CenturyLink 2015 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.assets, mortality and health care trend rates) in computing the pension and post-retirement benefits expense and

obligations. See Note 7—Employee Benefits for additional information.

Foreign Currency

Our results of operations include foreign subsidiaries, which are translated from the applicable functional

currency to the United States Dollar using the average exchange rates during the reporting period, while assets

and liabilities are translated at the reporting date. We include gains or losses from foreign currency

remeasurement in other income, net in our consolidated statements of operations. Certain non-U.S. subsidiaries

designate the local currency as their functional currency, and we record the translation of their assets and

liabilities into U.S. Dollars at the balance sheet date as translation adjustments and include them as a component

of accumulated other comprehensive loss in our consolidated balance sheets.

Common Stock

At December 31, 2015, we had 4 million unissued shares of CenturyLink, Inc. common stock reserved for

acquisitions. In addition, we had 25 million shares authorized for future issuance under our equity incentive

plans.

Preferred stock

Holders of outstanding CenturyLink, Inc. preferred stock are entitled to receive cumulative dividends,

receive preferential distributions equal to $25 per share plus unpaid dividends upon CenturyLink, Inc.’s

liquidation and vote as a single class with the holders of common stock.

Dividends

We pay dividends out of retained earnings to the extent we have retained earnings on the date the dividend

is declared. If the dividend is in excess of our retained earnings on the declaration date, then the excess is drawn

from our additional paid-in capital.

Recently Adopted Accounting Pronouncements

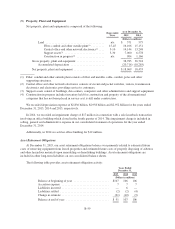

In 2015, we adopted Accounting Standards Update (“ASU”) 2015-03 “Simplifying the Presentation of Debt

Issuance Costs” (ASU 2015-03) and ASU 2015-17 “Balance Sheet Classification of Deferred Taxes”

(ASU 2015-17). Both ASUs are intended to simplify the presentation of financial information. ASU 2015-03

requires that debt issuance costs be presented as a reduction in the associated debt rather than as an other asset,

net. ASU 2015-17 requires that deferred taxes be presented on a net basis by jurisdiction as either a net

noncurrent asset or liability. The ASUs affect neither the timing of expense recognition related to the debt

issuance costs nor the timing of income and expense recognition related to deferred income taxes.

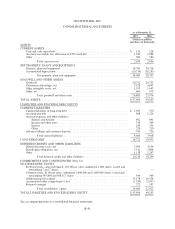

We adopted both ASU 2015-03 and 2015-17 by retrospectively applying the requirements of the ASUs to

our previously issued consolidated financial statements. The retrospective application had no impact on our net

income (loss) or earnings (loss) per share for the years ended December 31, 2014 and 2013, but resulted in the

following changes in our previously reported consolidated balance sheet as of December 31, 2014:

• A decrease of $880 million in Total current assets;

• A decrease of $164 million in Other assets, net;

• A decrease of $168 million in Long-term debt; and

• A decrease of $876 million in Deferred income taxes, net.

B-50