Cincinnati Bell 2001 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2001 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

19. COMMITMENTS AND CONTINGENCIE S

LEASE COMMITMENTS

The Company leases certain facilities and equipment used in its

operations. Total rental expenses were approximately $42 million,

$32 million and $23 million in 2001, 2000 and 1999, respectively.

At December 31, 2001, the total minimum annual rental

commitments, excluding interest, under noncancelable leases

are as follows:

Operating Capital

($ in millions) Leases Leases

2002 $42.1 $11.2

2003 37.8 8.4

2004 33.8 5.4

2005 26.5 3.1

2006 19.2 2.3

Thereafter 85.0 18.3

Total $244.4 $48.7

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

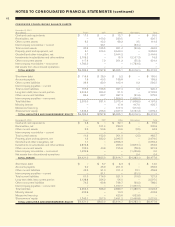

18. QUARTER LY FINANCIAL INFORMATION (UNAUDITED)

($ in millions, except per common share amounts) First Second Third Fourth Total

2001

Revenue $578.3 $608.0 $597.9 $ 566.3 $2,350.5

Operating income 17.5 26.9 22.2 (237.9) (171.3)

Loss from:

Continuing operations before extraordinary item

and cumulative effect of change in

accounting principle (34.0) (28.7) (27.9) (195.6) (286.2)

Net loss $ (34.0) $ (28.7) $ (27.9) $(195.6) $ (286.2)

Basic and diluted earnings per common share $ (0.17) $ (0.14) $ (0.14) $ (0.91) $ (1.36)

EBITDA $154.7 $162.0 $165.6 $ 143.2 $ 625.5

($ in millions, except per common share amounts) First Second Third Fourth To tal

2000

Revenue $460.2 $497.8 $531.2 $ 560.9 $2,050.1

Operating income (25.6) 20.7 20.1 24.0 39.1

Loss from:

Continuing operations before extraordinary item

and cumulative effect of change in

accounting principle (55.6) (29.5) (23.4) (267.8) (376.5)

Discontinued operations 0.1 0.2 0.1 (0.3) 0.2

Extraordinary item and cumulative effect of change

in accounting principle (0.8) — — — (0.8)

Net loss $ (56.3) $ (29.3) $ (23.3) $(268.1) $ (377.1)

Basic and diluted earnings per common share $ (0.28) $ (0.15) $ (0.12) $ (1.26) $ (1.82)

EBITDA $ 85.0 $129.7 $137.3 $ 146.0 $ 498.0

In the first quarter of 2000, the Company incurred a charge of

$0.8 million, net of tax, associated with the adoption of SAB 101

and presented as a cumulative effect of change in accounting

principle (further described in Note 1 of the Notes to

Consolidated Financial Statements). Revenue and expenses

appearing in the above table have been restated to reflect the

adoption of SAB 101 on January 1, 2000.

In the fourth quarter of 2000, the Company incurred a pretax

charge of $405 million in order to write down its portfolio of minor-

ity equity investments to market value at December 31, 2000. The

Company also recognized approximately $17 million in pretax

gains resulting from the liquidation of the Company’s investment in

PurchasePro.com. The net effect of these investment losses

reduced earnings per share by $1.08 in the fourth quarter.

In the fourth quarter of 2001, the Company incurred a pretax

charge included in operating income of $232 million related to

restructuring activities and asset impairments. The net effect of

these restructuring charges reduced earnings per share by

$0.69 in the fourth quarter.