Cincinnati Bell 2001 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2001 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

DISCUSSION OF OPERATING SEGM E NT RE S U LTS

The following discussion of the operating results of the

Broadband segment is presented on an as-reported basis except

for information related to 1999, which is presented on a pro forma

basis because it represents the best basis for comparison of

trends and operating results. The Local, Wireless and Other seg-

ments are discussed on an as-reported basis since there is no

distinction between pro forma and as-reported results with

respect to these segments.

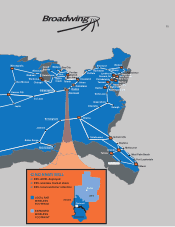

Depreciation expense of $346 million in 2000 increased

$186 million, or 117%, over 1999. This increase was incurred

primarily by the Broadband segment as a result of the Merger

and reflects the continued build out of its national optical net-

work. The Local and Wireless segments also incurred higher

depreciation expenses as both continued construction of their

regional network infrastructures. Amortization expense of

$114 million pertains to purchased goodwill and other intangible

assets and represented a $92 million increase over 1999, due

almost exclusively to the Merger.

The Company recorded approximately $1 million in net

restructuring credits relating to the restructuring initiative that

was undertaken in the fourth quarter of 1999. These credits con-

sisted of $1 million in additional severance expense, offset by a

$2 million reduction related to lease terminations.

Operating income of $39 million declined $100 million ver-

sus the $139 million reported in 1999. The operating income of

the Broadband segment decreased significantly as a result of

the Merger, while the Other segment also experienced a drop in

operating income due to the introduction of new products and

services. These decreases were partially offset by the improve-

ment of the Local and Wireless segments. On a pro forma basis,

operating income increased from a loss of $145 million to income

of $39 million as the Company fully integrated the operations of

the former IXC, increased revenue and controlled expenses.

Minority interest expense of $44 million in 2000 consists of

$49 million in dividends and accretion on the 121⁄2% preferred

stock of Broadwing Communications offset by approximately

$5 million that is attributable to AWS’s 19.9% minority interest in

the operating loss of the Company’s wireless business. Minority

interest expense increased $47 million from minority interest

income of $3 million in 1999. The increase is due to a full year of

dividends and accretion on the 121⁄2% preferred stock in 2000

versus only two months of dividends and accretion in 1999, as

the Merger took place on November 9, 1999.

The Company recorded nearly $16 million in losses in 2000

on the Applied Theory investment accounted for under the equity

method, or approximately 1% more than the $15 million

recorded in 1999. Losses in 1999 were related to Applied

Theory and a 13% share of operating losses of IXC due to the

Company’s ownership of IXC common stock from August 16,

1999 to the November 9, 1999 closing date of the Merger.

These amounts are reported in the Consolidated Statements of

Operations and Comprehensive Income (Loss) under the cap-

tion “Equity loss in unconsolidated entities.”

Interest expense increased to $164 million in 2000, a 165%

or $102 million increase over 1999. This was attributable to

higher average debt levels necessary to fund expansion of the

optical, wireless and local networks and higher interest rates. In

addition, the 2000 amounts reflect an entire year of interest

expense related to the debt used to fund the Merger, versus only

two months of interest expense related to such debt in 1999.

The Company incurred a $356 million loss on investments in

2000. This was the result of $405 million in realized losses on

the PSINet, Applied Theory and ZeroPlus.com investments, net

of $49 million in realized gains on the sale of the Company’s

investment in PurchasePro.com. No such losses were incurred

in 1999.

The income tax benefit of $166 million increased $197 million

versus the $31 million tax provision recorded in 1999. This

resulted primarily from recognized losses on investments, some-

what offset by the effect of certain nondeductible expenses such

as goodwill amortization and preferred stock dividends treated

as minority interest expense. The income tax provision for the

1999 period reflects an expense as operating losses generated

by Merger were included in results for only two months.

Income from discontinued operations, comprising the opera-

tions of the Company’s former Cincinnati Bell Supply (“CBS”)

subsidiary, contributed an additional $0.2 million in income (net

of tax) in 2000, or approximately $3 million less than in 1999, as

the business was sold in May 2000. The Company also recog-

nized $1 million in expense from a cumulative effect adjustment

that resulted from the adoption of Staff Accounting Bulletin

No. 101, “Revenue Recognition in Financial Statements” as

required by the Securities and Exchange Commission on

January 1, 2000 and all periods prior to adoption (see Note 1 of

the Notes to Consolidated Financial Statements).

The Company reported a net loss of $377 million as a result

of the above, versus the $31 million net income reported in

1999. Dividends and accretion on preferred stock were $8 mil-

lion in 2000, resulting in a net loss applicable to common

shareholders of $385 million. The loss per share of $1.82 was

$2.02 higher than in 1999, but included a $1.00 per common

share loss pertaining to investments. Excluding investment

losses, the adjusted loss per share of $0.82 decreased $1.02 in

comparison to the income per share of $0.20 in 1999. The

decrease in both the net income and income per share is related

to inclusion of a full year of results from Broadwing Communications

versus only two months of results after the Merger in 1999. On a

pro forma basis, the net loss increased by 6% or $21 million as

operating losses generated by the Broadband segment in 1999

decreased in 2000, but investment losses net of taxes incurred

in 2000 grew by more than the operating loss declined.