Dell 2001 Annual Report Download - page 68

Download and view the complete annual report

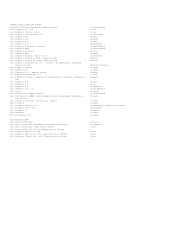

Please find page 68 of the 2001 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 3. Plan Section 9.1 is hereby amended to be and read as follows:

"9.1 ELIGIBILITY FOR LOAN.

(a) Subject to the provisions of this Article, the

following individuals shall be eligible for loans

under the Plan: (i) each Participant who is an

Employee and (ii) each party-in-interest, as that

term is defined in section 3(14) of ERISA, as to the

Plan, but only if such party-in-interest (i) retains

an Account balance under the Plan and (ii) is either

a Participant no longer employed by the Employer, a

beneficiary of a deceased Participant, or an

alternate payee under a qualified domestic relations

order, as that term is defined in section 414(p)(8)

of the Code. (An individual who is eligible to apply

for a loan under the Plan as described in the

preceding sentence shall hereinafter be referred to

as a "Participant" for purposes of this Article.)

(b) Notwithstanding the above, a Participant may not have

more than two (2) loan outstanding at any time;

provided, however, that for the Plan Year ending

December 31, 2001, a Participant may have up to three

(3) loans outstanding at any one time.

(c) Upon application by a Participant and subject to such

uniform and nondiscriminatory rules and regulations

as the Committee may establish, the Committee may in

its discretion direct the Trustee to make a loan or

loans to such Participant."

4. Plan Section 9.5(b) is hereby amended to be and read as follows:

"(b) The terms of the loan shall (i) require level amortization

with payments not less frequently than quarterly, (ii) require

that the loan be repaid (a) over an amortization period of one

to five years for the period from the Effective Date through

December 31, 2000, and (b) over an amortization period of one

to four and one-half years effective as of January 1, 2001,

(unless the Participant certifies in writing to the Committee

that the loan is to be used to acquire any dwelling unit which

within a reasonable time is to be used (determined at the time

the loan is made) as a principal residence of the Participant,

in which case the loan must be repaid over an amortization

period of five to twenty years), (iii) allow prepayment

without penalty at any time, provided that any prepayment must

be for the full outstanding loan balance (including interest),

(iv) require that the balance of the loan (including interest)

shall become due and payable (to the extent not otherwise due

and payable) within ninety days of the date the Participant

or, if applicable, the Participant's beneficiary, is first

entitled to a distribution from the Plan (other than a

distribution pursuant

2