Dell 2001 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2001 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

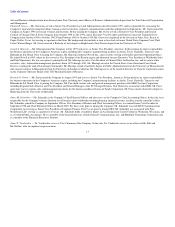

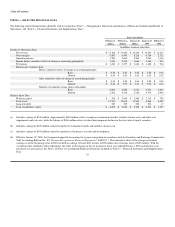

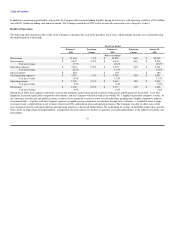

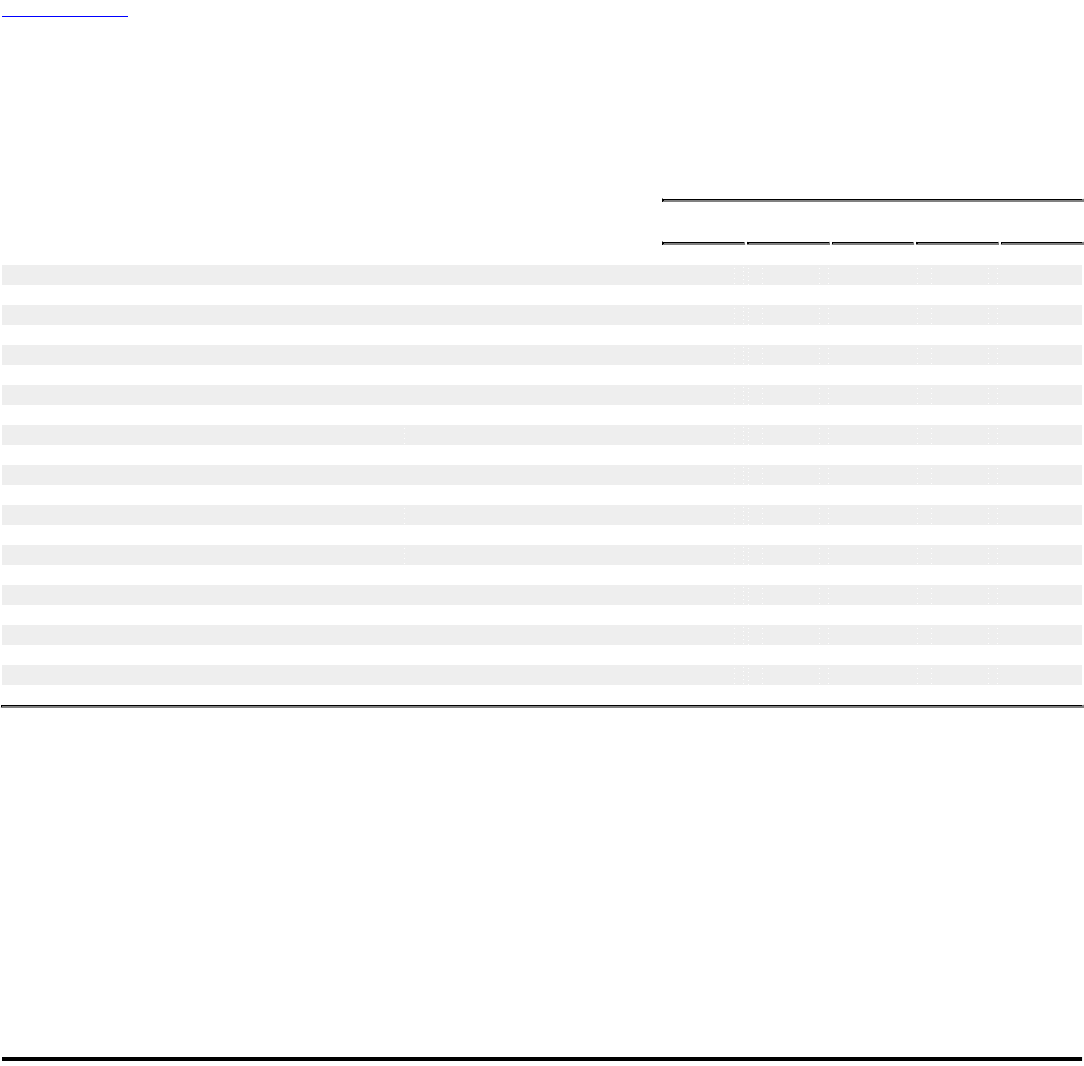

ITEM 6 — SELECTED FINANCIAL DATA

The following selected financial data should be read in conjunction "Item 7 — Management's Discussion and Analysis of Financial Condition and Results of

Operations" and "Item 8 — Financial Statements and Supplementary Data."

Fiscal Year Ended

February 1, February 2, January 28, January 29, February 1,

2002(a) 2001(b) 2000(c) 1999 1998

(in millions, except per share data)

Results of Operations Data:

Net revenue $ 31,168 $ 31,888 $ 25,265 $ 18,243 $ 12,327

Gross margin 5,507 6,443 5,218 4,106 2,722

Operating income 1,789 2,663 2,263 2,046 1,316

Income before cumulative effect of change in accounting principle(d) 1,246 2,236 1,666 1,460 944

Net income $ 1,246 $ 2,177 $ 1,666 $ 1,460 $ 944

Earnings per common share:

Before cumulative effect of change in accounting principle:

Basic $ 0.48 $ 0.87 $ 0.66 $ 0.58 $ 0.36

Diluted $ 0.46 $ 0.81 $ 0.61 $ 0.53 $ 0.32

After cumulative effect of change in accounting principle:

Basic $ 0.48 $ 0.84 $ 0.66 $ 0.58 $ 0.36

Diluted $ 0.46 $ 0.79 $ 0.61 $ 0.53 $ 0.32

Number of weighted average shares outstanding:

Basic 2,602 2,582 2,536 2,531 2,631

Diluted 2,726 2,746 2,728 2,772 2,952

Balance Sheet Data:

Working capital $ 358 $ 2,948 $ 2,489 $ 2,112 $ 758

Total assets 13,535 13,670 11,560 6,966 4,282

Long-term debt 520 509 508 512 17

Total stockholders' equity $ 4,694 $ 5,622 $ 5,308 $ 2,321 $ 1,293

(a) Includes a charge of $742 million. Approximately $482 million relates to employee termination benefits, facilities closure costs, and other asset

impairments and exit costs, while the balance of $260 million relates to other-than-temporary declines in the fair value of equity securities.

(b) Includes a charge of $105 million related to employee termination benefits and facilities closure costs.

(c) Includes a charge of $194 million related to a purchase of in-process research and development.

(d) Effective January 29, 2000, the Company changed its accounting for revenue recognition in accordance with the Securities and Exchange Commission's

Staff Accounting Bulletin No. 101, Revenue Recognition in Financial Statements ("SAB 101"). The cumulative effect of the change on retained

earnings as of the beginning of fiscal 2001 resulted in a charge to fiscal 2001 income of $59 million (net of income taxes of $25 million). With the

exception of the cumulative effect adjustment, the effect of the change on the net income for fiscal year ended February 2, 2001 and all prior years

presented was not material. See Note 1 of Notes to Consolidated Financial Statements included in "Item 8 — Financial Statements and Supplementary

Data." 16