Duke Energy 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

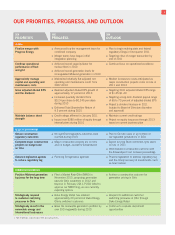

DELIVERING RESULTS TODAY: A FINANCIAL REPORT CARD

Duke Energy delivered exceptional 2010 results, both financially and operationally.

During 2010, we met our financial commitments as we grew earnings, increased

the quarterly dividend, and maintained the strength of our balance sheet. Extreme

weather boosted sales and earnings during 2010. We ended the year with adjusted diluted

earnings per share of $1.43, above our original adjusted diluted earnings guidance range

of $1.25 to $1.30.

The exceptional performance of our fleet and our employees’ dedication to delivering

high-quality customer service allowed us to capture the value of increased weather-related

sales. The company is positioned to achieve a long-term adjusted diluted earnings growth

rate of 4 to 6 percent.

1

In 2010, we increased our quarterly cash dividend to shareholders from $0.24 per share

to $0.245 per share. We are committed to growing the dividend and have targeted a long-

term dividend payout ratio of 65 to 70 percent, based on adjusted diluted earnings per share.

In 2010, we continued to focus on maintaining the

strength of our balance sheet. We are taking advantage of

historically low interest rates to issue debt to finance our

modernization programs. Over the past two years, we have

issued just over $5 billion of fixed-rate debt at an average

interest rate of 4.8 percent. These low interest rates will

help us mitigate customer rate impacts.

Our strong investment-grade credit ratings have stable

outlooks with both S&P and Moody’s. We had total avail-

able liquidity of approximately $3.4 billion at year-end.

Our shareholders enjoyed a total return (including

dividends and the change in stock price) of 9.5 percent in

2010, outperforming the Philadelphia Utility Index, which

returned 5.7 percent. Longer term, too, Duke Energy has

outperformed the utility index, with cumulative three-year

returns of 4.7 percent and five-year returns of 44.2 percent,

compared to -15.4 percent and 20.9 percent, respectively,

for the utility index.

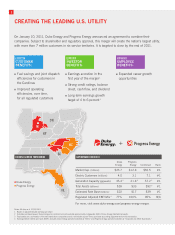

INTENDED MERGER WITH PROGRESS ENERGY

In January 2011, we announced our intended merger with Progress Energy. (See Creating

the Leading U.S. Utility, Page 2.) Headquartered in Raleigh, N.C., Progress Energy

has regulated utility operations in the Carolinas and Florida, with more than 3 million

customers. Our combined company will be unsurpassed in size and scale, serving more

than 7 million customers with around 57,000 megawatts (MW) of domestic nuclear, coal,

hydro and alternative energy generation. We are targeting closing the transaction by the end

of 2011, subject to shareholder and regulatory approval.

This strategic transaction involves more than just becoming the largest utility. The

size and scale of the combined company gives us the ability to achieve efficiencies and

effectively manage the transformation occurring in our industry. Additionally, we add an

outstanding group of teammates to help navigate the combined company into the future.

Over time, we believe that our customers will benefit from productivity gains and that our

employees will benefit from increased opportunities. We expect shareholders to realize earn-

ings accretion, based on adjusted diluted earnings per share, in the first year after closing.

We are very excited about this transaction. Our combined strength will exceed the

strength we have as separate companies. It will allow us to provide benefits to all our

LETTER TO STAKEHOLDERS (CONTINUED)

TOTAL SHAREHOLDER RETURN

(for periods ending Dec. 31, 2010)

One Year Three Years Five Years

45%

30

15

0

-15

Duke Energy Corporation

Philadelphia Stock Exchange Utility Sector Index

S&P 500 Index

1 From a base of 2009 adjusted diluted earnings per share of $1.22.

DUKE ENERGY CORPORATION / 2010 ANNUAL REPORT

3