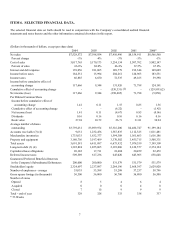

Dillard's 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

additional exit costs upon the closing of these properties during fiscal 2005. A breakdown of the asset impairment and

store closing charges for fiscal 2004 is as follows:

(in thousands of dollars)

Number of

Locations

Impairment

Amount

Stores closed during fiscal 2004 3 $ 2,928

Stores to close during fiscal 2005 4 4,052

Store impaired based on cash flows 1 703

Non-operating facilities 2 4,170

Joint Venture 1 7,564

Total 9 $19,417

2003 Compared to 2002

Advertising, selling, administrative and general (“SG&A”) expenses increased to 27.6% of sales for fiscal 2003

compared to 27.3% for fiscal 2002. The percentage increase is primarily due to a lack of sales leverage as SG&A

expenses decreased $66.1 million in 2003 compared to 2002. On a dollar basis significant decreases were noted in

payroll, advertising and bad debt expense. Payroll, advertising and bad debt expense declined $37.0 million, $8.6

million and $9.5 million, respectively. The decrease in payroll was caused primarily by a reduction in incentive based

sales payroll which is directly tied to the decrease in sales during 2003. The decline in advertising expense resulted

primarily from a reduction in newspaper advertising as the Company considers which media more appropriately matches

its customers’ lifestyles. Improvement in the quality of accounts receivable through lower delinquencies as well as a

reduction in outstanding accounts receivable contributed to the lower bad debt expense. SG&A expenses in fiscal 2003

include a $12.3 million pretax credit recorded due to the resolution of certain liabilities originally recorded in

conjunction with the purchase of Mercantile Stores Company, Inc.

Depreciation and amortization as a percentage of sales remained flat during fiscal 2003 principally due to lower capital

expenditures in fiscal 2003 combined with a lack of sales leverage from the 4% decline in comparable store sales during

the year.

Interest and debt expense as a percentage of sales was unchanged from fiscal 2002 as a result of the Company’s lack of

sales leverage. Interest expense declined $9.0 million due to the Company’s continuing focus on reducing its out-

standing debt levels. Average debt outstanding declined approximately $226 million in fiscal 2003. Interest expense for

fiscal 2003 includes a credit of $4.1 million received from the Internal Revenue Service as a result of the Company’s

filing of an interest netting claim related to previously settled tax years. A call premium of $15.6 million related to the

early retirement of debt is included in interest expense for fiscal 2003 compared to a call premium of $11.6 million

related to the early retirement of debt for fiscal 2002. The Company has retired all the remaining debt associated with

the call premiums in fiscal 2003 and 2002 and did not have any similar call premiums in fiscal 2004. Also included in

interest expense for the fiscal 2002 is a pretax gain of $4.8 million related to the early extinguishment of debt. The

Company retired $272 million in long-term debt and issued $50 million in new short-term borrowings during 2003.

During fiscal 2003, the Company recorded a pre tax charge of $44 million for asset impairment and store closing costs.

The charge includes a write down to fair value for certain under-performing properties. The charge consists of a write

down for a joint venture in the amount of $5.5 million, a write down of goodwill on two stores to be closed of $2.5

million and a write down of property and equipment in the amount of $35.7 million. A breakdown of the asset

impairment and store closing charges for fiscal 2003 is as follows:

(in thousands of dollars)

Number of

Locations

Impairment

Amount

Stores closed during fiscal 2003 3 $ 3,809

Stores to close during fiscal 2004 4 17,115

Store impaired based on cash flows 1 1,293

Non-operating facilities 7 16,030

Joint Venture 1 5,480

Total 16 $43,727

17