generation owners and marketers are parties to a series of agreements that provide for coordinated planning and operation... -

Page 17

...-NE charges to the distribution segments of CL&P, PSNH and WMECO which are collected under ISO-NE's FERC Electric Tariff No. 3, Transmission, Markets and Services Tariff (Tariff No. 3). Tariff No. 3 includes the Regional Network Service (RNS) and Schedule 21 - NU rate schedules to recover costs of... -

Page 18

..."Transmission Rate Matters and FERC Regulatory Issues" and "Business Development and Capital Expenditures" under Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations contained in this Annual Report on Form 10K. CONSTRUCTION AND CAPITAL IMPROVEMENT PROGRAM The... -

Page 19

... $441 million is expected to be expended by CL&P, $355 million by PSNH, $119 million by WMECO and $112 million by Yankee Gas. This capital budget includes anticipated costs for all committed capital projects (i.e. generation, transmission, distribution, environmental compliance and others) and those... -

Page 20

... general, the regulated companies pay approximately 60 percent of their earnings to NU parent in the form of common dividends. In 2009, CL&P, PSNH, WMECO, and Yankee Gas paid $113.8 million, $40.8 million, $18.2 million, and $19.1 million, respectively, in common dividends to NU parent. In 2009, NU... -

Page 21

... Condition and Results of Operations in this Annual Report on Form 10-K. NUCLEAR DECOMMISSIONING General CL&P, PSNH, WMECO and other New England electric utilities are stockholders in three inactive regional nuclear generation companies, Connecticut Yankee Atomic Power Company (CYAPC), Maine Yankee... -

Page 22

...generally require fixed percentages of energy supply to come from renewable energy sources such as solar, hydropower, landfill gas, fuel cells and other similar sources. New Hampshire's RPS provision requires increasing percentages of the electricity PSNH sells to its retail customers to have direct... -

Page 23

... by 2020. Massachusetts' RPS program required electricity suppliers to meet a 1 percent renewable energy standard in 2003, which increased to 4 percent for 2009 and has a goal of 15 percent by 2015. Any costs incurred in complying with RPS would be passed on to customers through rates. In addition... -

Page 24

... Utilities Service Company (NUSCO). Approximately 2,231 employees of CL&P, PSNH, WMECO, NUSCO and Yankee Gas are members of the International Brotherhood of Electrical Workers and The United Steelworkers and are covered by 11 union agreements. INTERNET INFORMATION Our website address is www.nu... -

Page 25

...our earnings, liquidity and business activities. The rates that our regulated companies charge their respective retail and wholesale customers are determined by their state utility commissions and by FERC. These commissions also regulate the companies' accounting, operations, the issuance of certain... -

Page 26

...energy requirements for PSNH are currently met primarily through PSNH's generation resources and fixed-price forward purchase contracts. PSNH's remaining energy needs are met primarily through spot market purchases. Unplanned forced outages of its generating plants could increase the level of energy... -

Page 27

...both our operational and financial performance. We cannot guarantee that any member of our management or any key employee at the NU parent or subsidiary level will continue to serve in any capacity for any particular period of time. In addition, a significant portion of our workforce, including many... -

Page 28

... dependent upon the specific requirements adopted and cannot be determined at this time. For further information, see Item 1, Business - "Other Regulatory and Environmental Matters" in this Annual Report on Form 10-K. As a holding company with no revenue-generating operations, NU parent is dependent... -

Page 29

... areas in which it is now supplying such service. In addition to the right to distribute electricity as set forth above, the franchises of PSNH include, among others, rights and powers to manufacture, generate, purchase, and transmit electricity, to sell electricity at wholesale to other utility... -

Page 30

... - Human Resources of Northeast Utilities Service Company (NUSCO), a subsidiary of NU. Executive Vice President and Chief Financial Officer of NU. Executive Vice President and Chief Operating Officer of NU. Senior Vice President, Enterprise Planning and Development of NUSCO. Chairman of the Board... -

Page 31

..., 2004. David R. McHale. Mr. McHale was elected Executive Vice President and Chief Financial Officer of NU, CL&P, WMECO and PSNH, effective January 1, 2009, elected a Director of PSNH and WMECO, effective January 1, 2005, of CL&P effective January 15, 2007 and of Northeast Utilities Foundation, Inc... -

Page 32

... Combined Notes to Consolidated Financial Statements, within this Annual Report on Form 10-K. There is no established public trading market for the common stock of CL&P, PSNH and WMECO. All of the common stock of CL&P, PSNH and WMECO is held solely by NU. During 2009 and 2008, CL&P approved and paid... -

Page 33

... Operations Attributable to Controlling Interest Cumulative Effects of Accounting Changes, Net of Tax Benefits Net Income/(Loss) Attributable to Controlling Interest Basic Common Shares Outstanding (Average) Fully Diluted Common Shares Outstanding (Average) Dividends Per Share Market Price - Closing... -

Page 34

... 382,692 507,086 498 WMECO Selected Consolidated Financial Data (Unaudited) (Thousands of Dollars) 2009 2008 2007 2006 2005 Operating Revenues Net Income Cash Dividends on Common Stock Property, Plant and Equipment, net Total Assets Rate Reduction Bonds Long-Term Debt (a) Obligations Under Capital... -

Page 35

..., which consist of The Connecticut Light and Power Company (CL&P), Public Service Company of New Hampshire (PSNH), Western Massachusetts Electric Company (WMECO), and Yankee Gas Services Company (Yankee Gas), earned $323.5 million, or $1.87 per share, in 2009, compared with $289.1 million, or... -

Page 36

... differences between allowed temporary rates and permanent rates will be reconciled back to August 1, 2009. On August 12, 2009, the Massachusetts Department of Public Utilities (DPU) approved the installation of 6 MW of solar energy generation in WMECO's service territory at an estimated cost of $41... -

Page 37

...fuel, materials and supplies in 2009 (largely due to lower amounts spent for Yankee Gas storage due to lower natural gas prices); and the absence in 2009 of the litigation settlement payment of $49.5 million made in March 2008. We project consolidated cash flows provided by operating activities, net... -

Page 38

...from improved collection efforts of customer receivables and higher distribution revenues. For the distribution segment of our regulated companies, a summary of changes in CL&P, PSNH and WMECO retail electric gigawatthour (GWh) sales and Yankee Gas firm natural gas sales for 2009 as compared to 2008... -

Page 39

...the electric distribution companies is allocated to the respective company's energy supply rate and recovered through its tariffs. Additionally, for CL&P and Yankee Gas, write-offs of uncollectible receivable balances attributable to qualified customers under financial or medical duress (or hardship... -

Page 40

... which time CL&P expects to remarket the bonds with a new coupon rate set through an auction process. Our planned financings for 2010 total approximately $145 million of new long-term debt to be issued in the first half of the year comprised of $95 million at WMECO and $50 million at Yankee Gas. We... -

Page 41

... $200 million into our pension plan in 2011. A summary of the current credit ratings and outlooks by Moody's Investors Service (Moody's), Standard & Poor's (S&P) and Fitch Ratings (Fitch) for senior unsecured debt of NU parent and WMECO and senior secured debt of CL&P and PSNH is as follows: Moody... -

Page 42

... general, the regulated companies pay approximately 60 percent of their earnings to NU parent in the form of common dividends. In 2009, CL&P, PSNH, WMECO, and Yankee Gas paid $113.8 million, $40.8 million, $18.2 million, and $19.1 million, respectively, in common dividends to NU parent. In 2009, NU... -

Page 43

... Power Company, which were transferred to WMECO in December 2008. In October 2008, CL&P and WMECO made state siting filings in Connecticut and Massachusetts, respectively, for the first and largest component of our New England East-West Solutions (NEEWS) project, the Greater Springfield Reliability... -

Page 44

... utility. Under the proposed arrangement, NU and NSTAR would sell to HQ 1,200 MW of firm electric transmission service over the HQ tie line project in order for HQ to sell and deliver this same amount of firm electric power from Canadian low-carbon energy resources to New England. The FERC granted... -

Page 45

... CL&P transmission PSNH transmission WMECO transmission HQ tie line project Subtotal transmission CL&P distribution PSNH distribution WMECO distribution Subtotal electric distribution PSNH generation WMECO generation Subtotal generation Yankee Gas distribution Corporate service companies Totals... -

Page 46

...recover all regional and local revenue requirements. These rates provide for annual true-ups to actual costs. The financial impacts of differences between actual and projected costs are deferred for future recovery from or refund to customers. As of December 31, 2009, NU was in a total underrecovery... -

Page 47

... rate increase. Hearings before the DPUC are scheduled to begin in March 2010 and a decision is expected in mid-2010. Standard Service and Last Resort Service Rates: CL&P's residential and small commercial customers who do not choose competitive suppliers are served under Standard Service (SS) rates... -

Page 48

... CL&P's customers. Procurement Fee Rate Proceedings: In prior years, CL&P submitted to the DPUC its proposed methodology to calculate the variable incentive portion of its transition service procurement fee, which was effective for the years 2004, 2005 and 2006, and requested approval of the pre-tax... -

Page 49

... in the long-term storage of their spent fuel. The Yankee Companies collect decommissioning and closure costs through wholesale, FERC-approved rates charged under power purchase agreements with several New England utilities, including our electric utility subsidiaries. These companies recover these... -

Page 50

...activity at the other energy services businesses other than E.S. Boulos Company (Boulos), an electrical contractor based in Maine that we continue to own and manage. NU Enterprises Contracts Wholesale Energy Contracts: NU Enterprises' wholesale energy contracts (managed through its subsidiary Select... -

Page 51

... an evaluation of potential counterparties' financial condition (including credit ratings), collateral requirements under certain circumstances (including cash advances, LOCs, and parent guarantees), and the use of standardized agreements that allow for the netting of positive and negative exposures... -

Page 52

... Changes in these estimates, assumptions and judgments, in and of themselves, could materially impact our financial position, results of operations or cash flows. Our management communicates to and discusses with our Audit Committee of the Board of Trustees critical accounting policies and estimates... -

Page 53

.... We have not been required to make a contribution to the Pension Plan since 1991. As of January 1, 2010 and 2009, the fair value of our Pension Plan assets decreased from prior years due primarily to negative financial market conditions. On October 7, 2009, the Internal Revenue Service issued final... -

Page 54

...increase to the Pension Plan's and PBOP Plan's reported cost as a result of a change in the following assumptions by 50 basis points (in millions): As of December 31, Pension Plan Cost Postretirement Plan Cost 2009 2008 2009 2008 Assumption Change Lower long-term rate of return Lower discount rate... -

Page 55

... we recorded a net after-tax reduction of 2008 earnings of $3.2 million related to Select Energy's remaining wholesale marketing contracts. We also recorded changes in fair value of certain derivative contracts of CL&P. Because CL&P is a cost-of-service, rate regulated entity, the cost or benefit of... -

Page 56

... million for NU of net changes in fair value of hedged debt and a negative $5.4 million and $4.8 million for NU and CL&P, respectively, of net unamortized premium and discount as of December 31, 2009. (c) Estimated interest payments on fixed-rate debt are calculated by multiplying the coupon rate on... -

Page 57

... operating leases, estimated future annual regulated company costs and the estimated future annual NU Enterprises costs. These payments are subject to change as certain purchase orders include estimates based on projected quantities of material and/or services that are provided on demand, the timing... -

Page 58

This Page Intentionally Left Blank -

Page 59

... CL&P and PSNH retail rates, partially offset by lower retail electric sales. Retail electric sales for the regulated companies decreased 3.5 percent. Gas distribution revenues decreased $128 million due primarily to decreased recovery of fuel costs primarily as a result of lower prices, partially... -

Page 60

... increase in deferred fuel costs, at Yankee Gas ($133 million) due to a decrease in gas prices in 2009 as compared to 2008, at WMECO ($45 million) due primarily to lower Basic/Default supply costs, and at PSNH ($38 million) due to an increased level of migration of ES customers to competitive supply... -

Page 61

... purchased power costs. The decrease in GSC supply costs was due primarily to a reduction in load caused primarily by customer migration to third party suppliers and lower retail sales ($432 million), partially offset by higher Yankee Gas expenses ($41 million) due primarily to higher fuel prices... -

Page 62

... to higher Connecticut gross earnings tax ($16 million) mainly as a result of higher CL&P and Yankee Gas revenues that are subject to gross earnings tax and higher property taxes at CL&P and PSNH ($5 million) as a result of higher plant balances and higher local municipal tax rates, partially offset... -

Page 63

...sales of CL&P's IPP purchased generation output to ISO-NE due to a decrease in the market price of energy ($163 million), partially offset by higher retail transmission revenues ($75 million). The lower GSC and supply-related FMCC revenue was due primarily to lower retail sales, lower customer rates... -

Page 64

...2009 due primarily to higher utility plant balances resulting from completed construction projects placed into service in the transmission segment ($19 million) and the distribution segment ($5 million). Amortization of Regulatory Assets, Net Amortization of regulatory assets, net expenses decreased... -

Page 65

...various suppliers that have been awarded the right to supply standard service (SS) and last resort service (LRS) load through a competitive solicitation process. The $174 million decrease in deferred fuel costs was due primarily to the combined effect of CL&P having a supply and delivery-related net... -

Page 66

... increases in the negative cash flow effect of our accounts payable balances related to operating activities and change in the amount of income tax refunds or payments. We project cash flows provided by operating activities at CL&P of approximately $440 million in 2010, net of RRB payments. In 2009... -

Page 67

... Net Interchange Power Fuel, purchased and net interchange power costs decreased $38 million in 2009 due primarily to an increased level of migration of ES customers to competitive supply and lower retail sales, partially offset by higher forward energy market prices. Other Operation Other operation... -

Page 68

...lower rate based on borrowing costs. Income Tax Expense Income tax expense increased $10 million in 2009 due primarily to higher pre-tax earnings ($6 million) and less favorable depreciation deduction adjustments ($2 million). Comparison of the Year 2008 to the Year 2007 Operating Revenues Operating... -

Page 69

Fuel, Purchased and Net Interchange Power Fuel, purchased and net interchange power costs increased $28 million in 2008 due primarily to higher forward energy market prices, partially offset by a decrease in payments to higher priced IPPs in 2008 as contracts expired. Other Operation Other operation... -

Page 70

... the difference to be deferred for future collection or refund. Lower other purchased power costs are due primarily to a decrease in costs associated with customer generation and IPPs. Other Operation Other operation expenses increased $9 million in 2009 as a result of higher retail transmission and... -

Page 71

...and higher operating expenses that are passed through to customers under FERC-approved transmission tariffs. Fuel, Purchased and Net Interchange Power Fuel, purchased and net interchange power expenses increased $1 million in 2008 due primarily to higher Basic/Default Service supply costs, partially... -

Page 72

... to vendors in 2009. These costs were deferred and are expected to be recovered from customers. WMECO anticipates filing a distribution rate case in mid-2010, which would include a request for the timely recovery of the December 2008 storm costs. This impact was offset by a decrease in the negative... -

Page 73

...a wide variety of customers and suppliers that include IPPs, industrial companies, gas and electric utilities, oil and gas producers, financial institutions, and other energy marketers. Margin accounts exist within this diverse group, and we realize interest receipts and payments related to balances... -

Page 74

...about market risk are set forth in Part II, Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, included in this Annual Report on Form 10-K. Item 8. Financial Statements and Supplementary Data NU, CL&P, PSNH and WMECO. The Consolidated Financial Statements... -

Page 75

..., 2004. David R. McHale. Mr. McHale was elected Executive Vice President and Chief Financial Officer of NU, CL&P, WMECO and PSNH, effective January 1, 2009, elected a Director of PSNH and WMECO, effective January 1, 2005, of CL&P effective January 15, 2007 and of Northeast Utilities Foundation, Inc... -

Page 76

... is applicable to all Trustees, directors, officers, employees, contractors and agents of NU, CL&P, PSNH and WMECO. The Code of Ethics and the Standards of Business Conduct have both been posted on the NU web site and are available at www.nu.com/investors/corporate_gov/default.asp on the Internet... -

Page 77

...Principal Accountant Fees and Services The information required by this Item for The Connecticut Light and Power Company, Public Service Company of New Hampshire and Western Massachusetts Electric Company and subsidiaries is omitted from this report but are set forth in the Annual Report on Form 10... -

Page 78

... Northeast Utilities (Parent) Statements of Cash Flows for the Years Ended December 31, 2009, 2008 and 2007 II. Valuation and Qualifying Accounts and Reserves for NU, CL&P, PSNH and WMECO for 2009, 2008 and 2007 All other schedules of the companies for which inclusion is required in the applicable... -

Page 79

.... NORTHEAST UTILITIES (Registrant) By /s/ Charles W. Shivery Charles W. Shivery Chairman of the Board, President and Chief Executive Officer (Principal Executive Officer) Date February 26, 2010 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below... -

Page 80

/s/ Kenneth R. Leibler Kenneth R. Leibler /s/ Robert E. Patricelli Robert E. Patricelli /s/ John F. Swope John F. Swope Trustee February 26, 2010 Trustee February 26, 2010 Trustee February 26, 2010 71 -

Page 81

NORTHEAST UTILITIES AND SUBSIDIARIES -

Page 82

... of the accompanying consolidated financial statements of Northeast Utilities and subsidiaries (NU or the Company) and of other sections of this annual report. NU's internal controls over financial reporting were audited by Deloitte & Touche LLP. Management is responsible for establishing and... -

Page 83

... statement schedules and an opinion on the Company's internal control over financial reporting based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to... -

Page 84

NORTHEAST UTILITIES AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (Thousands of Dollars) ASSETS Current Assets: Cash and cash equivalents Receivables, net Unbilled revenues Fuel, materials and supplies - current Marketable securities - current Derivative assets - current Prepayments and other Total ... -

Page 85

NORTHEAST UTILITIES AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (Thousands of Dollars) LIABILITIES AND CAPITALIZATION Current Liabilities: Notes payable to banks Long-term debt - current portion Accounts payable Accrued taxes Accrued interest Derivative liabilities - current Other Total Current ... -

Page 86

NORTHEAST UTILITIES AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (Thousands of Dollars, except share information) Operating Revenues Operating Expenses: Operation Fuel, purchased and net interchange power Other Maintenance Depreciation Amortization of regulatory assets, net Amortization of ... -

Page 87

... value Dividends on preferred shares of CL&P Allocation of benefits - ESOP Change in restricted shares, net Tax deduction for stock options exercised and Employee Stock Purchase Plan disqualifying dispositions Capital stock expenses, net Other comprehensive loss Balance as of December 31, 2009 287... -

Page 88

... Fuel, materials and supplies Taxes receivable/accrued Accounts payable Other current assets and liabilities Net cash flows provided by operating activities Investing Activities: Investments in property and plant Proceeds from sales of marketable securities Purchases of marketable securities Rate... -

Page 89

... Bonds, Pollution Control Notes and Other Fees and interest due for spent nuclear fuel disposal costs Change in fair value resulting from interest rate hedge instrument Unamortized premium and discount, net Reacquisition of Pollution Control Notes Total Long-Term Debt Less: Amounts due within one... -

Page 90

This Page Intentionally Left Blank -

Page 91

THE CONNECTICUT LIGHT AND POWER COMPANY AND SUBSIDIARIES -

Page 92

... consolidated financial statements of The Connecticut Light and Power Company and subsidiaries (CL&P or the Company) and of other sections of this annual report. CL&P's internal controls over financial reporting were audited by Deloitte & Touche LLP. Management is responsible for establishing... -

Page 93

... PUBLIC ACCOUNTING FIRM To the Board of Directors of The Connecticut Light and Power Company: We have audited the accompanying consolidated balance sheets of The Connecticut Light and Power Company and subsidiaries (a Connecticut corporation and a wholly owned subsidiary of Northeast Utilities) (the... -

Page 94

... CONNECTICUT LIGHT AND POWER COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS As of December 31, (Thousands of Dollars) ASSETS Current Assets: Cash Receivables, net Accounts receivable from affiliated companies Notes receivable from affiliated companies Unbilled revenues Materials and supplies... -

Page 95

... to banks Notes payable to affiliated companies Long-term debt - current portion Accounts payable Accounts payable to affiliated companies Accrued taxes Accrued interest Derivative liabilities - current Other Total Current Liabilities Rate Reduction Bonds Deferred Credits and Other Liabilities... -

Page 96

THE CONNECTICUT LIGHT AND POWER COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (Thousands of Dollars) 2009 For the Years Ended December 31, 2008 2007 Operating Revenues Operating Expenses: Operation Fuel, purchased and net interchange power Other Maintenance Depreciation Amortization of... -

Page 97

... guidance for other-than-temporary impairments (Note 1D) Net income Dividends on preferred stock Dividends on common stock Allocation of benefits - ESOP Capital stock expenses, net Capital contributions from NU parent Other comprehensive income 6,035,205 Balance as of December 31, 2009 25 216,316... -

Page 98

... stock Cash dividends on preferred stock (Decrease)/increase in short-term debt (Decrease)/increase in NU Money Pool borrowings Capital contributions from NU parent Issuance of long-term debt Reacquisition of long-term debt Retirements of rate reduction bonds Other financing activities Net cash... -

Page 99

PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE AND SUBSIDIARIES -

Page 100

... consolidated financial statements of Public Service Company of New Hampshire and subsidiaries (PSNH or the Company) and of other sections of this annual report. PSNH's internal controls over financial reporting were audited by Deloitte & Touche LLP. Management is responsible for establishing... -

Page 101

... statement schedules and an opinion on the Company's internal control over financial reporting based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to... -

Page 102

PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS As of December 31, (Thousands of Dollars) ASSETS Current Assets: Cash Receivables, net Notes receivable from affiliated companies Accounts receivable from affiliated companies Unbilled revenues Taxes receivable Fuel... -

Page 103

... banks Notes payable to affiliated companies Accounts payable Accounts payable to affiliated companies Accrued interest Derivative liabilities - current Other Total Current Liabilities Rate Reduction Bonds Deferred Credits and Other Liabilities: Accumulated deferred income taxes Accumulated deferred... -

Page 104

PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (Thousands of Dollars) For the Years Ended December 31, 2009 2008 2007 Operating Revenues Operating Expenses: Operation Fuel, purchased and net interchange power Other Maintenance Depreciation Amortization of... -

Page 105

... 31, 2008 Adoption of accounting guidance for other-than-temporary impairments (Note 1D) Net income Dividends on common stock Allocation of benefits - ESOP Capital contributions from NU parent Other comprehensive income Balance as of December 31, 2009 Common Stock Shares Amount 301 $ - Capital... -

Page 106

...dividends on common stock (Decrease)/increase in short-term debt Issuance of long-term debt Increase/(decrease) in NU Money Pool borrowings Capital contributions from NU parent Retirements of rate reduction bonds Other financing activities Net cash flows provided by financing activities Net increase... -

Page 107

WESTERN MASSACHUSETTS ELECTRIC COMPANY AND SUBSIDIARY -

Page 108

... consolidated financial statements of Western Massachusetts Electric Company and subsidiary (WMECO or the Company) and of other sections of this annual report. WMECO's internal controls over financial reporting were audited by Deloitte & Touche LLP. Management is responsible for establishing... -

Page 109

... ACCOUNTING FIRM To the Board of Directors of Western Massachusetts Electric Company: We have audited the accompanying consolidated balance sheets of Western Massachusetts Electric Company and subsidiary (a Massachusetts corporation and a wholly owned subsidiary of Northeast Utilities) (the "Company... -

Page 110

WESTERN MASSACHUSETTS ELECTRIC COMPANY AND SUBSIDIARY CONSOLIDATED BALANCE SHEETS As of December 31, (Thousands of Dollars) ASSETS Current Assets: Cash Receivables, net Accounts receivable from affiliated companies Unbilled revenues Taxes receivable Materials and supplies - current Marketable ... -

Page 111

WESTERN MASSACHUSETTS ELECTRIC COMPANY AND SUBSIDIARY CONSOLIDATED BALANCE SHEETS As of December 31, (Thousands of Dollars) LIABILITIES AND CAPITALIZATION Current Liabilities: Notes payable to banks Notes payable to affiliated companies Accounts payable Accounts payable to affiliated companies ... -

Page 112

WESTERN MASSACHUSETTS ELECTRIC COMPANY AND SUBSIDIARY CONSOLIDATED STATEMENTS OF INCOME (Thousands of Dollars) 2009 For the Years Ended December 31, 2008 2007 Operating Revenues Operating Expenses: Operation Fuel, purchased and net interchange power Other Maintenance Depreciation Amortization of ... -

Page 113

... December 31, 2008 Adoption of accounting guidance for other-than-temporary impairments (Note 1D) Net income Dividends on common stock Allocation of benefits - ESOP Capital contributions from NU parent Other comprehensive loss Balance as of December 31, 2009 Common Stock Shares Amount 434,653 $ 10... -

Page 114

...dividends on common stock (Decrease)/increase in short-term debt Issuance of long-term debt Retirements of rate reduction bonds Increase/(decrease) in NU Money Pool borrowings Capital contributions from NU parent Other financing activities Net cash flows provided by financing activities Net increase... -

Page 115

... Massachusetts Electric Company Consolidated: Northeast Utilities (NU or the Company) is the parent company of The Connecticut Light and Power Company (CL&P), Public Service Company of New Hampshire (PSNH), Western Massachusetts Electric Company (WMECO), and Yankee Gas Services Company (Yankee Gas... -

Page 116

... offset by a purchase price adjustment of $1.9 million and other charges from the sale of the competitive generation business. Included in the 2007 income tax expense for discontinued operations is a $0.8 million charge recognized to adjust the estimated income tax accrual for actual taxes paid on... -

Page 117

...including CL&P, PSNH, and WMECO, are collected under the New England Independent System Operator (ISO-NE) FERC Electric Tariff No. 3, Transmission, Markets and Services Tariff (Tariff No. 3). Tariff No. 3 includes Regional Network Service (RNS) and Schedule 21 - NU rate schedules to recover fees for... -

Page 118

... NU's non-financial assets and liabilities, such as Yankee Gas goodwill and AROs. As a result of adoption, the Company recorded a pre-tax charge to Net income of $6.1 million as of January 1, 2008 related to derivative liabilities for its remaining unregulated wholesale marketing contracts. In 2009... -

Page 119

... transmission and distribution segments of CL&P, PSNH (including its generation business) and WMECO, along with Yankee Gas' distribution segment, continue to be rate-regulated on a cost-of-service basis. Management believes it is probable that NU's regulated companies will recover their respective... -

Page 120

...: Under the terms of contracts with the Connecticut Yankee Atomic Power Company (CYAPC), Yankee Atomic Electric Company (YAEC), and Maine Yankee Atomic Power Company (MYAPC) (Yankee Companies), CL&P, PSNH, and WMECO are responsible for their proportionate share of the remaining costs of the nuclear... -

Page 121

... December 31, 2009 and 2008, respectively. PSNH default energy service (ES) revenues and costs are fully tracked, and the difference between ES revenues and costs are deferred. ES deferrals are being collected from/refunded to customers through a charge/(credit) in the subsequent ES rate period. As... -

Page 122

... charges on outstanding balances are calculated using Yankee Gas' weighted average cost of capital in accordance with the directives of the DPUC. WMECO Provision for Rate Refunds: The provision for rate refunds was established to reserve a refund to customers as a result of DPU service quality... -

Page 123

... of temporary differences is accounted for in accordance with the rate-making treatment of the applicable regulatory commissions and relevant accounting guidance. Details of income tax expense related to continuing operations are as follows: For the Years Ended December 31, 2009 2008 2007 NU NU NU... -

Page 124

... company tax return, and subsidiaries generating tax losses, if any, are paid for their losses when utilized. The tax effects of temporary differences that give rise to the current and long-term net accumulated deferred tax obligations are as follows: As of December 31, 2009 2008 NU NU (Millions... -

Page 125

... change. As a result, WMECO recorded an estimate of the impact of the new legislation as a $11.9 million decrease to Deferred tax liabilities and a decrease to Regulatory assets on its consolidated balance sheet as of December 31, 2008. Unrecognized Tax Benefits: As of December 31, 2009, NU and CL... -

Page 126

... as a component of Other income, net on the accompanying consolidated statements of income. The components of interest on uncertain tax positions by company in 2009, 2008 and 2007 are as follows: Other Interest Expense/(Income) (Millions of Dollars) CL&P PSNH WMECO NU parent and other Total For the... -

Page 127

... the cost of plant additions. In 2008, CL&P, PSNH and WMECO entered into certain equipment purchase contracts that required the Company to make advance payments during the design, manufacturing, shipment and installation of equipment. As of December 31, 2009 and 2008, these advance payments totaled... -

Page 128

...classes of utility plant-in-service are equivalent to composite rates as follows: (Percent) 2009 2008 2007 NU CL&P PSNH WMECO 2.9 3.0 2.7 2.9 3.0 3.1 2.7 2.8 3.2 3.3 2.8 2.9 K. Equity Method Investments Regional Nuclear Companies: As of December 31, 2009, CL&P, PSNH and WMECO owned common stock... -

Page 129

... cost of a company's short-term financings as well as a company's capitalization (preferred stock, long-term debt and common equity). The average rate is applied to average eligible CWIP amounts to calculate AFUDC. AFUDC is recorded on 100 percent of CL&P's and WMECO's CWIP for their NEEWS projects... -

Page 130

...15.9) (Millions of Dollars) ARO Asset As of December 31, 2009 Accumulated Depreciation of Regulatory ARO Asset Asset ARO Liabilities Asbestos Hazardous contamination Total AROs WMECO $ $ 0.2 0.5 0.7 $ $ (0.1) $ (0.1) (0.2) $ As of December 31, 2008 Accumulated Depreciation of Regulatory ARO... -

Page 131

... include changes in estimated quantities and removal costs, discount rates and inflation rates. N. Fuel, Materials and Supplies and Allowance Inventory Fuel, materials and supplies include natural gas storage, coal, oil and materials purchased primarily for construction or operation and maintenance... -

Page 132

... 31, 2008 2007 (Millions of Dollars) 2009 NU CL&P $ 135.6 119.0 $ 126.6 107.2 $ 112.2 95.0 Certain sales taxes are also collected by CL&P, WMECO, and Yankee Gas from their respective customers as agents for state and local governments and are recorded on a net basis with no impact on the... -

Page 133

... nuclear generating and transmission companies relates to the Company's investments, including CL&P, PSNH and WMECO's investments, in the Yankee Companies and NU's investments in two regional transmission companies. For the years ended December 31, 2009, 2008 and 2007, income tax expense associated... -

Page 134

...2007, NU, CL&P, PSNH and WMECO had no other such borrowings. T. Operating Expenses Fuel, purchased and net interchange power: For the years ended December 31, 2009, 2008, and 2007, fuel, purchased and net interchange power included costs related to fuel (and gas costs as it related to Yankee Gas) as... -

Page 135

..., engineering, financial, information technology, legal, operational, planning, purchasing, and other services to NU's companies. Two other subsidiaries construct, acquire or lease some of the property and facilities used by NU's companies. As of both December 31, 2009 and 2008, CL&P, PSNH and WMECO... -

Page 136

...NU Parent, CL&P, PSNH, WMECO, Yankee Gas and certain of NU's other subsidiaries are members of the Pool. The Pool provides a more efficient use of cash resources of NU and reduces outside short-term borrowings. NUSCO participates in the Pool and administers the Pool as agent for the member companies... -

Page 137

...of the prices of energy and energy-related products in procuring energy supply for its customers through the use of default service contracts, which fix the price of electricity purchased for customers for periods of time ranging from three months to three years and are accounted for as normal. PSNH... -

Page 138

... Long-Term Regulated Companies: CL&P commodity and capacity contracts required by regulation: Current Long-Term Commodity price and supply risk management: CL&P: Current PSNH: (1) Current (1) Long-Term Yankee Gas: Current Long-Term Derivatives designated as hedging instruments Interest rate risk... -

Page 139

... on Derivative NU Enterprises: Energy sales contract and energy price risk management Regulated Companies: CL&P energy and capacity contracts required by regulation Commodity price and supply risk management: CL&P PSNH Yankee Gas Fuel, purchased and net interchange power Regulatory assets... -

Page 140

... including PSNH's electricity procurement contracts, CL&P's bilateral agreements and NU Enterprises' electricity sourcing contracts, contain credit risk contingent features. These features require these companies or, in NU Enterprises' case, NU parent to maintain investment grade credit ratings from... -

Page 141

...31, 2009 CL&P PSNH WMECO Derivative Assets: Level 1 Level 2 Level 3 Total Derivative Liabilities: Level 1 Level 2 Level 3 Cash collateral posted Total Marketable Securities: Level 1: Money market and other Total Level 1 Level 2: U.S. Government issued debt securities (agency and treasury) Corporate... -

Page 142

... Energy wholesale marketing contracts and are reported in Fuel, purchased and net interchange power on the accompanying consolidated statements of income. Employee Benefits (All Companies) (2) 5. A. Pension Benefits and Postretirement Benefits Other Than Pensions Pursuant to GAAP, NU is required... -

Page 143

... service requirements. For current employees and certain retirees, the total benefit is limited to two times the 1993 per retiree health care cost. These costs are charged to expense over the estimated work life of the employee. NU uses a December 31st measurement date for the PBOP Plan. NU annually... -

Page 144

... cost, and unrecognized net actuarial gain/(loss) over the remaining service lives of its employees as calculated on an individual operating company basis. The accumulated benefit obligation for the Pension Plan was $2 billion ($725.8 million - CL&P; $312.4 million - PSNH; $146.4 million WMECO... -

Page 145

... 31, 2009 and 2008 and the changes in those amounts recorded during the years (millions of dollars): NU As of December 31, Pension SERP PBOP 2009 2008 2009 2008 2009 2008 0.3...dollars): NU Pension Estimated Expense in 2010 SERP PBOP Transition obligation Prior service cost/(credit) Net actuarial loss... -

Page 146

... follows: NU (Millions of Dollars) Service cost Interest cost Expected return on plan assets Net transition obligation cost Prior service cost/(credit) Actuarial loss Net periodic expense - before termination benefits Termination benefits Total - net periodic expense Pension Benefits 2009 2008 2007... -

Page 147

... reported for the health care plans. The effect of changing the assumed health care cost trend rate by one percentage point in each year would have the following effects (millions of dollars): NU One Percentage Point Increase One Percentage Point Decrease Effect on total service and interest cost... -

Page 148

... rates and equity and fixed income index closing prices to determine a net present value of the cash flows. Fixed income securities included in Level 2 are valued using pricing models, quoted prices of securities with similar characteristics or discounted cash flows. The pricing models utilize... -

Page 149

... during reporting period Purchases, sales and settlements Balance as of December 31, 2009 PBOP Plan Fixed Income $ 18.9 4.5 1.2 24.6 $ Estimated Future Benefit Payments: The following benefit payments, which reflect expected future service, are expected to be paid/(received) for the Pension, SERP... -

Page 150

...the Incentive Plan, in which CL&P, PSNH and WMECO participate, NU is authorized to grant up to 4.5 million new shares for various types of awards, including restricted shares, RSUs, performance shares and stock options to eligible employees and board members. As of December 31, 2009 and 2008, NU had... -

Page 151

... impact to NU, CL&P, PSNH and WMECO for the years ended December 31, 2008 and 2007. RSUs: NU has granted RSUs under the 2004 through 2009 incentive programs that are subject to three-year and four-year graded vesting schedules for employees, and one-year graded vesting schedules for board members... -

Page 152

... for the year ended December 31, 2009. Employee Share Purchase Plan: NU maintains an ESPP for all eligible NU, CL&P, PSNH, and WMECO employees, which allows for NU common shares to be purchased by employees at six-month intervals at 95 percent of the closing market price on the last day of each six... -

Page 153

...31, 2009, in addition to the 57 sites (17 for CL&P, 17 for PSNH, and 9 for WMECO), there were 12 sites (7 for CL&P, 2 for PSNH, and 1 for WMECO) for which there are unasserted claims; however, any related site assessment or remediation costs are not probable or estimable at this time. NU, CL&P, PSNH... -

Page 154

... recover environmental costs from its customers, and changes in WMECO's environmental reserves impact WMECO's Net income. B. Spent Nuclear Fuel Disposal Costs (CL&P, WMECO) Under the Nuclear Waste Policy Act of 1982 (the Act), CL&P and WMECO must pay the United States Department of Energy (DOE) for... -

Page 155

... Fuel. For further information on this trust, see Note 9, "Marketable Securities," to the consolidated financial statements. C. Long-Term Contractual Arrangements (NU, CL&P, PSNH, WMECO, Yankee Gas, NU Enterprises) Regulated Companies: Estimated Future Annual Regulated Companies Costs: The estimated... -

Page 156

... of its facility and is now engaged in the long-term storage of its spent fuel. The Yankee Companies collect decommissioning and closure costs through wholesale, FERCapproved rates charged under power purchase agreements with several New England utilities, including CL&P, PSNH and WMECO. FS-71 -

Page 157

... storage of their spent fuel. The Yankee Companies collect decommissioning and closure costs through wholesale, FERC-approved rates charged under power purchase agreements with several New England utilities, including CL&P, PSNH and WMECO. These companies recover these costs through state regulatory... -

Page 158

...-approved recoveries, which would be passed on to its customers, through reduced charges. E. Guarantees and Indemnifications (All Companies) NU parent provides credit assurances on behalf of its subsidiaries, including CL&P, PSNH, and WMECO, in the form of guarantees and LOCs in the normal course of... -

Page 159

... bonds, contain credit ratings triggers that would require NU parent to post collateral in the event that NU's unsecured debt credit ratings are downgraded below investment grade. F. Litigation and Legal Proceedings (All Companies) NU (including CL&P, PSNH and WMECO) are involved in legal, tax and... -

Page 160

.... 9. Marketable Securities (NU, WMECO) The Company elected to record exchange traded mutual funds purchased during 2009 in the NU supplemental benefit trust at fair value in order to reflect the economic effect of changes in fair value of all newly purchased equity securities in Net income... -

Page 161

... Other Total NU supplemental benefit trust WMECO spent nuclear fuel trust Short-term investments and money markets U.S. government issued debt securities (agency and treasury) Corporate debt securities Asset backed securities Other Total WMECO spent nuclear fuel trust Total NU (1) $ 21.9 5.6 13... -

Page 162

... management believes the Company will more likely than not be required to sell before recovery of amortized cost. Credit losses for the NU supplemental benefit trust were de minimus for the year ended December 31, 2009. There were credit losses of $0.7 million for the WMECO spent nuclear fuel trust... -

Page 163

... WMECO NU Capitalized CL&P PSNH WMECO 2009 2008 2007 $ 18.1 19.1 19.6 $ 12.8 12.7 13.2 $ 3.9 4.1 3.5 $ 3.4 3.8 4.0 $ 9.7 10.8 10.5 $ 6.1 6.8 6.5 $ 1.5 1.8 2.0 $ 1.1 1.3 1.2 Future minimum rental payments excluding executory costs, such as property taxes, state use taxes, insurance... -

Page 164

... Debt (All Companies) Long-term debt maturities and cash sinking fund requirements on debt outstanding as of December 31, 2009, for the years 2010 through 2014 and thereafter, which include fees and interest due for spent nuclear fuel disposal costs, net unamortized premiums or discounts and other... -

Page 165

...rate tax exempt, due 2028 5.25% fixed rate, tax exempt, due 2031 (1) Total Pollution Control Notes Total First Mortgage Bonds and Pollution Control Notes Fees and interest due for spent nuclear fuel disposal costs Less amounts due within one year (1) Unamortized premiums and discounts, net Long-term... -

Page 166

...requirements by certifying property additions. Any deficiency would need to be satisfied by the deposit of cash or bonds. Essentially all utility plant of CL&P, PSNH and Yankee Gas is subject to the liens of each company's respective first mortgage bond indenture. The CL&P, PSNH and WMECO tax-exempt... -

Page 167

... capitalization ratio requirement in its revolving credit agreement. CL&P, PSNH, and WMECO are subject to Section 305 of the Federal Power Act that makes it unlawful for a public utility to make or pay a dividend from any funds "properly included in its capital account." Management believes that... -

Page 168

... income/(loss) for NU, CL&P, PSNH and WMECO qualified cash flow hedging instruments are as follows: As of December 31, 2009 2008 NU NU (Millions of Dollars, Net of Tax) Balance at beginning of year Hedged transactions impacting Net income Change in fair value of interest rate swap agreements Cash... -

Page 169

... of existing interest rate hedges. The forward starting interest rate swap transactions settled by NU parent, CL&P, PSNH and Yankee Gas to hedge interest rate risk associated with their respective long-term debt issuances in 2008 resulted in a net of tax charge to Accumulated other comprehensive... -

Page 170

... of Yankee (Yankee Energy Services Company and Yankee Energy Financial Services Company), and the remaining operations of HWP that were not exited as part of the sale of the competitive generation business in 2006 and the sale of its transmission business to WMECO in December 2008. NU's consolidated... -

Page 171

... segment schedules due to rounding): For the Year Ended December 31, 2009 Regulated Companies Distribution (1) (Millions of Dollars) Operating revenues Depreciation and amortization Other operating expenses Operating income Interest expense, net of AFUDC Interest income Other income, net Income tax... -

Page 172

... as of December 31, 2008. For NU, these distribution and transmission assets are disclosed in the electric distribution columns above. The information related to the distribution and transmission segments for CL&P, PSNH and WMECO for the years ended December 31, 2009, 2008 and 2007 is included below... -

Page 173

... of Dollars) Operating revenues Depreciation and amortization Other operating expenses Operating income Interest expense, net of AFUDC Interest income Other income, net Income tax benefit Net income Cash flows for total investments in plant $ $ $ (1) Includes PSNH's generation activities. FS... -

Page 174

..., 2009. This CfD contract is supported by customers. Changes in the value of the CfD contract do not impact CL&P's net income. This event is not expected to result in additional CL&P liability or obligations beyond the contract payments scheduled to begin when the plant achieves commercial operation... -

Page 175

... $ 262,931 31,182 16,570 $ 275,135 34,125 16,203 $ 263,872 33,150 15,302 Operating Revenues Operating Income Net Income WMECO Consolidated Statements of Quarterly Financial Data (Thousands of Dollars) 2009 $ 291,765 34,865 16,689 $ 274,039 30,045 13,691 $ 301,033 29,364 14,318 $ 274... -

Page 176

... Sales Statistics 2009 Revenues: (Thousands) Regulated companies: Residential Commercial Industrial Wholesale Streetlighting and Railroads Miscellaneous and eliminations Total Electric Total Gas Total - Regulated companies NU Enterprises: Retail Wholesale Generation Services Miscellaneous and... -

Page 177

... Total Sales: (GWh) Residential Commercial Industrial Wholesale Streetlighting and Railroads Total Customers: (Average) Residential Commercial Industrial Streetlighting and Railroads Total WMECO Selected Consolidated Sales Statistics 2009 Revenues: (Thousands) Residential Commercial Industrial Other... -

Page 178

SCHEDULE I NORTHEAST UTILITIES (PARENT) FINANCIAL INFORMATION OF REGISTRANT BALANCE SHEETS AS OF DECEMBER 31, 2009 AND 2008 (Thousands of Dollars) 2009 ASSETS Current Assets: Cash Notes receivable from affiliated companies Accounts receivable Accounts receivable from affiliated companies Taxes ... -

Page 179

SCHEDULE I NORTHEAST UTILITIES (PARENT) FINANCIAL INFORMATION OF REGISTRANT STATEMENTS OF INCOME FOR THE YEARS ENDED DECEMBER 31, 2009, 2008 AND 2007 (Thousands of Dollars, Except Share Information) 2009 Operating Revenues Operating Expenses: Other Operating Loss Interest Expense Other Income: ... -

Page 180

SCHEDULE I NORTHEAST UTILITIES (PARENT) FINANCIAL INFORMATION OF REGISTRANT STATEMENTS OF CASH FLOWS FOR THE YEARS ENDED DECEMBER 31, 2009, 2008 AND 2007 (Thousands of Dollars) 2009 Operating Activities: Net income Adjustments to reconcile net income to net cash flows provided by/(used in) operating... -

Page 181

... those of customers. (b) Amounts written off, net of recoveries. The DPUC issued an order allowing CL&P and Yankee Gas to accelerate the recovery of uncollectible hardship accounts receivable outstanding for greater than 90 days. As of December 31, 2009, CL&P, WMECO and Yankee Gas had uncollectible... -

Page 182

... with a (+). Exhibit Number 3. (A) Description Articles of Incorporation and By-Laws Northeast Utilities 3.1 Declaration of Trust of NU, as amended through May 10, 2005 (Exhibit A.1, NU Form U-1 dated June 23, 2005, File No. 70-10315) (B) The Connecticut Light and Power Company 3.1 Certificate of... -

Page 183

...State of New Hampshire, CL&P and the Trustee (Pollution Control Bonds, 1992 Series A) dated as of December 1, 1992 (Exhibit C.2.33, 1992 NU Form U5S, File No. 030-00246) Loan Agreement between Connecticut Development Authority and CL&P (Pollution Control Bonds - Series A, Tax Exempt Refunding) dated... -

Page 184

... dated December 9, 2005 between CL&P, WMECO, Yankee Gas and PSNH, the Banks Named Therein, and Citicorp USA, Inc., as Administrative Agent (Exhibit 99.2, CL&P Current Report on Form 8-K dated December 9, 2005, File No. 000-00404) (C) Public Service Company of New Hampshire 4.1 First Mortgage... -

Page 185

... Administrative Agent (Exhibit 99.2, PSNH Current Report on Form 8-K dated December 9, 2005, File No. 001-06392) (D) Western Massachusetts Electric Company 4.1 Loan Agreement between Connecticut Development Authority and WMECO, (Pollution Control Revenue Bonds Series A, Tax Exempt Refunding) dated... -

Page 186

.... (Exhibit 10.22.1, 2006 NU Form 10-K, File No. 001-05324) 10.3 10.4 Northeast Utilities Service Company Transmission and Ancillary Service Wholesale Revenue Allocation Methodology, dated as of January 1, 2008 among The Connecticut Light and Power Company, Western Massachusetts Electric Company... -

Page 187

... Earnings to Fixed Charges Northeast Utilities 12 Ratio of Earnings to Fixed Charges (B) The Connecticut Light and Power Company 12 Ratio of Earnings to Fixed Charges (C) Public Service Company of New Hampshire 12 Ratio of Earnings to Fixed Charges (D) Western Massachusetts Electric Company 12... -

Page 188

... and David R. McHale, Executive Vice President and Chief Financial Officer of Northeast Utilities, pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, dated February 26, 2010 (B) The Connecticut Light and Power Company 32 Certification of Leon... -

Page 189

...23rd Floor Hartford, CT 06103 Preferred Stock Transfer Agent, Dividend Disbursing Agent and Registrar The Bank of New York Mellon Trust Company 480 Washington Boulevard Jersey City, NJ 07310-1900 Western Massachusetts Electric Company Pollution Control Revenue Bonds Trustee and Interest Paying Agent... -

Page 190

P.O. Box 270 Hartford, Connecticut 06141-0270 1-800-286-5000 www.nu.com Printed on recycled paper