CenturyLink 2015 Annual Report Download - page 129

Download and view the complete annual report

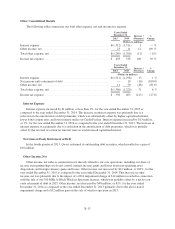

Please find page 129 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Segment Revenues

Consumer segment revenues increased by $27 million, or less than 1%, for year ended December 31, 2015

as compared to the year ended December 31, 2014. The increase in strategic services revenues was primarily due

to increases in the number of Prism TV customers, as well as from 2015 price increases on various services. The

decline in legacy services revenues was primarily due to declines in local and long-distance services volumes

associated with access line losses resulting from the competitive and technological changes as further described

above. Consumer segment revenues decreased by $10 million, or less than 1%, for the year ended December 31,

2014 as compared to the year ended December 31, 2013. The decline in legacy services revenues was due to the

same reasons noted above. The increase in strategic services revenues was primarily due to growth in the number

of high-speed Internet subscribers and increases in the number of Prism TV customers, as well as from 2014

price increases on various services. The increase in consumer segment revenues during 2015 as compared to the

decline in revenues for 2014 was primarily attributable to the above-noted price increases.

Segment Expenses

Consumer segment expenses increased by $5 million, or less than 1%, for the year ended December 31,

2015 as compared to the year ended December 31, 2014. This increase was primarily due to increases in Prism

TV content costs (resulting from higher volume and rates) and bad debt expense, which were partially offset by

reductions in employee-related costs, marketing and advertising expenses and fleet expenses. Consumer segment

expenses increased by $61 million, or 3%, for the year ended December 31, 2014 as compared to the year ended

December 31, 2013. This increase was primarily due to increases in marketing and advertising expenses, Prism

TV content costs resulting from subscriber growth in our Prism TV markets and the number of modems shipped

for Prism TV customers, which were partially offset by reductions in employee-related costs and facility costs.

Segment Income

Consumer segment income increased by $22 million, or 1%, for the year ended December 31, 2015 as

compared to the year ended December 31, 2014. This increase was primarily due to price increases on various

services and reduction of costs. Consumer segment income decreased by $71 million, or 2%, for the year ended

December 31, 2014 as compared to the year ended December 31, 2013. This decrease was primarily due to

customers migrating from legacy services to lower margin strategic services, and the increase in Prism TV

content costs.

Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accordance with accounting principles that are

generally accepted in the United States. The preparation of these consolidated financial statements requires

management to make estimates and assumptions that affect the reported amounts of our assets, liabilities,

revenues and expenses. We have identified certain policies and estimates as critical to our business operations

and the understanding of our past or present results of operations related to (i) goodwill, customer relationships

and other intangible assets; (ii) property, plant and equipment; (iii) pension and post-retirement benefits; (iv) loss

contingencies and litigation reserves; (v) Connect America Fund support payments; and (vi) income taxes. These

policies and estimates are considered critical because they had a material impact, or they have the potential to

have a material impact, on our consolidated financial statements and because they require us to make significant

judgments, assumptions or estimates. We believe that the estimates, judgments and assumptions made when

accounting for the items described below were reasonable, based on information available at the time they were

made. However, there can be no assurance that actual results will not differ from those estimates.

Goodwill, Customer Relationships and Other Intangible Assets

We amortize customer relationships primarily over an estimated life of 10 to 15 years, using either the sum-

of-the-years-digits or the straight-line methods, depending on the type of customer. We amortize capitalized

B-21