Dell 2001 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2001 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

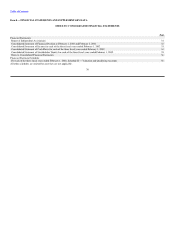

Table of Contents

Operating Expenses

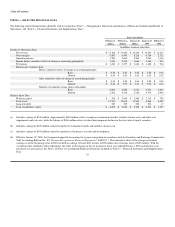

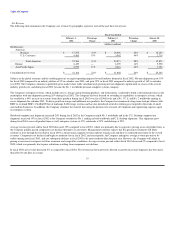

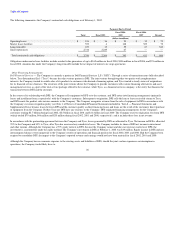

The following table presents certain information regarding the Company's operating expenses during each of the past three fiscal years (dollars in millions):

Fiscal Year Ended

February 1, February 2, January 28,

2002(a) 2001(b) 2000(c)

Operating Expenses:

Selling, general and administrative $ 2,784 $ 3,193 $ 2,387

% of net revenue 8.9% 10.0% 9.4%

Research, development and engineering $ 452 $ 482 $ 374

% of net revenue 1.5% 1.5% 1.5%

Special charges $ 482 $ 105 $ 194

% of net revenue 1.5% 0.3% 0.8%

Total operating expenses $ 3,718 $ 3,780 $ 2,955

% of net revenue 11.9% 11.8% 11.7%

(a) The $482 million charge relates to employee termination benefits, facilities closure costs, and other asset impairments and exit costs.

(b) The $105 million charge relates to employee termination benefits and facilities closure costs.

(c) The $194 million charge represents purchased in-process research and development.

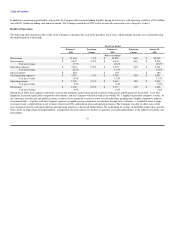

During fiscal 2000 and early 2001, the Company heavily invested in personnel and other support costs as the Company experienced significant growth and

anticipated additional future net unit shipments and revenue growth. As growth expectations were trimmed during late fiscal 2001 and into fiscal 2002, the

Company took decisive steps to manage expenses relative to revised growth rates. As a result, selling, general and administrative expenses declined in

absolute dollars and as a percent of net revenue in fiscal 2002 as compared to fiscal 2001. These actions included undertaking a reduction in the Company's

workforce, consolidation of facilities, and impairment of certain assets to align its cost structure with ongoing economic and industry conditions. A special

charge of $482 million related to these actions was recorded in operating expenses in the second quarter. A summary of this charge is as follows (in millions):

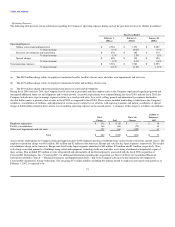

Liability at

Total Non-Cash February 1,

Charge Paid Charges 2002

Employee separations $ 134 $ (118) $ — $ 16

Facility consolidations 169 (46) (79) 44

Other asset impairments and exit costs 179 (16) (152) 11

Total $ 482 $ (180) $ (231) $ 71

As part of this undertaking, the Company eliminated approximately 4,000 employee positions worldwide from various business functions and job classes. The

employee separations charge was $91 million, $41 million and $2 million in the Americas, Europe and Asia-Pacific Japan segments, respectively. The facility

consolidations charge in the Americas, Europe and Asia Pacific-Japan segments amounted to $80 million, $76 million and $13 million, respectively. Non-

cash charges consisted primarily of buildings being exited and equipment, technology/software, and other assets being abandoned or disposed of as part of

these actions. This included $75 million to write off goodwill and substantially all intellectual property associated with the fiscal 2000 acquisition of

ConvergeNet Technologies, Inc. ("ConvergeNet"; for additional information regarding this acquisition, see Note 2 of Notes to Consolidated Financial

Statements included in "Item 8 — Financial Statements and Supplementary Data.") due to the Company's decision to discontinue the development of

ConvergeNet's proprietary storage technology. The remaining $71 million liability (including $16 million related to employees previously terminated) as of

February 1, 2002, is expected to be

21