Duke Energy 2010 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2010 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DUKE ENERGY CORPORATION / 2010 ANNUAL REPORT

21

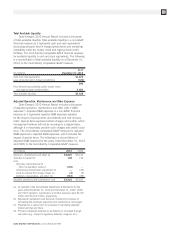

Total Available Liquidity

Duke Energy’s 2010 Annual Report includes a discussion

of total available liquidity. Total available liquidity is a non-GAAP

financial measure as it represents cash and cash equivalents

(excluding amounts held in foreign jurisdictions) and remaining

availability under the master credit and regional bank credit

facilities. The most directly comparable GAAP financial measure

for available liquidity is cash and cash equivalents. The following

is a reconciliation of total available liquidity as of December 31,

2010, to the most directly comparable GAAP measure:

As of

(In millions) December 31, 2010

Cash and cash equivalents $1,670

Less: Amounts held in foreign jurisdictions (724)

946

Plus: Remaining availability under master credit

and regional bank credit facilities 2,482

Total available liquidity $3,428

Adjusted Operation, Maintenance and Other Expenses

Duke Energy’s 2010 Annual Report includes a discussion

of adjusted operation, maintenance and other costs (“O&M

expenses”). Adjusted O&M expenses is a non-GAAP financial

measure as it represents reported O&M expenses adjusted

for the impact of special items and deferrals and cost recovery

riders. Special items represent certain charges and credits, which

management believes will not be recurring on a regular basis,

although it is reasonably possible such charges and credits could

recur. The most directly comparable GAAP measure for adjusted

O&M expenses is reported O&M expenses, which includes the

impact of special items. The following is a reconciliation of

adjusted O&M expenses for the years ended December 31, 2010

and 2009, to the most directly comparable GAAP measure:

(In millions) 2010 2009

Operation, maintenance and other (a) $3,825 $3,313

Transfers to capital (b) 108 149

Less:

Voluntary retirement plan &

office consolidation costs (c) (164) —

International transmission adjustment (c) — (30)

Costs to achieve the Cinergy merger (c) (4) (5)

Deferrals, recoverables, and other (d) (343) (85)

Adjusted operations and maintenance cost $3,422 $3,342

(a) As reported in the Consolidated Statements of Operations for the

years ended December 31, 2010 and December 31, 2009. 2008

and 2007 operation, maintenance and other expenses were $3,351

million and $3,324 million, respectively.

(b) Represents capitalized costs that were included for purposes of

calculating the employee operations and maintenance costs target.

(c) Presented as a special item for purposes of calculating adjusted

diluted earnings per share.

(d) Primarily represents expenses to be deferred or recovered through

rate riders (e.g., impact of regulatory deferrals, reagents, etc.).