Duke Energy 2010 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2010 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LETTER TO STAKEHOLDERS (CONTINUED)

RECOVERING FLEET MODERNIZATION COSTS

In 2011, we expect to ask regulators in up to three of our five jurisdictions to approve

customer rate increases so we can recover investments associated with environmental

compliance and new plant construction. You might ask, “How does a rate increase support

the affordable part of our mission, especially in these tough economic times?”

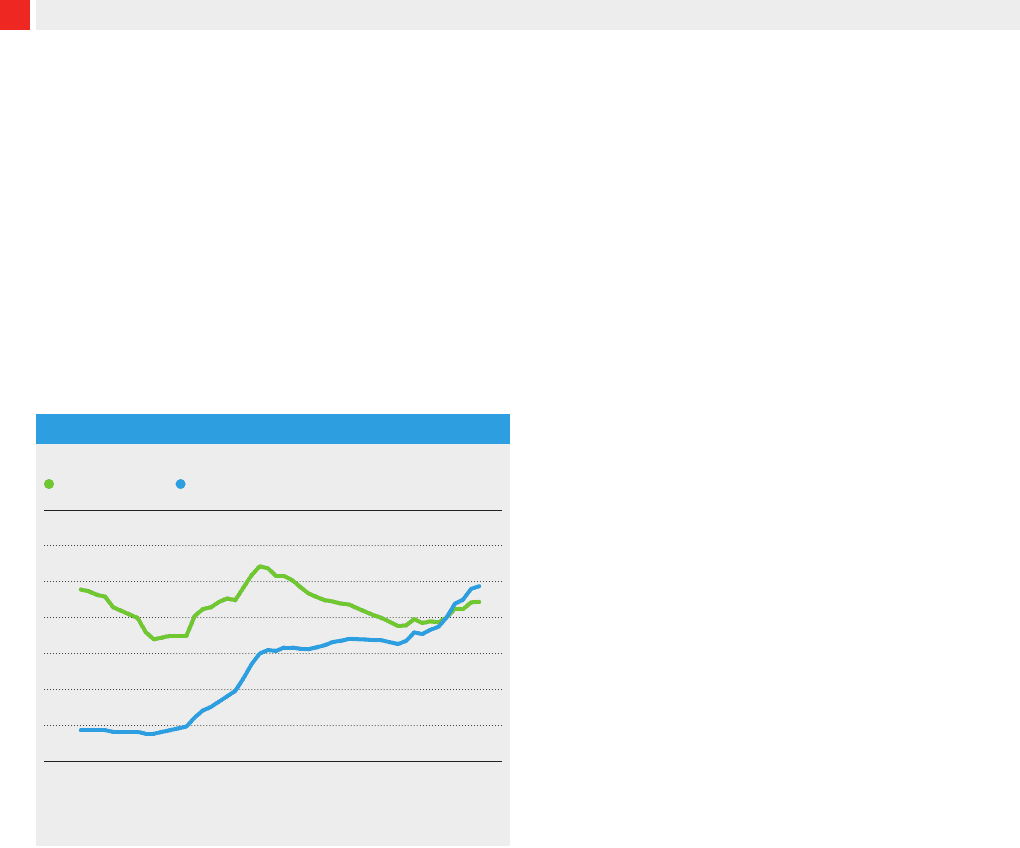

Here’s some perspective: Consider the graph on this page. It shows that the real cost

of electricity, averaged and adjusted for inflation, has declined over the past 50 years. In

fact, Duke Energy currently offers some of the most competitive electric rates in the United

States. Our rates in the Carolinas, in particular, benefit from the low-cost, baseload nuclear

power that serves our North Carolina and South Carolina customers.

In all our jurisdictions, we want to achieve pricing

structures that balance customer and shareholder needs.

To maintain that balance and keep rates low for customers,

we must obtain timely recovery of our investments and

earn a fair return.

We will continue to control costs and focus on

productivity. To that end, we have held nonrecoverable

operation and maintenance costs essentially flat for the

past four years.

A NEW PATH IN OHIO

Achieving a balance between our customers’ need for

affordable, reliable and clean power and our investors’ need

for competitive and fair returns has grown difficult in Ohio.

By law, Ohio customers can switch generation providers,

allowing them to capture the benefit of lower market prices.

However, our generation must stand ready to serve all

customers in our service territory, including those who have

switched. Therefore, we have not been able to adequately

recover our costs and earn a competitive and fair return on our investments.

This imbalance was highlighted in 2009, when market prices for energy plummeted,

along with the economy and industrial demand. As a result, our electric generation rates

have exceeded the prevailing market prices. By the end of 2010, approximately 65 percent

of customers receiving Duke Energy Ohio’s negotiated electric rates had switched to other

retail suppliers who offered generation at lower prices.

In the current Ohio regulatory framework, provisions in place do not allow utilities to

adequately recover their investments, whether in existing assets, new power plants to meet

future customer demand, or in improvements to comply with more stringent environmental

rules. This high-risk and low-reward environment makes it difficult to maintain a healthy

utility and justify future power plant investments in the state. Energy providers need

assurance that they can earn fair returns on existing and future investments to maintain

the current system and ensure the reliable delivery of power. A different regulatory

approach could help create much-needed jobs and begin to reposition the state for future

economic growth.

In the meantime, at the end of 2010, we filed a new electric standard service offer,

or Market Rate Offer, with the Public Utilities Commission of Ohio, requesting a plan to

set market-based rates for customers of Duke Energy Ohio. This filing was a significant

departure for Duke Energy Ohio, however, we believed it was the best option available to

us under the current rules. In late February, the Public Utilities Commission of Ohio failed

to approve our filing. In light of this ruling, we are currently exploring our options.

AVERAGE ANNUAL ELECTRICITY PRICES (ALL SECTORS), 1960 — 2009

(cents per kWh)

Real 2005 Dollars Nominal

14

12

10

8

6

4

2

0

Data Source: Energy Information Administration

‘60 ‘65 ‘70 ‘75 ‘80 ‘85 ‘90 ‘95 ‘00 ‘05 ‘09

8

DUKE ENERGY CORPORATION / 2010 ANNUAL REPORT