Dell 2001 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2001 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The difference between the Company's carrying amounts and fair value of its long-term debt and related interest rate swaps was not material at February 1,

2002 and February 2, 2001.

Financing Arrangements

The Company maintains a $250 million revolving credit facility, which expires in June 2002. At February 1, 2002 and February 2, 2001 this facility was

unused, and the Company currently does not intend to renew this facility. Commitment fees for this facility are payable quarterly and are based on specific

liquidity requirements. Commitment fees paid in fiscal 2002, 2001, and 2000 were not material. As part of this credit facility, the Company must meet certain

covenants. The Company is in compliance with all covenants.

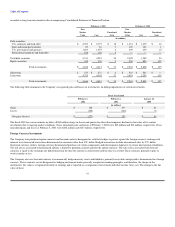

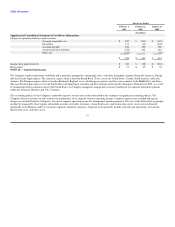

NOTE 4 — Income Taxes

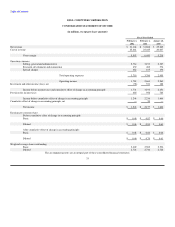

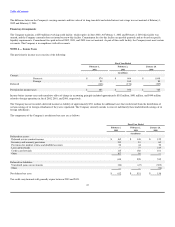

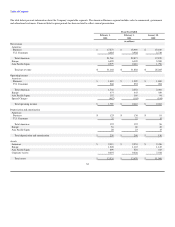

The provision for income taxes consists of the following:

Fiscal Year Ended

February 1, February 2, January 28,

2002 2001 2000

(in millions)

Current:

Domestic $ 574 $ 964 $ 1,008

Foreign 59 168 84

Deferred (148) (174) (307)

Provision for income taxes $ 485 $ 958 $ 785

Income before income taxes and cumulative effect of change in accounting principle included approximately $302 million, $491 million, and $449 million

related to foreign operations in fiscal 2002, 2001, and 2000, respectively.

The Company has not recorded a deferred income tax liability of approximately $711 million for additional taxes that would result from the distribution of

certain earnings of its foreign subsidiaries if they were repatriated. The Company currently intends to reinvest indefinitely these undistributed earnings of its

foreign subsidiaries.

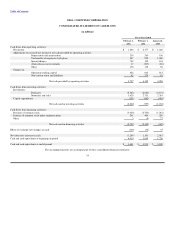

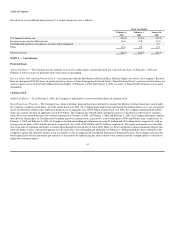

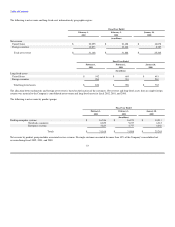

The components of the Company's net deferred tax asset are as follows:

Fiscal Year Ended

February 1, February 2, January 28,

2002 2001 2000

(in millions)

Deferred tax assets:

Deferred service contract income $ 165 $ 148 $ 125

Inventory and warranty provisions 133 81 60

Provisions for product returns and doubtful accounts 58 44 30

Loss carryforwards — 73 219

Credit carryforwards 115 188 101

Other 167 64 —

638 598 535

Deferred tax liabilities:

Unrealized gains on investments (26) (47) (303)

Other — — (74)

Net deferred tax asset $ 612 $ 551 $ 158

Tax credit carryforwards will generally expire between 2003 and 2023.

43