Dillard's 2004 Annual Report Download - page 12

Download and view the complete annual report

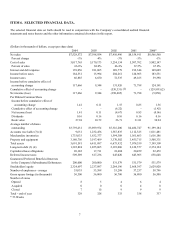

Please find page 12 of the 2004 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(1) During fiscal 2002, the Company adopted Statement of Financial Accounting Standards No. 142, “Goodwill and Other

Intangible Assets”. See Management’s Discussion and Analysis of Financial Condition and Results of Operations and

Note 3 to the Consolidated Financial Statements.

(2) During fiscal 2000, the Company changed its method of accounting for inventories under the retail method.

(3) The Company had $300 million in off-balance-sheet debt and accounts receivable for the fiscal years ended

2001, and 2000, respectively. See Note 16 to the Consolidated Financial Statements.

(4) During fiscal 2004, the Company sold its private label credit card business to GE Consumer Finance for $1.1

billion, which includes the assumption of $400 million of long-term securitization liabilities.

The items below are included in the Selected Financial Data.

2004

The items below amount to a net $64.5 million pretax gain ($42.1 million after tax or $0.50 per diluted share).

• a pretax gain of $83.9 million ($53.7 million after tax or $0.64 per diluted share) pertaining to the Company’s

sale of it private label credit card business to GE Consumer Finance (see Note 2 of the Notes to Consolidated

Financial Statements).

• a $19.4 million pretax charge ($11.6 million after tax or $0.14 per diluted share) for asset impairment and store

closing charges related to certain stores (see Note 14 of the Notes to Consolidated Financial Statements).

2003

The items below amount to a net $18.6 million pretax charge ($12.8 million after tax or $0.15 per diluted share).

• a $43.7 million pretax charge ($28.9 million after tax or $0.34 per diluted share) for asset impairment and store

closing charges related to certain stores (see Note 14 of the Notes to Consolidated Financial Statements).

• a call premium resulting in additional interest expense of $15.6 million ($10.0 million after tax or $0.12 per

diluted share) associated with a $125.9 million call of debt.

• a pretax gain of $15.6 million ($10.0 million after tax or $0.12 per diluted share) pertaining to the Company’s

sale of its interest in Sunrise Mall and its associated center in Brownsville, Texas (see Note 1 of the Notes to

Consolidated Financial Statements).

• a pretax gain of $12.3 million ($7.9 million after tax or $0.09 per diluted share) recorded due to the resolution

of certain liabilities originally recorded in conjunction with the purchase of Mercantile Stores Company, Inc.

• an $8.7 million pretax gain ($5.6 million after tax or $0.07 per diluted share) related to the sale of certain store

properties.

• $4.1 million ($2.6 million after tax or $0.03 per diluted share) received from the Internal Revenue Service as a

result of the Company’s filing of an interest-netting claim related to previously settled tax years.

8