CenturyLink 2015 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Historical Information

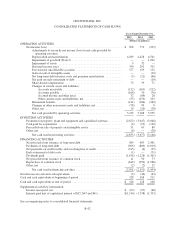

The following tables summarize our consolidated cash flow activities:

Years Ended

December 31, Increase /

(Decrease)2015 2014

(Dollars in millions)

Net cash provided by operating activities .............. $5,152 5,188 (36)

Net cash used in investing activities .................. (2,853) (3,077) (224)

Net cash used in financing activities .................. (2,301) (2,151) 150

Years Ended

December 31, Increase /

(Decrease)2014 2013

(Dollars in millions)

Net cash provided by operating activities .............. $5,188 5,559 (371)

Net cash used in investing activities .................. (3,077) (3,148) (71)

Net cash used in financing activities .................. (2,151) (2,454) (303)

Net cash provided by operating activities decreased by $36 million for the year ended December 31, 2015 as

compared to the year ended December 31, 2014 primarily due to a slight negative variance in net income

adjusted for non-cash items along with negative variances in accounts payable and other noncurrent assets and

liabilities, net. The decreases were substantially offset with positive variances in accrued income and other taxes

and other current assets and liabilities, net, which was primarily due to a payment of approximately $235 million

in 2014 to settle certain litigation. Our net cash provided by operating activities in 2015 was also positively

impacted by the cash received from the CAF Phase 2 support program, which was $209 million greater than the

cash we would have otherwise received during the same period under the interstate USF support program. Net

cash provided by operating activities decreased by $371 million for the year ended December 31, 2014 as

compared to the year ended December 31, 2013 primarily due to a negative variance in net income adjusted for

non-cash items along with a payment of approximately $235 million in the first quarter of 2014 to settle certain

litigation. These decreases were substantially offset by positive variances in the changes in accounts payable and

retirement benefits.

During the year ended December 31, 2015, we made a voluntary cash contribution to the trust of $100

million to fund our qualified pension plan. During the years ended December 31, 2014 and 2013, and prior to the

pension plan merger, we made required cash contributions to the trust of $157 million and $146 million,

respectively, to fund our qualified pension plans.

Net cash used in investing activities decreased by $224 million for the year end December 31, 2015 as

compared to the year ended December 31, 2014 primarily due to a decrease in payments of property, plant and

equipment and amounts paid for acquisitions in 2015. Net cash used in investing activities decreased by $71

million for the year ended December 31, 2014 as compared to the year ended December 31, 2013 primarily due

to less cash paid for acquisitions.

Net cash used in financing activities increased by $150 million for the year ended December 31, 2015 as

compared to the year ended December 31, 2014 primarily due to additional common stock repurchases as the net

debt repayments were approximately the same in both years. Net cash used in financing activities decreased by

$303 million for the year ended December 31, 2014 as compared to the year ended December 31, 2013 primarily

due to reductions in net debt paydowns in 2014 versus net borrowings in 2013 and common stock repurchases.

During the year ended December 31, 2015, we repurchased 27.1 million shares of the company’s

outstanding common stock in the open market. These shares were repurchased for an aggregate market price of

$800 million, or an average purchase price of $29.56 per share. The repurchased common stock has been retired.

B-32