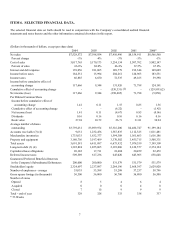

Dillard's 2004 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2004 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS.

EXECUTIVE OVERVIEW

Dillard’s, Inc. operates 329 retail department stores in 29 states. Our stores are located in suburban shopping malls and

offer a broad selection of fashion apparel and home furnishings. We offer an appealing and attractive assortment of

merchandise to our customers at a fair price. We offer national brand merchandise as well as our exclusive brand

merchandise. We seek to enhance our income by maximizing the sale of this merchandise to our customers. We do this

by promoting and advertising our merchandise and by making our stores an attractive and convenient place for our

customers to shop.

Fundamentally, our business model is to offer the customer a compelling price/value relationship through the

combination of high quality products and services at a competitive price. We seek to deliver a high level of profitability

and cash flow by:

• maximizing the effectiveness of our pricing and brand awareness;

• minimizing costs through leveraging our centralized overhead expense structure;

• sourcing;

• reinvesting operating cash flows into store growth, and distribution initiatives, and improving product quality in

our exclusive brands;

• returning profits to shareholders through dividends, share repurchases and increased share price; and

• continuing to offer access to credit services and financial products to our customers through our long-term

marketing and servicing alliance with GE Consumer Finance (“GE”).

The consumer retail sector is extremely competitive. Many different retail establishments compete for our customers’

business. These include other department stores, specialty retailers, discounters, internet and mail order retailers. We

also attempt to enhance our income by managing our operating costs without sacrificing service to our customers.

Items of note for the year ended January 29, 2005 include the following:

• The sale of substantially all of the assets of our private label credit card business and the establishment of a

long-term marketing and servicing alliance with GE. The sale generated total proceeds of $1.1 billion,

consisting of the assumption by GE of $400 million of securitized debt and net cash proceeds of approximately

$688 million and resulted in significantly strengthened financial position and liquidity. The financial impact of

the transaction on Dillard’s ongoing financial results will be determined by the effects of the Company’s use of

proceeds as well as the effect of income generated under the long-term marketing and servicing alliance.

Dillard’s expects to use net proceeds to reduce debt outstanding, to repurchase its common stock and for general

corporate purposes.

• The elimination of debt of $988 million, partially in conjunction with the sale of the credit card business.

• Gross profit improvement of 140 basis points of sales compared to the year ended January 31, 2004.

• Decrease in interest and debt expense of $42 million compared to the year ended January 31, 2004.

• Cash and cash equivalents of $498 million as of January 29, 2005.

10