Dillard's 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

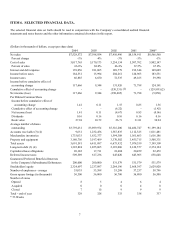

Sales

The percent change by category in the Company’s sales for the past two years is as follows:

Percent Change

Fiscal Fiscal

2004-2003 2003-2002

Cosmetics 1.3 (1.1)

Women’s and Juniors’ Clothing (2.4) (4.8)

Children’s Clothing (2.7) (8.9)

Men’s Clothing and Accessories (3.2) (5.8)

Shoes, Accessories and Lingerie 4.0 (0.8)

Home (2.0) (4.3)

The percent change by region in the Company’s sales for the past two years is as follows:

Percent Change

Fiscal Fiscal

2004-2003 2003-2002

Southeastern 0.2 (4.2)

Midwestern (2.1) (4.6)

Southwestern 1.5 (0.7)

Sales decreased 1% for the 52-week period ended January 29, 2005 compared to the 52-week period ended January 31,

2004 on both a total and comparable store basis. Sales were strongest and increased in cosmetics and shoes, accessories

and lingerie while sales declined in the remaining merchandising categories. Sales in the Western and Eastern regions

increased in fiscal 2004 while sales declined in the Central region. Dillard’s continues to focus on improvement in its

merchandise mix. The Company’s efforts to drive differentiation by offering more upscale, more fashion-forward and

younger-focused product choices are key strategies in this process. The Company seeks to provide such merchandise

from both national and exclusive brand sources. Under-performing lines of product from both national and exclusive

sources will continue to be eliminated and replaced with more promising brands in the Company’s ongoing efforts to

improve its merchandise mix. In addition, utilizing the Company’s existing information technology capabilities, the

Company will continue to tailor these assortments to the local demographics. During the fiscal years 2004, 2003 and

2002, sales of exclusive brand merchandise as a percent of total sales were 23.1%, 20.9% and 18.2%, respectively.

Sales decreased 4% for the 52-week period ended January 31, 2004 compared to the 52-week period ended February 1,

2003 on both a total and comparable store basis. Sales declined in all merchandising categories with the largest declines

in children’s, men’s clothing and accessories and women and juniors’ clothing. Sales in the home categories were in line

with the average sales performance while sales in accessories, shoes, lingerie and cosmetics were strongest and exceeded

the Company’s average sales performance for the period.

Cost of Sales

Cost of sales as a percentage of sales decreased to 66.6% during 2004 compared with 68.0% for 2003. The increase of

140 basis points in gross margin during fiscal 2004 was due to the Company’s successful efforts to improve its

merchandise mix and reduce markdown activity. The lower level of markdown activity decreased cost of sales by 50

basis points of sales. Improved levels of markups were responsible for a decrease in cost of sales of 90 basis points of

sales. All product categories had increased gross margins during 2004 except for the home category. Gross margins

were notably higher in men’s and children’s categories with margin improvement well above the average margin

improvement for the year.

Inventory in comparable stores at January 29, 2005 increased 1% compared to January 31, 2004. Overall inventory

increased 6% due primarily to an increase of $86 million relating to inventory in-transit.

15