DHL 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 DHL annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

tailored to our customers’ needs

Strategy +++ Stock +++ Group Management Report +++ Corporate Divisions

Company Report 2002

Solutions

Table of contents

-

Page 1

Company Report 2002 Strategy +++ Stock +++ Group Management Report +++ Corporate Divisions Solutions tailored to our customers' needs -

Page 2

...Net's global distribution network links goods, information and financial flows and develops customer-specific ... ...Solutions Deutsche Post World Net 2002 - A Year of Solutions 4 6 8 12 18 24 Letter to our Shareholders Members of the Board of Management Members of the Supervisory Board Corporate... -

Page 3

2 -

Page 4

..., America and Asia. We work only with high-quality materials, and we use only those colors and styles that we ourselves enjoy wearing. Anything less is simply not good enough. The second key to success is personal contact with our customers. Twice a year, we send our new catalogues to their homes... -

Page 5

... self-sufficient financial and corporate structures. What did we achieve? 2002 saw Deutsche Post World Net leverage its core strengths, persistently adhere to its strategic path and attain new milestones. We pursued a solid management strategy and met our expectations for the fiscal year as a whole... -

Page 6

... express business at the end of the year. We now plan to make this valuable brand the center of our global express and logistics business. I believe that the acquisition of DHL will enable us to continue to globally expand the Group's position and the success of our services. So what is our outlook... -

Page 7

... 1995, respectively. A trained bank officer and business school graduate, Uwe R. Dörken (born 1959) left McKinsey in 1991 to join the Group. He became a member of Deutsche Post AG's Board of Management in 1999 and was appointed chairman and CEO of DHL in 2001. Uwe R. Dörken Worldwide Express 6 -

Page 8

... Scheurle (born 1952) began his career in 1967 with a traineeship at Deutsche Bundespost. Starting in 1979, he has worked full-time for the Deutsche Postgewerkschaft. He has been a member of Deutsche Post AG's Board of Management since 2000. Dr. Frank Appel Corporate Services Dr. Frank Appel (born... -

Page 9

... State Secretary, Federal Ministry of Finance Alfred N. Schindler Chairman of the Supervisory Board and CEO, Schindler Holding AG Jürgen Sengera Chairman of the Board of Management, Westdeutsche Landesbank AG, Düsseldorf / Münster Ulrike Staake Managing Director, Deutsche Bank AG in Hamburg 8 -

Page 10

Members of the Supervisory Board Employees' representatives Rolf Büttner (Deputy Chair) Member of the Federal Executive Board of ver.di Frank von Alten-Bockum Managing Director, Deutsche Post AG Marion Deutsch Deputy Chair of Works Council, Deutsche Post AG, Mail Branch, Saarbrücken Henry ... -

Page 11

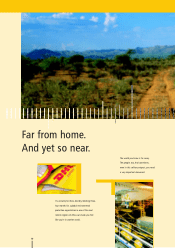

Far from home. And yet so near. The world you know is far away. The people, too. And sometimes, even in this solitary outpost, you need a very important document. It's certainly hot here. And dry. Working three, four months for a global environmental protection organization in one of the most ... -

Page 12

... provide door-to-door, worldwide delivery of every urgent consignment as fast as possible - including to the African savanna, of course. A logistical service that is actually priceless! DHL helped us out of another jam during my last project in the Amazon: the replacement lens for our high-powered... -

Page 13

... provider: targeted acquisitions have enabled us to expand the Group's service portfolio and created a global platform for our offering. Our customers benefit from our logistics expertise - worldwide. As part of our long-term corporate strategy, we intend to further enhance our enterprise value... -

Page 14

... position on the international markets to transform Deutsche Post World Net into the number-one provider. In the course of this initiative, "value creation" and "integration" will become the maxims for all functions, all organizational units, all locations and all employees over the next few years... -

Page 15

... key goals Create new, value-oriented ways of thinking and acting. Eliminate valuation discount compared with competitors on the capital market. Increase the satisfaction of our internal and external customers. Mobilize our employees around the world to achieve our collective, global goal. Creating... -

Page 16

..., DHL's global offering will be bundled in four brand areas: DHL Express, DHL Freight, DHL Danzas Air and Ocean and DHL Solutions. In addition, customers will be able to take advantage of a common sales structure worldwide. Consolidated key account management will guarantee a single point of contact... -

Page 17

... to expand its product and service offering and realize additional potential. Transparent, credible communication mobilizes employees A comprehensive value creation program like STAR can only be successfully planned and implemented if management and employees are involved on a broad level and are... -

Page 18

... centers Bonn Brussels Basel MAIL EXPRESS LOGISTICS FINANCIAL SERVICES Marketing and sales Customer service Operations and production Transport Purchasing IT Accounting Euro Express DHL Danzas Deutsche Post Postbank Increase in consolidated profit to â,¬3.1 billion by end of 2005 17 The Group -

Page 19

... receiving good initial valuations from the rating agencies, we successfully entered the debt capital markets in the autumn with our first bond. Deutsche Post stock data 2001 2002 Change in % Year-end closing price High Low Price/earnings Price/cash flow 1) Number of shares Market capitalization... -

Page 20

...by 50 base points to 2.75%. External factors interrupt trend towards outperformance Deutsche Post stock performed broadly in line with the overall market in the year under review. Our share price proved particularly resistant in the first half of the year, getting off to a strong start and reaching... -

Page 21

... overview: Deutsche Post World Net ratings Moody's Investors Service Standard & Poor's Fitch Ratings Long-term Short-term Outlook Aa3 P-1 Stable A+ A-1 Stable AAF1+ Stable The rating analysts were particularly impressed with the Group's solid financial structure and strong cash flow. All... -

Page 22

... do everything in our power to report on our Company in an open and timely manner, and to ensure that our work lives up to the justifiably high expectations of investors and analysts. The investor relations events Exchange symbols of Deutsche Post stock scheduled for fiscal year 2003 can be found on... -

Page 23

... work in our production facilities, carrying out such tasks as the packaging and distribution of our sensitive goods. Now that's an integrated system solution! Our customers are among the world's youngest citizens. For these newest additions to the human race, nothing but the best will do. In order... -

Page 24

... meet our high storage and transport demands. Because we insist that the utmost care be taken in the manufacture, packaging and delivery of food for babies and children. We also depend on Deutsche Post to execute the mailing campaigns we use to inform young mothers in Germany about our products, as... -

Page 25

Group Management Report We focus on sustained value creation In fiscal year 2002, we successfully continued on our path towards becoming the world's largest integrated logistics service provider, in addition to repeating our track record of strong earnings. With our Group-wide value creation ... -

Page 26

... in Europe: we expanded our mail activities in the Netherlands and were awarded a license for the British mail market in the year under review. Postbank reinforced its strong position in the German retail banking sector and, at the same time, expanded its service offering for corporate customers... -

Page 27

... of the statutory exclusive license to 100g and three times the standard rate, respectively, in an initial step as of 2003. At the same time, competitors were granted access to the market for outgoing cross-border mail services. In a second step, the weight limit will be lowered to 50g as of 2006... -

Page 28

... year under review. Deutsche Post World Net has secured an excellent starting position by making targeted acquisitions over the past few years. This will allow the Group to further expand its position as one of the world's leading logistics service providers. Global sourcing: strategic procurement... -

Page 29

... high transport costs. The rise in costs was due to increased fuel prices and higher security premiums as a result of the terrorist attacks on September 11, 2001. The market for air-based global courier and express business recorded belowaverage growth in the US and Europe in the year under review... -

Page 30

... benefited directly from the recovery in transportation volumes in the second half of the year, allowing us to make up the initial year-on-year shortfall. The market for ocean freight developed more positively in the year under review than in 2001: shifts in customer needs and lower prices compared... -

Page 31

... economic conditions, Deutsche Post World Net recorded a slight increase in revenue of 3.0% to â,¬23,068 million (previous year: â,¬22,398 million) in Germany. With the takeover of DHL, we further expanded our position on the international markets. In Europe (excluding Germany), revenue was... -

Page 32

... profit from operating activities developed more positively than our projections during the year. The return on sales based on EBITA fell to 6.2% (previous year: 7.6%). This decrease is directly related to the decline in the return on sales in the MAIL Corporate Division. Some of the other Corporate... -

Page 33

...services to Germany. The was only partially offset by the positive development at Infopost (addressed advertising mailings) from international customers as well as the expansion of the product range with DHL's former "World Mail" product. The Worldwide Express Business Division, which is represented... -

Page 34

...the Express Europe Business Division, which recorded strong development due to its market leadership in certain countries as well as cost savings in France and the Benelux states in particular. In fiscal year 2001, we began restructuring DHL in the US in order to return this company to profitability... -

Page 35

...the area of information technology. In addition, we increased the allowance for losses on loans and advances. The cost/income ratio improved by 5.9 percentage points to 77.7%, reflecting the faster rise in income than expenses. The return on equity (RoE) rose 1.3 percentage points year-on-year to 10... -

Page 36

... with its parent company, Wegener N.V., we expanded our business activities in the Netherlands in the year under review. In addition, we were awarded a license for the British mail market. These activities will be organized in two new Business Divisions: Foreign Domestic International is home to our... -

Page 37

... Group's economic position The Group's economic position was impacted by several significant factors in 2002. With the first-time consolidation of DHL, we experienced a substantial increase in the size of our consolidated group. An impairment loss of â,¬205 million was charged on DHL USA's goodwill... -

Page 38

... Corporate Division. After adjustment for the effect of the banking business, the Group has a capital ratio of 19.1% (previous year: 24.3%) and thus a sound financing structure, as is evident from a glance at the key figures in the "Postbank at equity" scenario. IAS 39: International Accounting... -

Page 39

... date) mean that we have sufficient funds to finance both the growth we are aiming for and our planned investments. The key elements of the cash flow statement (Postbank at equity) have been summarized below in order to explain the financial position. The complete consolidated financial statements... -

Page 40

... for our financial position Deutsche Post World Net Postbank at equity Jan. 1 - Dec. 31, 2001 Deutsche Post World Net Postbank at equity Jan. 1 - Dec. 31, 2002 Cash and cash equivalents as of Dec. 31 Net profit before changes in working capital Net cash from operations (Cash flow I) Net cash from... -

Page 41

...the individual Business Departments, Corporate Departments and subsidiaries. The transfer of information to higher levels in the hierarchy is controlled by way of predefined materiality levels, updated on a quarterly basis, and consolidated centrally. The Board of Management receives a report on the... -

Page 42

...'s aircraft fleet. The primary risks affecting the FINANCIAL SERVICES Corporate Division are market price risk and counterparty (default) risk. These are intensively monitored and managed by Postbank using a comprehensive set of instruments for risk management in foreign exchange trading, securities... -

Page 43

...of the underlying financial product's price. Corporate Treasury: corporate function responsible for ensuring financing and cash management. Controls all of the Group's financial flows and advises Group companies in all matters related to financing, financial risk management and payment transactions... -

Page 44

... EXPRESS Corporate Division. In the second quarter of 2002, we started to install an innovative online communications platform which forms a cornerstone of the Europe-wide harmonization of our information technology. This new platform is a multi-functional, mobile terminal for parcel delivery, and... -

Page 45

... report in the current fiscal year. We intend to press ahead with the use of environmental management systems. In 2002, DHL became the first air express courier to be certified under DIN ISO 14001 for its environmental management. Certification of the express service in Germany will be completed... -

Page 46

... September 11, 2001. Group-wide procurement bundled In the year under review, Corporate Purchasing entered into a number of worldwide agreements with global suppliers for goods and services with a high procurement volume. This has helped to increase the Group's security of supply, while at the same... -

Page 47

... 2001 Dec. 31, 2002 Change in % Corporate Divisions MAIL Corporate Division 1) EXPRESS Corporate Division 1) LOGISTICS Corporate Division 1) FINANCIAL SERVICES Corporate Division 1) 2) Other/Consolidation 1) 2) Group 1) Group 3) Regions 1) Germany Europe (excl. Germany) Americas (North, Central and... -

Page 48

... off our sales and marketing activities in the Express Germany Business Division to Deutsche Post Euro Express Deutschland GmbH & Co. OHG (DPEED). Collective wage agreements on standard market conditions of work and payment were concluded with the unions for the employees of both companies; these... -

Page 49

... absence rate dropped to 5.9%, the lowest level in the Company's history. Training and further education intensified and expanded internationally By providing training and further education as required, we are creating the foundation upon which our employees will be able to meet the changing... -

Page 50

... 31, 2003. With the acquisition of this express service provider, which is known under the name Mayne Logistics Loomis, DHL is further expanding its market share in Canada, thereby systematically strengthening its position in the North American market for groundbased express delivery. On February 13... -

Page 51

...to lead to lower consumer spending and investment than in the other euro-zone countries. Starting from fiscal year 2003, our mail business will also be affected by two external factors. From January, the price cuts ordered by the regulatory authority will have a negative impact on annual revenue and... -

Page 52

... change in the reporting structure: the Eurocargo Business Unit will be transferred from the LOGISTICS Corporate Division to the EXPRESS Corporate Division. With STAR, we have given our shareholders and the capital markets a clear indication of our commitment to value creation at Deutsche Post World... -

Page 53

52 -

Page 54

...I found it immediately on the Internet. Actually, I can do a lot of my banking from home, since Postbank not only has outlets throughout Germany, but also offers almost everything online and over the phone. I could even set up my new standing orders right now over the Internet. "Laura, just give me... -

Page 55

... additional services and products in new Corporate Divisions. The mail business contributed around 28% of total revenue in fiscal year 2002. MAIL Corporate Division 1) 2001 2002 Change in % Total revenue Profit from operating activities (EBITA) Return on sales 2) Investments Employees calculated... -

Page 56

... new growth markets in Europe. In order to leverage these opportunities, we established the Foreign Domestic International and Solutions International Business Divisions in 2002. Both Business Divisions will begin contributing to operations in fiscal year 2003. Foreign Domestic International is home... -

Page 57

... an 11.0% share of this highly fragmented market. Revenue remains stable At â,¬11,666 million, revenue in the MAIL Corporate Division remained at the prioryear level (â,¬11,707 million) in fiscal year 2002. Revenue per business day remained at â,¬47.0 million, while revenue per employee rose from... -

Page 58

...9.0 billion advertising mailings. Although sales in the higher-priced area of addressed mailings (Infopost/Infobrief) were stable, Revenue: Mail Communication Business Division (Deutsche Post AG share) 15.8% Private communication 66.5% Business communication 9.7% Service and supplementary products... -

Page 59

...decrease was planned in order to increase the average price, it was also brought about by economic factors. In the area of value added services, we recorded growth with products such as Mailingfactory, which allows small and mid-sized business customers to design their own direct marketing campaigns... -

Page 60

... sales units - from Key Account Management through to the Direct Marketing Center - are now even more focused on our customers' specific needs and usage patterns. Outlook Two external factors will influence our mail business in fiscal year 2003: firstly, the price cuts that have been ordered... -

Page 61

... Division Our solution: All global services under a sing The EXPRESS Corporate Division provides domestic and international parcel and express delivery services as well as cross-border mail transport. Deutsche Post World Net is one of the leading international providers in both of these areas... -

Page 62

... year under review, the EXPRESS Corporate Division consisted of four Business Divisions: Express Germany and Express Europe offer high-performance products and perfect service for parcel and express transportation in Germany and more than 20 European countries. Global Mail provides cross-border mail... -

Page 63

... providers of cross-border mail services in 2001. The market for air-based global courier and express business recorded belowaverage growth in the US and Europe in the year under review, whereas the AsiaPacific region still has substantial growth potential. German CEP market 2001 23% Deutsche Post... -

Page 64

...was primarily due to the first-time consolidation of DHL. On a comparable basis, revenue approximately matched the previous year's level. Revenue by Business Division in â,¬m 2001 2002 Change in % Express Germany Express Europe Global Mail Worldwide Express Internal revenue Total 2,795 2,054 1,315... -

Page 65

...) of â,¬243 million, representing a return on sales of 1.9%. For detailed information on earnings development, please see the "Business Developments" section of the Group Management Report, page 33. Strengthening our global market position In the year under review, investments totaling â,¬3,759... -

Page 66

.... Deutsche Post World Net again had among the fastest mail transit times within Europe according to a study of international companies carried out by UNEX :over the last few years, we have reduced the average transit time for letters by around one day to 2.2 days. Our PACKSTATION delivery service... -

Page 67

... Deutsche Post World Net's LOGISTICS Corporate Division implements complex logistics solutions for customers all around the world. We recognized at an early stage that, given the highly fragmented nature of the logistics market, only globally active providers offering a wide range of services... -

Page 68

... materials. The market for logistics services has changed in recent years. Industry has started to produce and sell its goods in more and more countries around the world. The complexity of goods flows is increasing - and so, too, are requirements for workflow management. If companies were to... -

Page 69

... growing number of companies are coming to the conclusion that outsourcing their logistics services is the right solution for them. Deutsche Post World Net is benefiting from this trend. We have developed IT systems to monitor goods flows at all times, manage the flow of information, and incorporate... -

Page 70

... exchange rates. In the Eurocargo Business Unit, the first-time full consolidation of Kelpo Kuljetus and the first-time consolidation of the Cargoplan/Cargoline group, as well as the incorporation of a number of smaller business units from the EXPRESS Corporate Division had a positive effect... -

Page 71

... position in Eastern Europe with the integration of the Cargoplan/Cargoline group, we experienced considerable success in the Chinese growth market, where Deutsche Post World Net is one of the few international logistics providers with A licenses and certification to operate as an NVOCC . This means... -

Page 72

...supply chain will be outsourced to service providers to an even greater extent. Since procurement, production and sales are all becoming increasingly global in their nature, the demand is for logistics providers who can offer their customers value added services and also follow them into new markets... -

Page 73

... also be able to call on our mobile sales units. FINANCIAL SERVICES Corporate Division 1) 2001 2002 Change in % Revenue and income from banking transactions Profit from operating activities (EBITA) Investments Cost/income ratio Return on equity (RoE) Employees calculated as FTEs, excluding trainees... -

Page 74

... on particularly profitable sectors such as insurance and investments. In the Corporate Banking segment, we provide large companies with relationship banking services as well as supplementary customized financial services. We also develop specialized forms of finance for this target group. Logistics... -

Page 75

...points year-on-year to 10.7%. This ratio serves as a measure of the profitability of the equity that has been utilized. It increased due to the fact that earnings improved once again. Growth recorded for all banking products In the checking accounts business, the number of private checking accounts... -

Page 76

... US subsidiary PB Capital Corporation developed according to plan. This company forms our platform for logistics finance in North America. At Group level, we are already working closely together with the logistics units DHL and Danzas. The most recent product of this collaboration is cash forwarding... -

Page 77

... were previously spread across different locations close to the stock exchange in Frankfurt. PFS advises and manages our public and special funds, develops new investment products and assumes an active role as the Group's financial service provider. At the same time, we have concentrated our risk... -

Page 78

...'s high standards of quality. Postbank scored high marks once again in the German customer survey "Kundenmonitor Deutschland 2002", ranking second among all banks and savings banks. Customers also continue to report high levels of satisfaction with the service they receive in the retail outlets... -

Page 79

... service institution (factor) purchases its customers' accounts receivable on a one-time or regular basis. CEP market Market for courier, express and parcel services. Fast Moving Consumer Goods Consolidated loads Individual shipments transported overland, both domestically and internationally... -

Page 80

... what quality standards letters, parcels and press products must be transported within Germany and in Europe. Multi-channel bank A bank that markets its products and services using several sales channels. Non-Vessel Operating Common Carrier (NVOCC) A transport company that carries goods by sea... -

Page 81

...global mail, express delivery and logistics services, as well as a wide-ranging financial services offering. Deutsche Post World Net is one of the largest and most powerful logistics providers in the world. This service range is represented by a strong brand portfolio comprising Deutsche Post, DHL... -

Page 82

... delivery. Danzas acquires the Cargoplan / Cargoline group, headquartered in Vienna, making it the leading logistics service provider in Austria and strengthening its presence in Eastern / Central Europe. July Deutsche Post World Net announces plans to work together with the Dutch direct marketing... -

Page 83

... for groundbased express delivery and to press ahead with our global growth strategy. October The first bond to be issued by Deutsche Post is received positively on the international financial markets. In order to meet the high level of investor interest, we increase the planned issuing volume... -

Page 84

Contact For information on Deutsche Post stock please e-mail [email protected]. Investor Relations Fax: +49 (0)228/1 82-6 32 99 E-mail: [email protected] Press office Fax: +49 (0)228/1 82-98 22 E-mail: [email protected] Deutsche Post World Net on the Internet: www.dpwn.de April 2003 Mat... -

Page 85

Financial Report 2002 Income Statement +++ Balance Sheet +++ Cash Flow Statement +++ Notes Achievements that convince our shareholders -

Page 86

... Statement of Changes in Equity Notes 4 58 59 64 Auditors' Report Postbank at Equity Summary of the HGB Annual Financial Statements of Deutsche Post AG Report by the Supervisory Board Corporate Governance Committees Mandates Financial Highlights Financial Calendar Group 6-Year Review 66 68... -

Page 87

... fiscal year 2002? 'First, we can state with absolute confidence that Deutsche Post World Net's financial position continues to be extremely solid. Our economic development in 2002 was impacted by various factors, only some of which were under our control. Then there is the first-time consolidation... -

Page 88

... item and disclosed it in the FINANCIAL SERVICES Corporate Division for the first time in fiscal year 2002, i.e. we disclosed it in the Corporate Division which also bears the management responsibility for the retail outlets. In addition, we completely reversed Postbank's remaining negative goodwill... -

Page 89

... expanded our position on the international markets. Despite an economically difficult operating environment, our earnings were higher than our intra-year projections had anticipated. Thanks to active management of our cash and cash equivalents, we have maintained our solid financial position and... -

Page 90

... 1 to December 31 in â,¬m Note Deutsche Post World Net 2001 Deutsche Post World Net 2002 Revenue and income from banking transactions Other operating income Total operating income Materials expense and expenses from banking transactions Staff costs * Depreciation and amortization expense excluding... -

Page 91

... Provisions Provisions for pensions and other employee benefits Tax provisions Other provisions 36 75 37 38 39 6,627 1,311 3,033 10,971 6,292 1,510 4,882 12,684 Liabilities Financial liabilities Trade payables Liabilities from financial services Other liabilities Total equity and liabilities... -

Page 92

... income Net profit before changes in working capital Changes in working capital Inventories Receivables and other assets Current financial instruments Receivables and other securities/liabilities from financial services Provisions Liabilities and other items Net cash from operations / Cash flow... -

Page 93

... IAS 39 reserve Consolidated net profit* Total equity Balance at Jan. 1, 2001 Capital transactions with owner Capital contribution from retained earnings Dividend Other changes in equity not recognized in income Currency translation differences Other changes Changes in equity recognized in income... -

Page 94

... statements of Deutsche Post World Net for fiscal year 2002 were prepared in accordance with the International Accounting Standards (IASs, in future: "International Financial Reporting Standards" - IFRSs) adopted and published by the International Accounting Standards Board (IASB), and with the... -

Page 95

...2002 generally include all German and foreign operating companies in which Deutsche Post AG directly or indirectly holds a majority of voting rights. The companies are consolidated from the date on which Deutsche Post World Net is able to exercise control. The companies listed in the table below are... -

Page 96

... as a subsidiary since January 2002. Deutsche Post AG acquired a further 53.6% interest in DHL International during the course of the year under review. This now gives us 100% of the shares of the global market leader in the international courier express business. The total purchase price for the... -

Page 97

... At Deutsche Post World Net, these relate only to internally developed software. In addition to direct costs, the production cost of internally developed software includes an appropriate share of attributable production overheads. Any borrowing costs are not included in production costs. Value added... -

Page 98

... with the acquisition or production of items of property, plant and equipment is included in the cost if it cannot be deducted as input tax. Depreciation is generally charged using the straight-line method. Deutsche Post World Net applies the following useful lives: Useful lives years In accordance... -

Page 99

... necessary specific valuation allowances, global valuation allowances are charged to take account of identifiable risks from the general credit risk. Current financial instruments Originated loans and receivables are carried at amortized cost. Purchased loans and receivables classified as "held to... -

Page 100

... fiscal year 2002, we accounted for the executive stock option program for the first time on the basis of IFRS Exposure Draft ED 2: "Share-based Payment", which provides for fair value accounting for stock options. This resulted in a â,¬12 million increase in staff costs. Under the IASs, the change... -

Page 101

... the transfer of this real estate to the Pension Trust. Further details on the Pension Trust can be found in note 37. We presented our STAR value creation program in fiscal year 2002. This aims to fundamentally restructure Deutsche Post World Net. Provisions of â,¬1,077 million were recognized in... -

Page 102

... service provider for the management of written communications. EXPRESS The EXPRESS Corporate Division is home to Deutsche Post AG's national and international parcels and express activities. The Global Mail Business Division is also allocated to the EXPRESS Corporate Division. EXPRESS includes DHL... -

Page 103

... payments, deposits, retail and corporate banking, fund products and investment securities services. The FINANCIAL SERVICES Corporate Division also includes the retail outlets, the retail outlet networks of McPaper and Deutsche Post Service- und Vertriebsgesellschaften, and the Pension Service... -

Page 104

...capitalized Income from investment securities and insurance business (financial services) Income from loss compensation Income from hedged loans and receivables Income from vehicle center services Income from accounting services Income from fees and reimbursements Income from housing management cost... -

Page 105

... in staff costs was due primarily to the full consolidation of DHL International. Staff costs relate mainly to wages, salaries and compensation, as well as all other benefits paid to employees of the Group for their services in the year under review. Retirement benefit expenses relate to current and... -

Page 106

... costs Travel, training and incidental staff costs Telecommunication costs Insurance costs Other business taxes Cost of purchased cleaning, transportation and security services Bad debt allowances and other write-downs on receivables Allowance for losses on loans and advances (financial services... -

Page 107

... tax is attributable to DHL International. The change in the income tax expense is due to the lower year-on-year reduction in deferred tax assets from tax loss carryforwards at Deutsche Post AG. The reconciliation to the effective tax expense is shown below, based on profit from ordinary activities... -

Page 108

... earnings per share, the average number of shares outstanding is adjusted for the number of all potentially dilutive shares. There were 7,190,106 stock options for employees (previous year: 7,387,544) and 10,306,038 stock options for executives (previous year: 5,173,140) at the reporting date. There... -

Page 109

...based on the opening balances in fiscal year 2001: Intangible assets in â,¬m Internally generated intangible assets Purchased intangible assets Goodwill Negative goodwill Advance payments Total Historical cost Opening balance at Jan. 1, 2001 Changes in consolidated group Additions Reclassifications... -

Page 110

...: Goodwill in â,¬m 2002 Danzas group DHL International Other Group companies 1,840 1,742 792 4,374 26 Property, plant and equipment Changes in property, plant and equipment in fiscal year 2002 are presented below, based on the opening balances in fiscal year 2001: Property, plant and equipment... -

Page 111

... and equipment where Deutsche Post World Net has paid advances in connection with uncompleted transactions. Assets under development relate to items of property, plant and equipment in progress at the balance sheet date for whose production internal or thirdparty costs have already been incurred... -

Page 112

... Investments in subsidiaries Available for sale Noncurrent financial instruments Other equity investments Loans to subsidiaries Originated loans Loans to other investees Housing promotion loans Other loans Total Historical cost Opening balance at Jan. 1, 2001 Changes in consolidated group Additions... -

Page 113

...from sales of assets Receivables from cash-on-delivery Receivables from loss compensation (recourse claims) Receivables from employees and executive body members Short-term loans and interest receivables Advance payments Receivables from Bundesanstalt für Post und Telekommunikation Receivables from... -

Page 114

... loans to customers (available for sale) thereof fair value hedges 37,772 9,210 889 5,405 3,112 44,066 38,687 5,294 779 4,412 2,411 43,878 Gains of â,¬11 million (previous year: â,¬11 million) on the measurement of unhedged purchased available-for-sale loans to other banks were credited directly... -

Page 115

... other banks Loans and advances to customers -10 -611 -621 -9 -579 -588 The allowance for losses on loans and advances changed as follows in fiscal year 2002: Change in loan loss allowance in â,¬m Specific risks 2001 2002 Country risks 2001 2002 Potential risks 2001 2002 Total 2001 2002 Opening... -

Page 116

... equities thereof investment fund shares 46,544 1,399 1,206 193 47,943 43,250 911 707 204 44,161 â,¬42,539 million (previous year: â,¬36,251 million) of the investment securities relates to listed securities. Losses on the measurement of unhedged availablefor-sale securities were charged directly... -

Page 117

...assets Receivables and other securities from financial services Other current assets Pension provisions Other provisions Financial liabilities Other liabilities 13 6 10 13 58 12 Deferred tax assets from tax loss carryforwards Deutsche Post AG Deutsche Postbank group DHL International Danzas group... -

Page 118

... meaning of section 15 of the AktG (German Stock Corporation Act). The Board of Management has not exercised its authorization to increase our share capital. The stock options were granted to employees under the terms of the employee equity compensation program launched at the time of Deutsche Post... -

Page 119

... was changed in fiscal year 2002. Starting in fiscal year 2002, the stock option program is measured using investment techniques by applying option pricing models (fair value measurement). The prior-period amounts were restated to reflect the new accounting policy. This resulted in staff costs of... -

Page 120

... of the revaluation reserve relates to gains or losses on the fair value measurement of financial instruments of the Deutsche Postbank group due to the negative developments on the international capital markets. Consolidated net profit The consolidated net profit for fiscal year 2002 amounts to... -

Page 121

... 4,049 6,292 The provisions for pensions and other employee benefits relate principally to the following companies: Allocation of pension provisions to companies in â,¬m 2001 2002 Deutsche Post AG Deutsche Postbank group Danzas group DHL International Other Group companies 5,957 552 98 0 20 6,627... -

Page 122

...pension funds and Deutsche Post Pensionsfonds GbR were provided with plan assets (funded pension plans). Deutsche Post AG and Deutsche Postbank AG have entered into direct commitments for the remaining plans. Other funded benefit obligations relate primarily to the Danzas group and DHL International... -

Page 123

... to the state pension system operated by the statutory pension insurance funds, to which contributions for hourly workers and salaried employees are remitted in the form of non-wage costs, Deutsche Post AG and Deutsche Postbank AG pay contributions to defined contribution plans in accordance with... -

Page 124

...and guarantees that the special pension fund is able at all times to meet the obligations it has assumed in respect of its funding companies. Where the federal government makes payments to the special pension fund under the terms of this guarantee, it cannot claim reimbursement from Deutsche Post AG... -

Page 125

... services Other current assets Pension provisions Miscellaneous provisions 68 101 43 106 86 8 592 1 0 82 0 13 900 520 54 0 56 0 165 995 39 Other provisions Financial liabilities Other liabilities Other provisions changed as follows in fiscal year 2002, based on the opening balances of fiscal... -

Page 126

...provided for restructurings as part of the Group-wide STAR value creation program in the year under review, relating primarily to termination benefit obligations to employees (partial retirement programs, transitional benefits), expenses from the closure of terminals and subsequent impairment losses... -

Page 127

... European Investment Bank fell at the same time by â,¬143 million to â,¬585 million. The longer-term loans are mainly attributable to Deutsche Post International (DPI). Finance lease liabilities increased by â,¬353 million and relate primarily to DHL International. Other financial liabilities fell... -

Page 128

...to 5 years More than 5 years 2,399 1 4 2,404 2,658 43 6 2,707 42 Liabilities from financial services Trade payables Trade payables are attributable to the following companies: Trade payables in â,¬m 2001 2002 Deutsche Post AG Danzas group DHL Deutsche Postbank group Other Group companies 927... -

Page 129

The maturity structure of liabilities from financial services is as follows: Maturities in â,¬m Less than 1 year 2001 2002 1 to 5 years 2001 2002 More than 5 years 2001 2002 Total 2001 2002 Deposits from other banks Due to customers Securitized liabilities Trading liabilities/Hedging derivatives (... -

Page 130

... with credit balances Payable to employees and members of executive bodies Social security liabilities Incentive bonuses COD liabilities Derivatives Overtime claims Other compensated absences Housing management prepayments Liabilities on BHW loan Liabilities to subsidiaries Advance payments received... -

Page 131

... in DHL International amounting to â,¬963 million (purchase price less cash and cash equivalents acquired), and the acquisition of DHL India (â,¬32 million). Other significant financial investments were the acquisition of additional shares of DSL Holding AG i.A. (â,¬59 million), the Danzas Cargoplan... -

Page 132

... bank balances, all receivables, liabilities, securities, loans and accrued interest. Examples of derivatives include options, swaps and futures. Deutsche Postbank group accounts for most of the financial instruments in Deutsche Post World Net. The risks and fair values of Deutsche Postbank... -

Page 133

... triggered by changes in interest rates, volatility, foreign exchange rates and share prices. The changes in value are derived from daily marking-to-market, irrespective of the carrying amounts of assets and liabilities. To quantify these risks, the Deutsche Postbank group uses suitable statistical... -

Page 134

... gross volume of all sales and purchases. The notional amount is a reference value for determining reciprocally agreed settlement payments; it does not represent recognizable receivables or liabilities. Risk-weighted assets Market risk positions Positions for which capital charges are required Core... -

Page 135

... presents the open interest rate and foreign currency forward transactions and option contracts of the Deutsche Postbank group at the balance sheet date. Derivatives of the Deutsche Postbank group Fair value in â,¬m Notional amount 2001 Positive fair values 2001 Negative fair values 2001 Notional... -

Page 136

... is an active market for a financial instrument (e.g. a stock exchange), the full fair value is expressed by the market or quoted exchange price at the reporting date. Because there is not an active market for all assets, the full fair value of such instruments must be calculated by using investment... -

Page 137

... 45.2 Risks and fair values of financial instruments in other Deutsche Post World Net companies Derivatives As part of Deutsche Post World Net's risk management strategy, derivatives are used to offset risks from exchange rate, interest rate and commodity price movements. Derivatives may generally... -

Page 138

... rate risk. We use interest rate swaps to modify the fixed interest rates of financial liabilities. Interest rate swaps are structured so that Deutsche Post World Net pays a defined floating rate of interest on a particular amount of notional principal, and receives in return a certain fixed rate... -

Page 139

... Groß- und Außenhandels against Deutsche Post AG in October 2002. This industry association had claimed that letter postage rates had not been effectively approved by the appropriate authorities. The court rejected this allegation. Further details can be found in the Group Management Report. 54 -

Page 140

... Operating and office equipment Aircraft 3,483 146 198 0 3,827 4,701 131 408 367 5,607 Deutsche Post AG DHL International Danzas group Deutsche Postbank group Other Group companies 2,163 0 953 179 532 3,827 2,770 1,246 939 254 398 5,607 The increase in future minimum lease payments is due... -

Page 141

... the provision of goods and services entered into with unconsolidated companies were conducted on an arm's length basis at standard market terms and conditions. All companies classified as related parties that are controlled by Deutsche Post World Net or on which the Group can exercise significant... -

Page 142

... Deutsche Post Adress GmbH EXPRESS Deutsche Post Euro Express Deutschland oHG DHL US Ground Co. DHL International (UK) Ltd. DHL International S.R.L. DHL Worldwide Express GmbH DHL International S.A. Van Gend & Loos B.V. DHL Japan Inc. LOGISTICS Air Express International USA, Inc. Danzas S.A. Danzas... -

Page 143

... and the statements of changes in equity and cash flows as well as the notes to the financial statements for the business year from January 1 to December 31, 2002. The preparation and the content of the consolidated financial statements according to the International Accounting Standards of the IASB... -

Page 144

... operating activities after goodwill amortization (EBIT) Net loss from associates Net income from measurement of Deutsche Postbank group at equity Net other finance costs Net financial income Profit from ordinary activities Income tax expense Net profit for the period before minority interest and... -

Page 145

...Equity Issued capital Reserves* Consolidated net profit* 1,113 2,663 1,577 5,353 Minority interest Provisions Provisions for pensions and other employee benefits Tax provisions Other provisions 6,075 574 2,681 9,330 Liabilities Financial liabilities Trade payables Liabilities from financial services... -

Page 146

... at equity Net interest income Net profit before changes in working capital Changes in working capital Inventories Receivables and other assets Current financial instruments Receivables and other securities/liabilities from financial services Provisions Liabilities and other items Net cash from... -

Page 147

... statements of Deutsche Post AG including the Deutsche Postbank group at equity were prepared in accordance with the International Accounting Standards (IASs, in future: "International Financial Reporting Standards" - IFRSs) adopted and published by the International Accounting Standards Board (IASB... -

Page 148

Postbank at Equity Review Report Deutsche Post AG, Bonn, has prepared consolidated financial statements for the fiscal year January 1 to December 31, 2002 in accordance with International Accounting Standards (IASs) that qualify as statutory exempting consolidated financial statements pursuant to ... -

Page 149

... Trust Net income for the year (HGB) Adjustments Provisions for pensions Pension Trust Deferred taxes Internally developed software Remeasurement of fixed assets Other provisions/Accruals Gain from merger of Deutsche Post Beteiligungen GmbH Other Net profit for the period (IAS) A B C D E F 1,965... -

Page 150

... assets Inventories Receivables and other assets Cash-in-hand, central bank balances, bank balances and checks 101 3,624 151 3,876 Prepaid expenses 162 17,607 84 2,892 763 3,739 167 19,786 37 5,509 10,334 15,880 Tangible assets Financial assets Gain from merger of Deutsche Post Beteiligungen GmbH... -

Page 151

... MAIL Corporate Division's European strategy, including its entry onto the Dutch market. Another major topic was the acquisition of equity interests, particularly the increase in the Company's interest in DHL International Ltd. to 100%. The Executive Committee of the Supervisory Board met four times... -

Page 152

...standards, we confirm that 1. the factual statements made in the report are correct, 2. the Company's compensation with respect to the transactions listed in the report was not inappropriately high." The annual financial statements of Deutsche Post AG and the Group, the respective management reports... -

Page 153

... between the Supervisory Board and the Board of Management. Good corporate governance should aim to generate a sustained increase in the Company's value while promoting the confidence of investors, customers, employees and the public in the management and supervision of Deutsche Post AG. As an... -

Page 154

Corporate Governance/Committees Executive Bodies Committees The Supervisory Board has created four committees composed of its members: Executive Committee Shareholders' representatives Josef Hattig (Chair) Hero Brahms Dr. Manfred Overhaus Employees' representatives Rolf Büttner (Deputy Chair) ... -

Page 155

...Danzas Holding AG 1), Switzerland (Supervisory Board /Chair) Deutsche Post Beteiligungen GmbH 1) (Supervisory Board/Chair, until Aug. 28, 2002, company merged) Deutsche Post Ventures GmbH 1) (Investment Committee) DHL Worldwide Express B.V. 1), the Netherlands (Board of Directors) C.V. International... -

Page 156

... boards required by law a.i.s AG ASL Aircraft Services Lemwerder GmbH Klöckner & Co. AG SURTECO AG Wilhelm Karmann GmbH Membership of comparable bodies* Ardex GmbH (Advisory Board) Dresdner Bank AG (Advisory Board) Gesellschaft für Stromwirtschaft m.b.H. (Advisory Board) RAG Trading International... -

Page 157

.../revenue 2) Cash flow I Profit from ordinary activities less extraordinary expense/average equity Revenue by Corporate Division 27.7% MAIL â,¬11,666m 21.7% LOGISTICS â,¬9,152m 29.6% EXPRESS â,¬12,489m 21.0% FINANCIAL SERVICES â,¬8,872m Revenue by region 26.2% Europe excl. Germany â,¬10... -

Page 158

...on Q1 Annual General Meeting 2) Press and analyst conference on H1 Analyst conference call on Q1-Q3 Live Internet broadcast at http://investorrelations.dpwn.de Live Internet broadcast of the speech by the Chairman of the Board of Management at http://investorrelations.dpwn.de Subject to correction... -

Page 159

... Other/Consolidation Total EBITDA Profit from operating activities before goodwill amortization (EBITA) MAIL MAIL share EXPRESS EXPRESS share LOGISTICS LOGISTICS share FINANCIAL SERVICES FINANCIAL SERVICES share Corporate Divisions total Other/Consolidation Total Return on sales 3) EBIT in â,¬m in... -

Page 160

...) Workforce calculated as FTEs (excluding trainees) Average workforce Staff costs Key figures (Diluted) earnings per share 6) (Diluted) earnings per share 6) before extraordinary expense Cash flow 4) per share 6) Dividend per share 6) Return on equity before taxes 4) 5) 6) 7) in â,¬m in â,¬m in... -

Page 161

Published by: Deutsche Post AG Headquarters Corporate Departments Investor Relations, Corporate Communications 53250 Bonn Germany Responsible for ...Gersthofen Mat. No. 675-200-126 English translation by: Deutsche Post Foreign Language Service et al. This Annual Report is also published in German.