Dell 2001 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2001 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

labor associated with service dispatches. Factors that affect the Company's warranty liability include the number of installed units, historical and anticipated

rate of warranty claims on those units and cost per claim to satisfy the Company's warranty obligation. As these factors are impacted by actual experience and

future expectations, the Company assesses the adequacy of its recorded warranty liabilities and adjusts the amounts as necessary. Costs associated with

service and extended warranty contracts for which the Company is obligated to perform are recognized over the term of the contract.

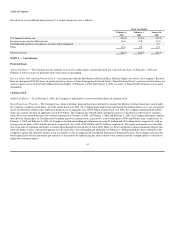

Advertising Costs — Advertising costs are charged to expense as incurred. Advertising expenses for fiscal years 2002, 2001, and 2000, were $361 million,

$431 million, and $325 million, respectively.

Shipping Costs — The Company's shipping and handling costs are included in cost of sales for all periods presented.

Stock-Based Compensation — The Company applies the intrinsic value method in accounting for its stock option and stock purchase plans. Accordingly, no

compensation expense has been recognized for options granted with an exercise price equal to market value at the date of grant or in connection with the

employee stock purchase plan. See Note 6 for the pro forma disclosure of the effect on net income and earnings per common share as if the fair value based

method had been applied in measuring compensation expense.

Income Taxes — Deferred tax assets and liabilities are recorded based on the difference between the financial statement and tax basis of assets and liabilities

using enacted tax rates in effect for the year in which the differences are expected to reverse.

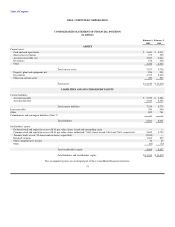

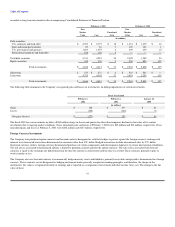

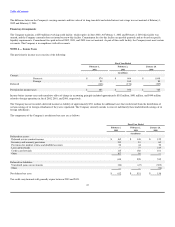

Earnings Per Common Share — Basic earnings per share is based on the weighted effect of all common shares issued and outstanding, and is calculated by

dividing net income by the weighted average shares outstanding during the period. Diluted earnings per share is calculated by dividing net income by the

weighted average number of common shares used in the basic earnings per share calculation plus the number of common shares that would be issued

assuming exercise or conversion of all potentially dilutive common shares outstanding. The following table sets forth the computation of basic and diluted

earnings per share for each of the past three fiscal years:

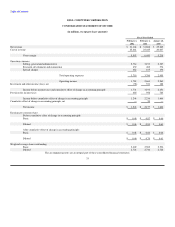

Fiscal Year Ended

February 1, February 2, January 28,

2002 2001 2000

(in millions, except per-share amounts)

Net income $ 1,246 $ 2,177 $ 1,666

Weighted average shares outstanding:

Basic 2,602 2,582 2,536

Employee stock options and other 124 164 192

Diluted 2,726 2,746 2,728

Earnings per common share:

Before cumulative effect of change in accounting principle

Basic $ 0.48 $ 0.87 $ 0.66

Diluted $ 0.46 $ 0.81 $ 0.61

After cumulative effect of change in accounting principle

Basic $ 0.48 $ 0.84 $ 0.66

Diluted $ 0.46 $ 0.79 $ 0.61

Comprehensive Income — The Company's comprehensive income is comprised of net income, foreign currency translation adjustments, and unrealized gains

and losses, net of tax, on derivative financial instruments and investments classified as available-for-sale.

Recently Issued Accounting Pronouncements — In June 2001, the Financial Accounting Standards Board (FASB) issued SFAS 141, Business Combinations,

and SFAS 142, Goodwill and Other

38