Cincinnati Bell 2001 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2001 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

The Wireless segment continued significant EBITDA

improvements as CBW leveraged its network investment and

benefited from an embedded customer base, low customer

churn and ongoing promotional efforts. In 2001, EBITDA of

nearly $66 million represented a $48 million improvement over

the prior year. Additionally, EBITDA margin increased 16 margin

points to nearly 27% in the current year.

2000 COMPARED TO 1999

REVEN U E Wireless segment revenue nearly doubled in 2000,

growing 97% to $180 million. Revenue growth of $89 million

was the result of higher service revenue as equipment sales

were virtually unchanged in comparison to 1999. Service rev-

enue continued to grow on the basis of both postpaid and

prepaid subscribership, increasing from $79 million in 1999 to

$167 million in 2000 as a result of relatively high ARPU and low

customer churn.

Approximately 177,000 net subscribers were added during

2000, with growth coming almost equally from the postpaid and

prepaid categories. At the end of 2000, total subscribership

stood at approximately 340,000, a 110% increase versus the end

of 1999. Subscribership of 340,000 represented approximately

10% of the licensed population of potential subscribers within the

Greater Cincinnati and Dayton, Ohio metropolitan areas.

ARPU from postpaid subscribers of $66 in 2000 remained

relatively constant in comparison to 1999 due to pricing pres-

sure from increasing competition. Average monthly customer

churn remained low and was among the best in the industry at

1.42% for postpaid subscribers. Additionally, subscribership to

CBW’s i-wirelessSM prepaid product grew from approximately

11,000 subscribers at the end of 1999 to more than 97,000 at

the end of 2000. This is significant for the reasons noted in the

previous section.

COSTS AND EX P E N S E S Cost of services and prod-

ucts were 45% of revenue during 2000, significantly less than the

64% incurred during 1999. In total, costs of services and products

increased 37% in 2000 to $80 million due primarily to increased

subscribership and associated interconnection charges, incollect

expense, customer care and operating taxes. Gross profit and

gross profit margin also continued their rapid improvement,

increasing to almost $100 million and 55%, respectively. Gross

profit margin of 55% in 2000 represents nearly 20 points in gross

margin improvement versus 36% in 1999.

SG&A expenses increased by nearly $23 million in 2000, or

39%, in support of significant growth in subscribership. In 2000,

the CPGA for postpaid customers was $342, or 9% less than

the $376 incurred in 1999. SG&A expenses also dropped signif-

icantly as a percentage of total revenue, decreasing from 64% of

revenue in 1999 to 45% in 2000.

In 2000, EBITDA of nearly $19 million represented a $44 mil-

lion improvement over 1999. Also increasing was EBITDA margin,

expanding to 10% in 2000, an improvement of more than 38 mar-

gin points versus the –28% EBITDA margin reported in 1999.

OTHE R

The Other segment comprises the operations of the Company’s

CBAD (formerly Cincinnati Bell Long Distance), CBD, ZoomTown

and Public subsidiaries. The results of operations of Cincinnati Bell

Supply are no longer reflected in this segment pursuant to the sale

of this business in the second quarter of 2000. Effective on

January 1, 2002, as further described in Note 3 of

the Notes to Consolidated Financial Statements, ZoomTown’s

managed web hosting activities were merged into Broadwing

Communications and will be reported in the Broadband segment

subsequent to December 31, 2001. ZoomTown’s DSL and

internet operations will be assumed by CBT subsequent to

December 31, 2001. In addition, in February 2002, the Company

announced an agreement to divest 97.5% of CBD. The

Company closed the sale of CBD on March 8, 2002.

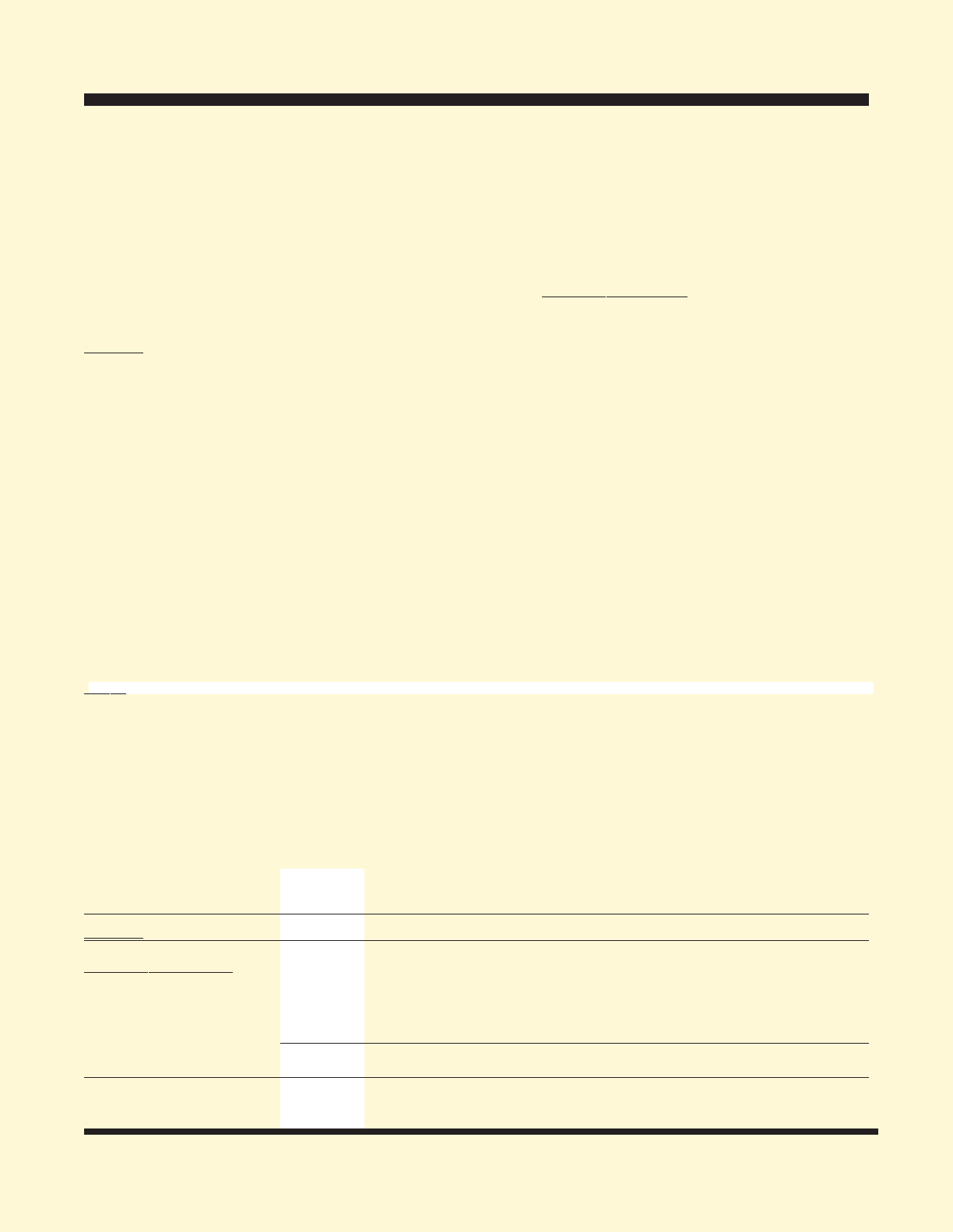

$ Change % Change $ Change % Change

2001 2001 2000 2000

($ in millions) 2001 2000 vs. 2000 vs. 2000 1999 vs. 1999 vs. 1999

REVEN U E $166.3 $142.2 $24.1 17% $109.3 $ 32.9 30%

COSTS AND EX P E N S E S:

Cost of services

and products 95.6 84.3 11.3 13% 58.3 26.0 45%

Selling, general

and administrative 44.1 54.3 (10.2) (19%) 26.6 27.7 104%

Total costs

and expenses 139.7 138.6 1.1 1% 84.9 53.7 63%

EBITDA $ 26.6 $ 3.6 $23.0 n/m $ 24.4 $(20.8) (85)%

EBITDA margin 16.0% 2.5% +14 pts 22.3% (20) pts