Dillard's 2004 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2004 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

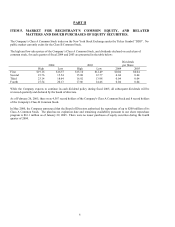

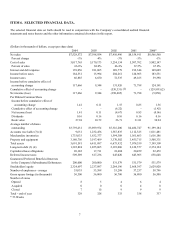

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, AND RELATED

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

The Company’s Class A Common Stock trades on the New York Stock Exchange under the Ticker Symbol “DDS”. No

public market currently exists for the Class B Common Stock.

The high and low sales prices of the Company’s Class A Common Stock, and dividends declared on each class of

common stock, for each quarter of fiscal 2004 and 2003 are presented in the table below:

Dividends

2004 2003 per Share

High Low High Low 2004 2003

First $19.16 $16.57 $15.10 $12.49 $0.04 $0.04

Second 23.76 15.54 15.08 12.77 0.04 0.04

Third 23.14 18.64 16.92 13.98 0.04 0.04

Fourth 27.54 20.13 17.86 14.46 0.04 0.04

While the Company expects to continue its cash dividend policy during fiscal 2005, all subsequent dividends will be

reviewed quarterly and declared by the board of directors.

As of February 26, 2005, there were 4,567 record holders of the Company's Class A Common Stock and 8 record holders

of the Company's Class B Common Stock.

In May 2000, the Company announced that the Board of Directors authorized the repurchase of up to $200 million of its

Class A Common Stock. The plan has no expiration date and remaining availability pursuant to our share repurchase

program is $16.1 million as of January 29, 2005. There were no issuer purchases of equity securities during the fourth

quarter of 2004.

6