Cincinnati Bell 2001 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2001 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

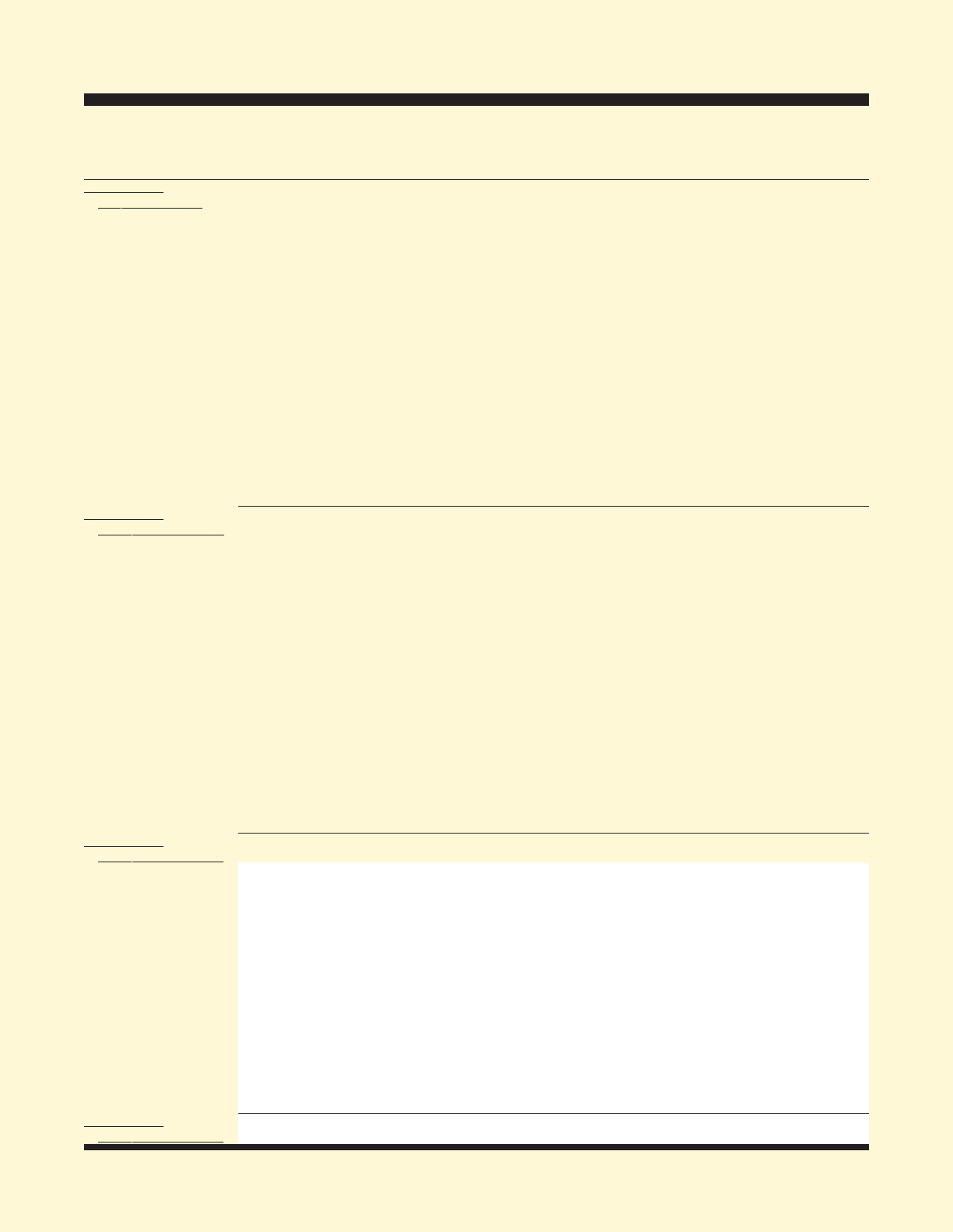

CONSOLIDATED STATEMENTS OF SHAREOWNERS’ EQUITY

6

3

⁄

4

% Cumulative Accumulated

Convertible Additional Other Com-

Preferred Shares Common Shares Treasury Shares Paid-in Accumulated prehensive

(Dollars and shares in millions) Shares Amount Shares Amount Shares Amount Capital Deficit Income (Loss) Total

BALANCE AT

JANUARY 1, 1999 — $ — 136.4 $1.4 — $ — $ 147.4 $ — $ (6.7) $ 142.1

Shares issued under

employee plans — — 3.2 — — — 46.3 — — 46.3

Net income — — — — — — — 31.4 — 31.4

Additional minimum

pension liability

adjustment — — — — — — — — 3.6 3.6

Unrealized gain on

investments — — — — — — — — 170.0 170.0

Restricted stock

amortization — — 0.7 — — — 5.1 — — 5.1

Dividends:

Common Shares, at

$.20 per share — — — — — — — (27.5) — (27.5)

Preferred Shares — — — — — — 1.8 (3.9) — (2.1)

Equity issued in

connection

with Merger 0.2 129.4 68.4 0.7 — — 1,778.9 — — 1,909.0

Treasury shares

repurchased — — — — (7.8) (145.1) — — — (145.1)

BALANCE AT

DECEM B E R 31, 19 9 9 0.2 129.4 208.7 2.1 (7.8) (145.1) 1,979.5 — 166.9 2,132.8

Shares issued under

employee plans — — 5.0 — — — 130.0 — — 130.0

Net loss — — — — — — — (377.1) — (377.1)

Depository share

conversion 2.9 — — — — — — — — —

Additional minimum

pension liability

adjustment — — — — — — — — (0.1) (0.1)

Unrealized loss on

investments, net of

reclassification

adjustments — — — — — — — — (84.1) (84.1)

Restricted stock

amortization — — 0.1 — — — 3.6 — — 3.6

Dividends on

preferred shares — — — — — — (12.3) — — (12.3)

Redemption of 71⁄2%

convertible

preferred stock — — 9.5 0.1 — — 228.6 — — 228.7

BALANCE AT

DECEM B E R 31, 2000 3.1 129.4 223.3 2.2 (7.8) (145.1) 2,329.4 (377.1) 82.7 2,021.5

Shares issued under

employee plans — — 2.3 0.1 — — 40.7 — — 40.8

Net loss — — — — — — — (286.2) — (286.2)

Additional minimum

pension liability

adjustment — — — — — — — — (0.1) (0.1)

Unrealized loss on

investments, net of

reclassification

adjustments — — — — — — — — (85.9) (85.9)

Unrealized loss on

interest rate swaps — — — — — — — — (7.4) (7.4)

Restricted stock

amortization — — 0.3 — — — 6.1 — — 6.1

Dividends on

preferred shares — — — — — — (10.4) — — (10.4)

BALANCE AT

DECEM B E R 31, 20013.1 $129.4 225.9 $2.3 (7.8) $(145.1) $2,365.8 $(663.3) $ (10.7) $1,678.4

The accompanying notes are an integral part of the financial statements.