Dell 2001 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2001 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

February 1, 2002 and February 2, 2001, the Company had accrued approximately $78 million and $40 million of such expenses. The leases are classified as

operating leases, and therefore, the leased assets and obligations (other than the aforementioned $78 million and $40 million) are not reflected on the

accompanying Consolidated Statement of Financial Position.

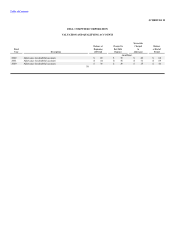

Future minimum lease payments under these leases as of February 1, 2002 are as follows: $4 million in fiscal 2003; $3 million in fiscal 2004; $3 million in

fiscal 2005; $2 million in fiscal 2006; $1 million in fiscal 2007; and $1 million thereafter. Residual value guarantees of up to $162 million, $306 million and

$71 million are due in fiscal 2004, 2006 and 2008, respectively.

As part of the above lease transactions, the Company restricted $90 million and $7 million of its investment securities as collateral for specified lessor

obligations under the leases as of February 1, 2002 and February 2, 2001. These investment securities are restricted as to withdrawal and are managed by third

parties subject to certain limitations under the Company's investment policy. In addition, the Company must meet certain financial covenant requirements

related to interest coverage, net debt to capitalization, and consolidated tangible net worth as defined by the underlying agreements. The tangible net worth

financial covenant requires that the Company's Tangible Net Worth, as defined, not be less than $1 billion. The Company was in compliance with all financial

covenants in fiscal 2002, 2001, and 2000.

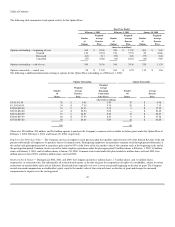

The Company leases other property and equipment, manufacturing facilities and office space under non-cancelable leases. Certain leases obligate the

Company to pay taxes, maintenance and repair costs. Future minimum lease payments under all non-cancelable leases (excluding the master lease facilities

described above) as of February 1, 2002 are as follows: $36 million in fiscal 2003; $28 million in fiscal 2004; $25 million in fiscal 2005; $21 million in fiscal

2006; $14 million in fiscal 2007; and $72 million thereafter. Rent expense under all leases totaled $93 million, $95 million, and $81 million for fiscal 2002,

2001 and 2000, respectively.

Legal Matters — The Company is subject to various legal proceedings and claims arising in the ordinary course of business. The Company's management

does not expect that the outcome in any of these legal proceedings, individually or collectively, will have a material adverse effect on the Company's financial

condition, results of operations or cash flows.

Certain Concentrations — All of the Company's foreign currency exchange and interest rate derivative instruments involve elements of market and credit risk

in excess of the amounts recognized in the consolidated financial statements. The counterparties to the financial instruments consist of a number of major

financial institutions. In addition to limiting the amount of agreements and contracts it enters into with any one party, the Company monitors its positions with

and the credit quality of the counterparties to these financial instruments. The Company does not anticipate nonperformance by any of the counterparties.

The Company's investments in debt securities are placed with high quality financial institutions and companies. The Company's investments in debt securities

primarily have maturities of less than three years. Management believes that no significant concentration of credit risk for investments exists for the

Company.

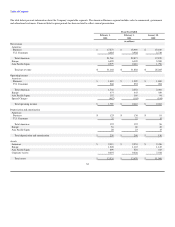

The Company markets and sells its products and services to large corporate, government, healthcare and education customers, small-to-medium businesses

and individuals. Its receivables from such parties are well diversified.

The Company purchases a number of components from single sources. In some cases, alternative sources of supply are not available. In other cases, the

Company may establish a working relationship with a single source, even when multiple suppliers are available, if the Company believes it is advantageous to

do so due to performance, quality, support, delivery, capacity or price considerations. If the supply of a critical single-source material or component were

delayed or curtailed, the Company's ability to ship the related product in desired quantities and in a timely manner could be adversely affected. Even where

alternative sources of supply are available,

48