Duke Energy 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

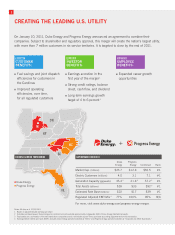

CREATING THE LEADING U.S. UTILITY

Notes: All data as of 12/31/2010.

1 Based on adjusted diluted earnings per share.

2 Excludes purchased power. Duke Energy and combined amounts exclude approximately 4 gigawatts (GW) of Duke Energy International assets.

3 Total assets are a summation of the two stand-alone companies and do not include any pro-forma purchase accounting adjustments from this transaction.

4 Earnings before interest and taxes (EBIT); excludes Duke Energy operations labeled as “Other,” and Progress Energy operations labeled as “Corporate and Other Businesses.”

+

KEY MERGER STATISTICS

OH

NC

SC

KY

FL

IN

Duke Energy

Progress Energy

Duke Progress

Energy Energy Combined Rank

Market Cap. (billions) $23.7 $12.8 $36.5 #1

Electric Customers (millions) 4.0 3.1 7.1 #1

Generation Capacity (gigawatts) 35.4

2 21.8

2 57.2

2 #1

Total Assets (billions) $59 $33 $92

3 #1

Estimated Rate Base (billions) $22 $17 $39 #1

Regulated Adjusted EBIT Mix 4 77% 100% 85% N/A

For more, visit www.duke-energy.com/progress-energy-merger.

DIVERSE SERVICE TERRITORIES

On January 10, 2011, Duke Energy and Progress Energy announced an agreement to combine their

companies. Subject to shareholder and regulatory approval, this merger will create the nation’s largest utility,

with more than 7 million customers in six service territories. It is targeted to close by the end of 2011.

EXPECTED

CUSTOMER

BENEFITS:

■Fuel savings and joint dispatch

efficiencies for customers in

the Carolinas

■Improved operating

efficiencies, over time,

for all regulated customers

EXPECTED

INVESTOR

BENEFITS:

■Earnings accretion in the

first year of the merger 1

■Strong credit ratings, balance

sheet, cash flow, and dividend

■Long-term earnings growth

target of 4 to 6 percent 1

EXPECTED

EMPLOYEE

BENEFITS:

■Expanded career growth

opportunities

2