Dillard's 2004 Annual Report Download - page 13

Download and view the complete annual report

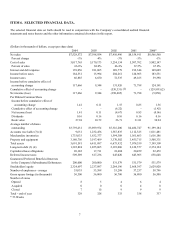

Please find page 13 of the 2004 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2002

The items below amount to a net $3.0 million pretax gain ($1.8 million after tax or $0.02 per diluted share).

• a pretax gain of $64.3 million ($41.1 million after tax or $0.48 per diluted share) pertaining to the Company’s

sale of its interest in FlatIron Crossing, a Broomfield, Colorado shopping center (see Note 1 of the Notes to

Consolidated Financial Statements).

• a pretax asset impairment and store closing charge of $52.2 million ($33.4 million after tax or $0.39 per diluted

share) related to certain stores (see Note 14 of the Notes to Consolidated Financial Statements).

• a call premium resulting in additional interest expense of $11.6 million ($7.4 million after tax or $0.09 per

diluted share) associated with a $143.0 million call of debt.

• a pretax charge of $5.4 million ($3.5 million after tax or $0.04 per diluted share) on the amortization of off-

balance-sheet accounts receivable securitization (see Note 16 of the Notes to Consolidated Financial

Statements).

• a pretax gain of $4.8 million ($3.0 million after tax or $0.04 per diluted share) on the early extinguishment of

debt.

• a pretax gain of $3.1 million ($2.0 million after tax or $0.02 per diluted share) from an investee partnership of

the Company who received an unusual distribution in the settlement of a receivable.

2001

The items below amount to a net $5.6 million pretax gain ($3.6 million after tax or $0.04 per diluted share).

• a pretax asset impairment and store closing charge of $3.8 million ($2.4 million after tax or $0.03 per diluted

share) related to certain stores.

• a pretax gain of $9.4 million ($6.0 million after tax or $0.07 per diluted share) on the early extinguishment of

debt.

2000

The items below amount to a net $38.2 million pretax gain ($21.3 million after tax or $0.23 per diluted share).

• a pretax asset impairment and store closing charge of $51.4 million ($36.0 million after tax or $0.40 per diluted

share) related to certain stores.

• a pretax gain of $42.7 million ($27.3 million after tax or $0.30 per diluted share) on the early extinguishment of

debt.

• a pretax gain of $46.9 million ($30.0 million after tax or $0.33 per diluted share) on the Company’s change in

its method of accounting for inventories under the retail inventory method.

9