Duke Energy 2010 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2010 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DUKE ENERGY CORPORATION / 2010 ANNUAL REPORT

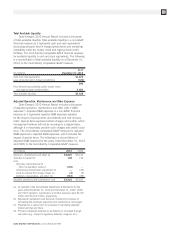

20 NON-GAAP FINANCIAL MEASURES (CONTINUED)

The following is a reconciliation of adjusted segment EBIT for the years ended December 31, 2010 and 2009, to the most

directly comparable GAAP measure:

For the Year Ended December 31, 2010

Economic

Adjusted Goodwill & Hedges Reported

Segment Other Asset (Mark-to- Segment

(In millions) EBIT Impairments Market) EBIT

U.S. Franchised Electric & Gas $2,966 $ — $— $2,966

Commercial Power 398 (660) 33 (229)

International Energy 486 — — 486

Total 2010 reportable segment EBIT $3,850 $(660) $33 $3,223

For the Year Ended December 31, 2009

Economic

Adjusted International Goodwill & Hedges Reported

Segment Transmission Other Asset (Mark-to- Segment

(In millions) EBIT Adjustment Impairments Market) EBIT

U.S. Franchised Electric & Gas $2,321 $ — $ — $ — $2,321

Commercial Power 500 — (413) (60) 27

International Energy 409 (26) (18) — 365

Total 2009 reportable segment EBIT $3,230 $(26) $(431) $(60) $2,713

Adjusted Earnings per Share Accretion in Year One

of Merger with Progress Energy

Duke Energy’s 2010 Annual Report includes a reference

to Duke Energy’s assumption that the merger transaction is

anticipated to be accretive in the first year after closing, based

upon adjusted diluted EPS.

This accretion assumption is a non-GAAP financial measure

as it is based upon diluted EPS from continuing operations

attributable to Duke Energy Corporation shareholders, adjusted

for the per-share impact of special items and the mark-to-market

impacts of economic hedges in the Commercial Power segment

(as discussed above under “Adjusted Diluted Earnings per Share

(‘EPS’)”). The most directly comparable GAAP measure for

adjusted diluted EPS is reported diluted EPS from continuing

operations attributable to Duke Energy Corporation common

shareholders, which includes the impact of special items

(including costs-to-achieve the merger) and the mark-to-market

impacts of economic hedges in the Commercial Power segment.

On a reported diluted EPS basis, this transaction is not

anticipated to be accretive due to the level of costs-to-achieve

the merger. Due to the forward-looking nature of this non-GAAP

financial measure for future periods, information to reconcile

it to the most directly comparable GAAP financial measure is

not available at this time, as management is unable to project

special items or mark-to-market adjustments for future periods.

Dividend Payout Ratio

Duke Energy’s 2010 Annual Report includes a discussion

of Duke Energy’s anticipated long-term dividend payout ratio

of 65-70% based upon adjusted diluted EPS. This payout ratio

is a non-GAAP financial measure as it is based upon forecasted

diluted EPS from continuing operations attributable to Duke

Energy Corporation shareholders, adjusted for the per-share

impact of special items and the mark-to-market impacts of

economic hedges in the Commercial Power segment (as

discussed above under “Adjusted Diluted Earnings Per Share

(‘EPS’)”). The most directly comparable GAAP measure for

adjusted diluted EPS is reported diluted EPS from continuing

operations attributable to Duke Energy Corporation common

shareholders, which includes the impact of special items

and the mark-to-market impacts of economic hedges in

the Commercial Power segment. Due to the forward-looking

nature of this non-GAAP financial measure for future periods,

information to reconcile it to the most directly comparable

GAAP financial measure is not available at this time, as

management is unable to project special items or mark-to-

market adjustments for future periods.