Duke Energy 2010 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2010 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

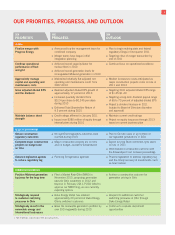

OUR PRIORITIES, PROGRESS, AND OUTLOOK

OUR

PRIORITIES

OUR

PROGRESS

OUR

OUTLOOK

OVERALL

Finalize merger with

Progress Energy

■Announced top-tier management team for

combined company

■Merger teams have begun initial

integration planning

■Plan to begin making state and federal

regulatory filings in first quarter 2011

■Targeting close of merger transaction by

end of 2011

Continue operational

performance of fleet

and grid

■Achieved record capacity factor for

nuclear fleet in 2010

■Achieved record generation levels for

nonregulated Midwest generation in 2010

■Continue focus on operational excellence

Aggressively manage

capital and operating and

maintenance costs

■Maintained relatively flat adjusted net

operating and maintenance costs1 from

2007-2010

■Modest increases to costs anticipated as

major construction projects come on line in

2011 and 2012

Grow adjusted diluted EPS

and the dividend

■Realized adjusted diluted EPS growth of

approximately 17 percent in 2010

■Increased quarterly dividend from

$0.24 per share to $0.245 per share

during 2010

■Delivered Total Shareholder Return of

9.5 percent during 2010

■Targeting 2011 adjusted diluted EPS range

of $1.35-$1.40

■Targeting a long-term dividend payout range

of 65 to 70 percent of adjusted diluted EPS

■Project a dividend increase in 2011

(subject to Board of Directors discretion

and approval)

Maintain balance sheet

strength

■Credit ratings affirmed in January 2011

■Issued over $285 million of equity through

internal plans during 2010

■Maintain current credit ratings

■Project no equity issuances through 2013

based on current business plan

REGULATED OPERATIONS

Obtain constructive

regulatory outcomes

■No significant regulatory outcomes were

reached during 2010

■Plan to file rate cases in up to three of

our regulated jurisdictions in 2011

Complete major construction

projects on budget and

on time

■Major construction projects are on time

and on budget, except for Edwardsport

■Expect to bring Buck combined-cycle plant

on line in 2011

■Work toward a constructive outcome with

the Edwardsport cost increase proceedings

Advance legislative agenda

to reduce regulatory lag

■Planning for legislative agendas ■Propose legislation to address regulatory lag

and the timely recovery of investments, such

as new nuclear

COMMERCIAL BUSINESSES

Position Midwest generation

business for the long term

■Filed a Market Rate Offer (MRO) in

November 2010, proposing generation

rates for Ohio customers in 2012 and

beyond; in February 2011, PUCO failed to

approve our MRO filing; we are currently

exploring options

■Achieve a constructive outcome for

generation pricing in Ohio

Strategically respond

to customer switching

pressures in Ohio

■Duke Energy Retail has retained

approximately 60 percent of Duke Energy

Ohio's switched customers

■Respond to additional customer

switching pressures in Ohio through

Duke Energy Retail

Strategically invest in the

renewable energy and

International businesses

■Grew the renewable generation portfolio by

over 250 megawatts during 2010

■Continue to evaluate investment

opportunities

1 Net of deferrals, cost recovery riders and special items

13