Dell 2001 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2001 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

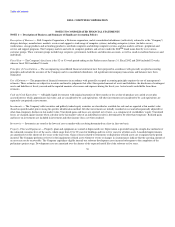

In addition to the $482 million charge described above, the Company also recorded an impairment charge of $260 million during the second quarter reflecting

other-than-temporary declines in fair value of certain venture investments. This charge was recorded in investment and other income (loss), net.

During the fourth quarter of fiscal 2001, the Company undertook a separate program to reduce its workforce and to exit certain facilities during fiscal 2002.

Total charges recorded were $105 million. The charges consisted of approximately $50 million in employee termination benefits with the remainder relating

to facilities closure costs. The employee separations, which occurred primarily in the United States and which were completed in fiscal 2002, affected

1,700 employees across a majority of the Company's business functions and job classes. As of February 1, 2002, approximately $19 million remains in

accrued and other liabilities, substantially all of which relates to net lease expenses that will be paid over the respective lease terms through fiscal 2006.

On October 20, 1999, the Company acquired all the outstanding shares of ConvergeNet, a developer of storage domain management technology, in exchange

for 6.9 million shares of the Company's common stock and $4.5 million cash for total purchase consideration of $332 million. The ConvergeNet acquisition

was recorded under the purchase method of accounting. Accordingly, the purchase price was allocated to the net assets acquired based on their estimated fair

values at the date of acquisition. The amount allocated to purchased in-process research and development of $194 million was determined based on an

appraisal using established valuation techniques in the storage management industry and expensed upon acquisition because technological feasibility had not

been established and no future alternative uses existed. The excess of cost over net assets acquired was recorded as goodwill, included in other assets, and

amortized over an estimated remaining life of eight years. As discussed above, remaining unamortized goodwill was written off in fiscal 2002.

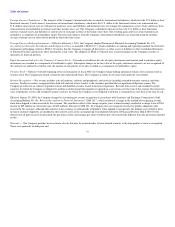

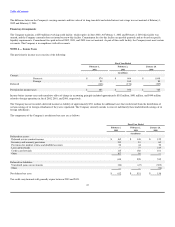

NOTE 3 — Financial Instruments

Disclosures About Fair Values of Financial Instruments

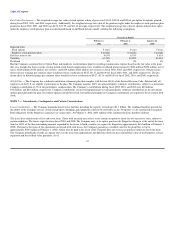

The fair value of investments, long-term debt and related interest rate derivative instruments has been estimated based upon market quotes from brokers. The

fair value of foreign currency forward contracts has been estimated using market quoted rates of foreign currencies at the applicable balance sheet date. The

estimated fair value of foreign currency purchased option contracts is based on market quoted rates at the applicable balance sheet date and the Black-Scholes

options pricing model. Considerable judgment is necessary in interpreting market data to develop estimates of fair value. Accordingly, the estimates presented

herein are not necessarily indicative of the amounts that the Company could realize in a current market exchange. Changes in assumptions could significantly

affect the estimates.

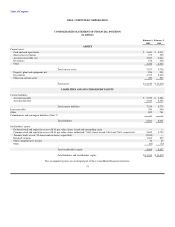

Cash and cash equivalents, accounts receivable, accounts payable and accrued and other liabilities are reflected in the accompanying consolidated financial

statements at cost, which approximates fair value because of the short-term maturity of these instruments.

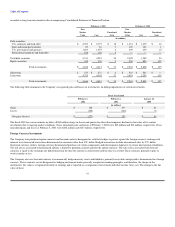

Investments

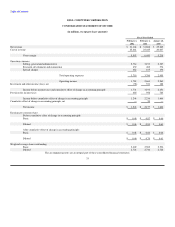

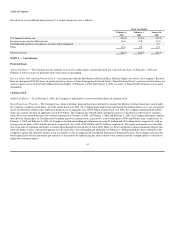

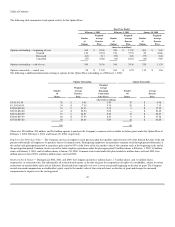

The following table summarizes by major security type the fair market value and cost of the Company's investments. All investments with remaining

maturities in excess of one year are

40