Dillard's 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dillard’s

DILLARD’S, INC. 2004 ANNUAL REPORT

Table of contents

-

Page 1

Dillard's D I L L A R D ' S , I N C. 2 0 0 4 A N N U A L R E P O R T -

Page 2

...lower debt levels. At year end, our cash and cash equivalents were $498.2 million. In 2004, we opened eight new Dillard's stores in excellent locations, five of which were replacement stores. As we continued to focus on store productivity, we closed four under-performing locations and redirected the... -

Page 3

... Dillard Executive Vice President of Dillard's, Inc. William Dillard, II Chairman of the Board and Chief Executive Officer of Dillard's, Inc. James I. Freeman Senior Vice President and Chief Financial Officer of Dillard's, Inc. John Paul Hammerschmidt Retired Member of Congress Harrison, Arkansas... -

Page 4

... number, your address and phone number. Corporate Headquarters 1600 Cantrell Road Little Rock, Arkansas 72201 Mailing Address Post Office Box 486 Little Rock, Arkansas 72203 Telephone: 501-376-5200 Fax: 501-376-5917 Listing New York Stock Exchange, Ticker Symbol "DDS" STORE OPENINGS - 2004 Dillard... -

Page 5

...file number 1-6140 DILLARD'S, INC. (Exact name of registrant as specified in its charter) DELAWARE (State or other jurisdiction of incorporation or organization) 71-0388071 (IRS Employer Identification Number) 1600 CANTRELL ROAD, LITTLE ROCK, ARKANSAS 72201 (Address of principal executive office... -

Page 6

DOCUMENTS INCORPORATED BY REFERENCE Portions of the Proxy Statement for the Annual Meeting of Stockholders to be held May 21, 2005 (the "Proxy Statement") are incorporated by reference into Part III. 2 -

Page 7

... Executive Officers of the Registrant. Executive Compensation. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. Certain Relationships and Related Transactions. Principal Accountant Fees and Services. PART IV 15. Exhibits and Financial Statement Schedule... -

Page 8

...net sales with a guaranteed minimum annual rent. In general, the Company pays the cost of insurance, maintenance and any increase in real estate taxes related to the leases. At January 29, 2005, there were 329 stores in operation with gross square footage approximating 56.3 million feet. The Company... -

Page 9

... of operations, financial condition or cash flows. ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. No matter was submitted to a vote of security holders during the fourth quarter of the year ended January 29, 2005. Executive Officers of the Company The following table lists the names... -

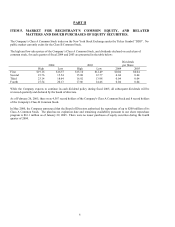

Page 10

...ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, AND RELATED MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. The Company's Class A Common Stock trades on the New York Stock Exchange under the Ticker Symbol "DDS". No public market currently exists for the Class B Common Stock. The high and low sales... -

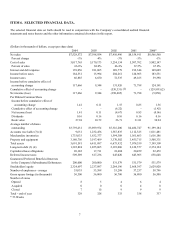

Page 11

... Preferred Beneficial Interests in the Company's Subordinated Debentures 200,000 Stockholders' equity 2,324,697 Number of employees - average 53,035 Gross square footage (in thousands) 56,300 Number of stores Opened 8 Acquired 0 Closed 7 Total - end of year 329 * 53 Weeks 2003 $7,598,934 -4% 5,170... -

Page 12

... to the Company's sale of it private label credit card business to GE Consumer Finance (see Note 2 of the Notes to Consolidated Financial Statements). a $19.4 million pretax charge ($11.6 million after tax or $0.14 per diluted share) for asset impairment and store closing charges related to certain... -

Page 13

... per diluted share) pertaining to the Company's sale of its interest in FlatIron Crossing, a Broomfield, Colorado shopping center (see Note 1 of the Notes to Consolidated Financial Statements). a pretax asset impairment and store closing charge of $52.2 million ($33.4 million after tax or $0.39 per... -

Page 14

... exclusive brands; returning profits to shareholders through dividends, share repurchases and increased share price; and continuing to offer access to credit services and financial products to our customers through our long-term marketing and servicing alliance with GE Consumer Finance ("GE"). The... -

Page 15

... merchandise. • • • Legal Proceedings On July 29, 2002, a Class Action Complaint (followed on December 13, 2004 by a Second Amended Class Action Complaint) was filed in the United States District Court for the Southern District of Ohio against the Company, the Mercantile Stores Pension Plan... -

Page 16

... long-term marketing and servicing alliance between the Company and GE and the resulting gain on the sale of its credit card business to GE. Cost of Sales. Cost of sales includes the cost of merchandise sold net of purchase discounts, bankcard fees, freight to the distribution centers, employee and... -

Page 17

...using the specific identified cost method. Allowance for doubtful accounts. In 2004, the Company sold substantially all of its accounts receivable to GE and no longer maintains an allowance for doubtful accounts. Prior to the sale, the accounts receivable from the Company's private label credit card... -

Page 18

... store locations or tax planning, the Company's effective tax rate and tax balances could be affected. As such these estimates may require adjustment in the future as additional facts become known or as circumstances change. The Company's income tax returns are periodically audited by various state... -

Page 19

... (5.8) 4.0 (0.8) (2.0) (4.3) Cosmetics Women's and Juniors' Clothing Children's Clothing Men's Clothing and Accessories Shoes, Accessories and Lingerie Home The percent change by region in the Company's sales for the past two years is as follows: Percent Change Fiscal Fiscal 2004-2003 2003-2002... -

Page 20

... $8.6 million and advertising of $16.9 million. The reduction in services purchased and communications was partially due to the sale of the credit card business in November 2004 and costs reductions throughout the year. Services purchased includes marketing, collection fees and merchandise handling... -

Page 21

... million related to the early extinguishment of debt. The Company retired $272 million in long-term debt and issued $50 million in new short-term borrowings during 2003. During fiscal 2003, the Company recorded a pre tax charge of $44 million for asset impairment and store closing costs. The charge... -

Page 22

... the sale 2004 Compared to 2003 The Company completed its sale of its credit card business to GE and entered into a ten year marketing and servicing alliance. GE will own the accounts and balances generated during the term of the alliance and will provide all key customer service functions supported... -

Page 23

... for the year. During 2004, the operating cash flows of the Company increased due to increased net income and a reduction in accounts receivable balances prior to the sale of the credit card business. Adding to the increased cash flow, accounts payable and accrued expenses increased $295 million in... -

Page 24

...11.3 million. During 2004, investing cash flows were positively impacted by the net proceeds of $688 million received from the sale of the credit card business to GE (see Note 2 of the Notes to Consolidated Financial Statements). During 2003, the Company recorded a gain of $15.6 million and received... -

Page 25

... expects to finance its capital expenditures and its working capital requirements including required debt repayments and stock repurchases, if any, from cash flows generated from operations. As a result of the Company's sale of its credit card business, the Company does not currently expect to... -

Page 26

... of credit of $69.7 million. Other long-term commitments consist of liabilities incurred relating to the Company's defined benefit plans. The Company expects pension expense to be approximately $8.9 million in fiscal 2005 with a liability of $91 million. The Company expects to make a contribution... -

Page 27

... Company's customers; the impact of competitive pressures in the department store industry and other retail channels including specialty, off-price, discount, internet, and mail-order retailers; trends in personal bankruptcies and charge-off trends in the credit card receivables portfolio; changes... -

Page 28

... in the SEC's rules and forms, and that such information is accumulated and communicated to the Company's management, including its Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding the required disclosures. In designing and evaluating the... -

Page 29

... pages F-2 and F-3 of this report. William Dillard, II, Chairman of the Board of Directors and Chief Executive Officer, has certified to the New York Stock Exchange that he is not aware of any violations by the Company of the exchange's corporate governance listing standards. Attached as an exhibit... -

Page 30

...officers. The current version of such Code of Conduct is available free of charge on Dillard's, Inc. web site, www.dillards.com , and is available in print to any shareholder who requests copies by contacting Julie J. Bull, Director of Investor Relations, at the Company's principal executive offices... -

Page 31

... principal accountant fees and services is incorporated herein by reference to the information under the heading "Independent Accountant Fees" in the Proxy Statement. PART IV ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULE. (a)(1) and (2) Financial Statements and Financial Statement Schedule An... -

Page 32

... authorized. Dillard's, Inc. Registrant Date: April 14, 2005 /s/ James I. Freeman James I. Freeman, Senior Vice President and Chief Financial Officer (Principal Financial and Accounting Officer) Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below... -

Page 33

... AND FINANCIAL STATEMENT SCHEDULE DILLARD'S, INC. AND SUBSIDIARIES Year Ended January 29, 2005 Page Report of Independent Registered Public Accounting Firm Management's Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm Consolidated Balance... -

Page 34

... of their operations and their cash flows for each of the three years in the period ended January 29, 2005, in conformity with accounting principles generally accepted in the United States of America. Also, in our opinion, such financial statement schedule, when considered in relation to the basic... -

Page 35

... using those criteria, it believes that, as of January 29, 2005, the Company's internal control over financial reporting is effective. Deloitte & Touche LLP, an independent registered public accounting firm, has audited the financial statements of the Company for the fiscal years ended January... -

Page 36

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Stockholders and Board of Directors of Dillard's, Inc. Little Rock, Arkansas We have audited management's assessment, included in the accompanying Management's Report on Internal Control over Financial Reporting, that Dillard's, Inc. and... -

Page 37

...audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated financial statements and financial statement schedule as of and for the year ended January 29, 2005 of the Company and our report dated April 13, 2005 expressed an unqualified... -

Page 38

... Balance Sheets Dollars in Thousands Assets Current Assets: Cash and cash equivalents Accounts receivable (net of allowance for doubtful accounts of $0 and $40,967) Merchandise inventories Other current assets Total current assets Property and Equipment: Land and land improvements Buildings... -

Page 39

...Cumulative effect of accounting change Net Income (Loss) See notes to consolidated financial statements. $7,528,572 287,699 7,816,271 5,017,765 2,098,791 301,917 54,774 139,056 19,417 7,631,720 184,551 66,885 117,666 - $ 117,666 $1.41 - $1.41 $1.41 - $1.41 Years Ended January 31, 2004 $7,598,934 264... -

Page 40

... under stock option, employee savings __ 25,646 17 __ and stock bonus plans Purchase of 2,000,000 shares of treasury stock Cash dividends declared: Common stock, $.16 per share - - - - Balance, January 29, 2005 $1,146 $40 $739,620 $(13,333) See notes to consolidated financial statements. Retained... -

Page 41

... Net cash from sale of credit card business Proceeds from sale of joint venture Net cash provided by (used in) investing activities Financing Activities: Principal payments on long-term debt and capital lease obligations (Decrease) increase in short-term borrowings and capital lease obligations Cash... -

Page 42

... Accounting Policies Description of Business - Dillard's, Inc. (the "Company") operates retail department stores located primarily in the Southeastern, Southwestern and Midwestern areas of the United States. The Company's fiscal year ends on the Saturday nearest January 31 of each year. Fiscal years... -

Page 43

... prescribed in SFAS No. 142. The Company identified its reporting units under SFAS No. 142 at the store unit level. The fair value of these reporting units was estimated using the expected discounted future cash flows and market values of related businesses, where appropriate. Prior to the adoption... -

Page 44

... of the gift card. Prior to the sale of its credit card business to GE, finance charge revenue earned on customer accounts, serviced by the Company under its proprietary credit card program, was recognized in the period in which it was earned. Beginning November 1, 2004, the Company's share of... -

Page 45

... of retail department stores. Revenues from customers are derived from merchandise sales and service charges and interest on the Company's proprietary credit card prior to November 1, 2004. The Company does not rely on any major customers as a source of revenue. New Accounting Pronouncements In... -

Page 46

... Company completed the sale of substantially all of the assets of its private label credit card business to GE. The purchase price of approximately $1.1 billion includes the assumption of $400 million of securitization liabilities, the purchase of owned accounts receivable and other assets. Net cash... -

Page 47

... of dollars) Long-term debt: Interest Call premium Loss on early retirement of long-term debt Amortization of debt expense Interest on capital lease obligations Interest on receivable financing Interest paid during fiscal 2004, 2003 and 2002 was approximately $145.4 million, $186.9 million and... -

Page 48

...457 23,570 1,308 24,878 $72,335 (in thousands of dollars) Current: Federal State Deferred: Federal State A reconciliation between the Company's income tax provision and income taxes using the federal statutory income tax rate is presented below: Fiscal 2004 $64,593 1,834 433 25 $66,885 Fiscal 2003... -

Page 49

...") representing beneficial ownership interest in the assets of Dillard's Capital Trust I, a consolidated entity of the Company. Holders of the Capital Securities are entitled to receive cumulative cash distributions, payable quarterly, at the annual rate of 7.5% of the liquidation amount of $25 per... -

Page 50

... are used to purchase Class A Common Stock of the Company for the account of the employee. The terms of the plan provide a six-year graduated-vesting schedule for the Company contribution portion of the plan. The Company incurred expense of $11 million, $12 million and $14 million for fiscal 2004... -

Page 51

... estimated future benefits payments for the nonqualified benefit plan are as follows: (in thousands of dollars) Fiscal Year 2005 2006 2007 2008 2009 2010-2014 Total payments for next ten fiscal years $ 3,604 4,731 4,841 4,804 5,363 32,314 $55,657 10. Stockholders' Equity Capital stock is comprised... -

Page 52

... options to purchase shares of Class A Common Stock to certain key employees of the Company. Exercise and vesting terms for options granted under the plans are determined at each grant date. All options were granted at not less than fair market value at dates of grant. At the end of fiscal 2004, 11... -

Page 53

... with Accounting Principles Board Opinion No. 25, "Accounting for Stock Issued to Employees," the Company uses the intrinsic value method of accounting for stock options. No compensation cost has been recognized in the consolidated statements of operations for the Company's stock option plans. The... -

Page 54

...a mall in Yuma, Arizona with a book value of $55 million at January 29, 2005. On July 29, 2002, a Class Action Complaint (followed on December 13, 2004 by a Second Amended Class Action Complaint) was filed in the United States District Court for the Southern District of Ohio against the Company, the... -

Page 55

... realize in a current market exchange. The fair value of trade accounts receivable is determined by discounting the estimated future cash flows at current market rates, after consideration of credit risks and servicing costs using historical rates. The fair value of the Company's long-term debt and... -

Page 56

...term borrowings under its accounts receivable conduit facilities related to seasonal financing needs. The Company's receivable financing conduits were terminated and amounts outstanding were repaid concurrent with the sale of the Company's private label credit card business to GE on November 1, 2004... -

Page 57

...to the sale of the Company's credit card business to GE Consumer Finance (see Note 2 of the Notes to Consolidated Financial Statements). • a $14.7 million pretax charge ($8.6 million after tax or $0.10 per diluted share) for asset impairment and store closing charges related to certain stores (see... -

Page 58

...417 $ - 40,967 49,755 (1) Accounts written off and charged to allowance for losses on accounts receivable (net of recoveries). (2) On November 1, 2004, the Company sold substantially all the assets of its private label credit card business. As a result, the Company no longer maintains an allowance... -

Page 59

... ended November 1, 2003 in 1-6140). Purchase, Sale and Servicing Transfer Agreement among GE Capital Consumer Card Co., General Electric Capital Corporation, Dillards, Inc. and Dillard National Bank (Exhibit 2.1 to Form 8-K dated as of August 12, 2004 in 1-6140). Private Label Credit Card Program... -

Page 60

21 23 Subsidiaries of Registrant. Consent of Independent Registered Public Accounting Firm. 31(a) Certification of Chief Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. 31(b) Certification of Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act ...