Dell 2001 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2001 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

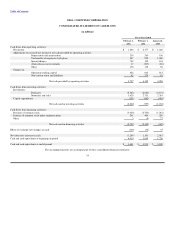

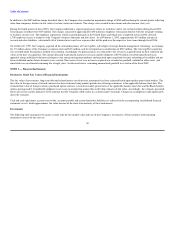

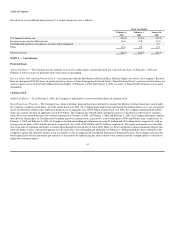

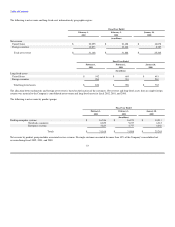

The effective tax rate differed from statutory U.S. federal income tax rate as follows:

Fiscal Year Ended

February 1, February 2, January 28,

2002 2001 2000

U.S. federal statutory rate 35.0% 35.0% 35.0%

Foreign income taxed at different rates (6.6) (5.8) (6.0)

Nondeductible purchase of in-process research and development — — 2.8

Other (0.4) 0.8 0.2

Effective tax rate 28.0% 30.0% 32.0%

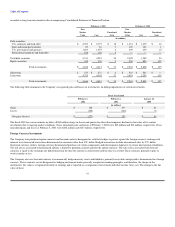

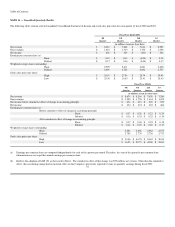

NOTE 5 — Capitalization

Preferred Stock

Authorized Shares — The Company has the authority to issue five million shares of preferred stock, par value $.01 per share. At February 1, 2002 and

February 2, 2001 no shares of preferred stock were issued or outstanding.

Series A Junior Participating Preferred Stock — In conjunction with the distribution of Preferred Share Purchase Rights (see below), the Company's Board of

Directors designated 200,000 shares of preferred stock as Series A Junior Participating Preferred Stock ("Junior Preferred Stock") and reserved such shares for

issuance upon exercise of the Preferred Share Purchase Rights. At February 1, 2002 and February 2, 2001, no shares of Junior Preferred Stock were issued or

outstanding.

Common Stock

Authorized Shares — As of February 1, 2002, the Company is authorized to issue seven billion shares of common stock.

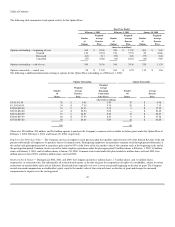

Share Repurchase Program — The Company has a share repurchase program that it uses primarily to manage the dilution resulting from shares issued under

the Company's employee stock plans. As of the end of fiscal year 2002, the Company had cumulatively repurchased 940 million shares over a six-year period

out of its authorized 1 billion share repurchase program, for an aggregate cost of $9.8 billion. During fiscal year 2002, the Company repurchased 68 million

shares of common stock for an aggregate cost of $3.0 billion. The Company has utilized equity instrument contracts to facilitate its repurchase of common

stock, but has not entered into any new contracts subsequent to October of 2000. At February 1, 2002 and February 2, 2001, the Company held equity options

that allow for the purchase of 25 million and 78 million shares of common stock, respectively, at an average price of $58 and $50 per share, respectively. At

February 1, 2002 and February 2, 2001, the Company also had outstanding put obligations covering 51 million and 122 million shares, respectively, with an

average exercise price of $45 and $44 per share, respectively, for a total of $2.3 billion and $5.4 billion, respectively. The equity instruments are exercisable

only at the date of expiration and expire at various dates through the first quarter of fiscal 2004. However, these instruments contain termination triggers that

allow the holder to force settlement beginning at an $8 share price. The outstanding put obligations at February 1, 2002 permitted net share settlement at the

Company's option and, therefore, did not result in a liability on the accompanying Consolidated Statement of Financial Position. The Company's practice has

been to physically settle in-the-money put contracts as they mature by repurchasing the shares subject to the contracts and the Company plans to continue to

utilize this settlement option.

44