CarMax 2016 Annual Report Download

Download and view the complete annual report

Please find the complete 2016 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX

2016

CARMAX, INC.

ANNUAL REPORT

FISCAL YEAR 2016

CARMAX, INC. ANNUAL REPORT FISCAL YEAR 2016

Table of contents

-

Page 1

2016 CAR MAX, I NC. AN N UAL R E P ORT F I SCAL YEAR 2016 CARMAX, INC. ANNUAL REPORT FISCAL YEAR 2016 CARMAX -

Page 2

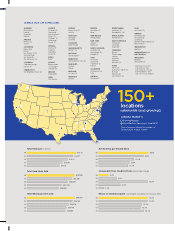

...RHODE ISLAND Salt Lake City VIRGINIA Lexington Louisville LOUISIANA Albuquerque NEW YORK Providence (2) SOUTH CAROLINA Baton Rouge MASSACHUSETTS Albany* Rochester NORTH CAROLINA Bakersï¬eld Fresno Los Angeles* (12) Sacramento (4) San Diego (2) San Francisco* (3) COLORADO Atlanta (6) Augusta... -

Page 3

... than half of total visits to carmax.com came from our mobile site or mobile applications. We want to ensure that these customers receive the same superior customer experience online that they've always received in our stores. We're just concluding the process of rolling out a new adaptive and more... -

Page 4

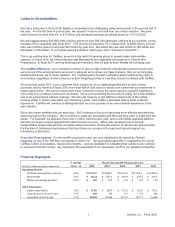

...total cost of $2.4 billion. This program reflects both our confidence in our company's future and our ongoing commitment to increase shareholder value. CarMax Cares. Since its inception in 2003, The CarMax Foundation has granted more than $30 million to communities where our associates live and work... -

Page 5

..., VIRGINIA (Address of principal executive offices) 23238 (Zip Code) Registrant's telephone number, including area code: (804) 747-0422 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, par value $0.50 New York... -

Page 6

...(as defined in Rule 12b-2 of the Act). Yes The aggregate market value of the registrant's common stock held by non-affiliates as of August 31, 2015, computed by reference to the closing price of the registrant's common stock on the New York Stock Exchange on that date, was $12,500,766,966. On March... -

Page 7

...in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information PART III Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters... -

Page 8

.... The projected number, timing and cost of new store openings. Our gross profit margin, inventory levels and ability to leverage selling, general and administrative and other fixed costs. Our sales and marketing plans. The capabilities of our proprietary information technology systems and... -

Page 9

... City through a tax-free transaction, becoming an independent, publicly traded company. As of February 29, 2016, we operated 158 used car stores in 78 metropolitan markets. Our home office is located at 12800 Tuckahoe Creek Parkway, Richmond, Virginia. CarMax Business We operate in two reportable... -

Page 10

...,000 customer accounts in its $9.59 billion portfolio of managed receivables. Competition CarMax Sales Operations. The U.S. used car marketplace is highly fragmented, and we face competition from franchised dealers, who sell both new and used vehicles; independent used car dealers; online and mobile... -

Page 11

.... The ESPs we currently offer on all used vehicles provide coverage up to 60 months (subject to mileage limitations). GAP covers the customer for the term of their finance contract. All EPPs that we sell (other than manufacturer programs on new car sales) have been designed to our specifications and... -

Page 12

..., including our credit processing information system. Our proprietary store technology provides our management with real-time information about many aspects of store operations, such as inventory management, pricing, vehicle transfers, wholesale auctions and sales consultant productivity. Our... -

Page 13

...items are available free of charge through the "Corporate Governance" link on our investor information home page at investors.carmax.com, shortly after we file them with, or furnish them to, the Securities and Exchange Commission (the "SEC"): annual reports on Form 10-K, quarterly reports on Form 10... -

Page 14

...new and used car dealers and online and mobile sales platforms, as well as millions of private individuals. Competitors buy and sell the same or similar makes of vehicles that we offer in the same or similar markets at competitive prices. New car dealers in particular, including publicly-traded auto... -

Page 15

...cost of capital and working capital financing, including the long-term financing to support our geographic expansion, could adversely affect sales, operating strategies and store growth. Although internally generated cash flows have recently been sufficient to fund geographic expansion, there can be... -

Page 16

...new vehicles, it could make buying a new vehicle more attractive to our customers than buying a used vehicle, which could have a material adverse effect on sales and results of operations and could result in decreased used margins. Manufacturer incentives could contribute to narrowing this price gap... -

Page 17

...to purchase a greater percentage of our inventory from third-party auctions, which is generally less profitable for CarMax. Our ability to source vehicles through our appraisal process could also be affected by competition, both from new and used car dealers directly and through third-party websites... -

Page 18

... our business, sales and results of operations. Our business strategy includes opening stores in new and existing markets and implementing new initiatives to elevate the experience of our customers. The expansion of our store base places significant demands on our management team, our associates and... -

Page 19

... but a few range from 25 to 35 acres, and non-production stores are generally on 4 to 12 acres. We have recently incorporated small format stores into our future store opening plans. These stores are located in smaller markets or areas where the sales opportunity is below that of mid-sized and large... -

Page 20

... Jersey New Mexico New York North Carolina Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina Tennessee Texas Utah Virginia Washington Wisconsin Total Count 1 3 1 1 1 9 5 2 2 3 1 3 7 15 1 10 1 4 158 Of the 158 used car stores open as of February 29, 2016, 84 were located on owned sites... -

Page 21

... President and Chief Financial Officer Executive Vice President and Chief Operating Officer Executive Vice President, Strategy and Business Transformation Senior Vice President, CarMax Auto Finance Senior Vice President and Chief Marketing Officer Senior Vice President, General Counsel and Corporate... -

Page 22

...management succession plan, on February 1, 2016, Mr. Nash, formerly executive vice president, human resources and administrative services, was promoted to president of CarMax and Mr. Wood, formerly executive vice president, stores, was promoted to executive vice president and chief operating officer... -

Page 23

...related to employee equity awards or the exercises of employee stock options. Approximate Dollar Value of Shares that May Yet Be Purchased Under the Programs (1) $ 1,447,148,751 $ 1,447,148,751 $ 1,398,019,339 Period December 1-31, 2015 January 1-31, 2016 February 1-29, 2016 Total (1) Total Number... -

Page 24

... price appreciation plus dividends, as applicable) on our common stock for the last five fiscal years with the cumulative total return of the S&P 500 Index and the S&P 500 Retailing Index. The graph assumes an original investment of $100 in CarMax common stock and in each index on February 28, 2011... -

Page 25

... Wholesale vehicle unit sales CarMax Auto Finance information CAF total interest margin (2) Other information Used car stores Associates (1) $ $ $ $ $ $ $ $ $ $ (2) Beginning fiscal 2016, SG&A per unit calculations are based on used units. All periods presented have been revised for this new... -

Page 26

... wholesale auctions at 67 used car stores and we operated 2 new car franchises. CarMax Auto Finance In addition to third-party financing providers, we provide vehicle financing through CAF, which offers financing solely to customers buying retail vehicles from CarMax. CAF allows us to manage... -

Page 27

...increased sales of wholesale vehicles and ancillary products and, over time, increased CAF income. To expand our vehicle unit sales at new and existing stores, we will need to continue delivering an unrivaled customer experience and hiring and developing the associates necessary to drive our success... -

Page 28

... auto loan receivables. Revenue Recognition We recognize revenue when the earnings process is complete, generally either at the time of sale to a customer or upon delivery to a customer. As part of our customer service strategy, we guarantee the retail vehicles we sell with a , money-back guarantee... -

Page 29

...of total sales in fiscal 2016. All periods presented have been revised for this new presentation. UNIT SALES Years Ended February 29 or 28 Used vehicles Wholesale vehicles 2016 619,936 394,437 Change 6.5% 4.9% 2015 582,282 376,186 Change 10.5% 9.8% 2014 526,929 342,576 AVERAGE SELLING PRICES Years... -

Page 30

... to 10-year old used vehicle market by approximately 5% in calendar 2014. The increase in average retail vehicle selling price primarily reflected changes in our sales mix, with an increased mix of 0- to 4year old vehicles in fiscal 2015. From 2008 through 2012, new car industry sales were at rates... -

Page 31

...of ESPs and GAP (collectively reported in EPP revenues, net of a reserve for estimated contract cancellations), net third-party finance fees and other revenues. Starting in fiscal 2016, new car sales are also included as a component of other revenues, along with service department sales. We refer to... -

Page 32

... decline in new car industry sales and the associated slow down in used vehicle trade-in activity, compared with pre-recession periods. The higher wholesale values increased both our vehicle acquisition costs and our used vehicle average selling prices, which climbed from $16,291 in fiscal 2009 to... -

Page 33

... on a $300 million term loan entered into in November 2014. Other Expense Fiscal 2016 Versus Fiscal 2015. During fiscal 2016, we recorded a one-time charge of $8.3 million associated with a property that is no longer planned to be used. Income Taxes The effective income tax rate was 38.3% in fiscal... -

Page 34

...rate Weighted average credit score (3) Weighted average loan-to-value (LTV) (4) Weighted average term (in months) (1) (2) (3) (4) All information relates to loans originated net of 3-day payoffs and vehicle returns. Vehicle units financed as a percentage of total retail used units sold. The credit... -

Page 35

... the 13.3% growth in used vehicle revenues. The increase in CAF's penetration rate in fiscal 2015 included the effect of the increase in loans originated in the CAF Tier 3 loan origination program. The total interest margin declined to 6.5% of average managed receivables from 6.9% in fiscal 2014... -

Page 36

... PLANNED STORE OPENINGS Location Springfield, Illinois Pleasanton, California El Paso, Texas Westborough, Massachusetts Bristol, Tennessee Meridian, Idaho Maple Shade, New Jersey Daytona Beach, Florida Kentwood, Michigan Fremont, California Santa Rosa, California Mobile, Alabama Palmdale, California... -

Page 37

... loan receivables (see Operating Activities). During fiscal 2016, we increased net borrowings under the revolving credit facility by $404.6 million. During fiscal 2015, we received proceeds of $300 million from a variable-rate term loan entered into in November 2014. Net cash provided by financing... -

Page 38

... vehicles. Loans originated in the CAF Tier 3 loan origination program are currently being funded using existing working capital. The timing of principal payments on the non-recourse notes payable is based on the timing of principal collections and defaults on the securitized auto loan receivables... -

Page 39

...-term debt (2) Finance and capital leases (3) Operating leases (3) Purchase obligations (4) Defined benefit retirement plans (5) Unrecognized tax benefits (6) Total (1) $ $ $ $ (2) (3) (4) (5) (6) This table excludes the non-recourse notes payable that relate to auto loan receivables funded... -

Page 40

... both fixed- and variable-rate securities. Our derivative instruments are used to manage differences in the amount of our known or expected cash receipts and our known or expected cash payments principally related to the funding of our auto loan receivables. Disruptions in the credit markets could... -

Page 41

..., 2016. KPMG LLP, the company's independent registered public accounting firm, has issued a report on our internal control over financial reporting. Their report is included herein. THOMAS J. FOLLIARD CHIEF EXECUTIVE OFFICER THOMAS W. REEDY EXECUTIVE VICE PRESIDENT AND CHIEF FINANCIAL OFFICER 37 -

Page 42

... for our opinion. A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles... -

Page 43

... (1) 82.0 14.5 3.5 100.0 86.9 13.1 2.7 9.2 0.2 - 6.3 2.4 3.9 SALES AND OPERATING REVENUES: Used vehicle sales Wholesale vehicle sales Other sales and revenues NET SALES AND OPERATING REVENUES Cost of sales GROSS PROFIT CARMAX AUTO FINANCE INCOME Selling, general and administrative expenses Interest... -

Page 44

... thousands) NET EARNINGS Other comprehensive income (loss), net of taxes: Net change in retirement benefit plan unrecognized actuarial losses Net change in cash flow hedge unrecognized losses Other comprehensive (loss) income, net of taxes TOTAL COMPREHENSIVE INCOME $ $ See accompanying notes to... -

Page 45

...2015 (In thousands except share data) ASSETS CURRENT ASSETS: Cash and cash equivalents Restricted cash from collections on auto loan receivables Accounts receivable, net Inventory Other current assets TOTAL CURRENT ASSETS Auto loan receivables, net Property and equipment, net Deferred income taxes... -

Page 46

... from collections on auto loan receivables Increase in restricted cash in reserve accounts Release of restricted cash from reserve accounts Purchases of money market securities, net Purchases of trading securities Sales of trading securities NET CASH USED IN INVESTING ACTIVITIES FINANCING ACTIVITIES... -

Page 47

...from the exercise/vesting of equity awards Balance as of February 28, 2015 Net earnings Other comprehensive loss Share-based compensation expense Repurchases of common stock Exercise of common stock options Stock incentive plans: Shares issued Shares cancelled Tax effect from the exercise/vesting of... -

Page 48

... operation that provides financing to customers buying retail vehicles from CarMax. We seek to deliver an unrivaled customer experience by offering a broad selection of high quality used vehicles and related products and services at low, no-haggle prices using a customer-friendly sales process... -

Page 49

... rates associated with these financial instruments, the carrying value of our cash and cash equivalents, restricted cash, accounts receivable, money market securities, accounts payable, short-term debt and long-term debt approximates fair value. Our derivative instruments and mutual funds are... -

Page 50

.... We use a combination of insurance and selfinsurance for a number of risks including workers' compensation, general liability and employee-related health care costs, a portion of which is paid by associates. Estimated insurance liabilities are determined by considering historical claims experience... -

Page 51

...the time of sale to a customer or upon delivery to a customer. As part of our customer service strategy, we guarantee the retail vehicles we sell with a 5-day, money-back guarantee. We record a reserve for estimated returns based on historical experience and trends. We also sell ESP and GAP products... -

Page 52

... excess of par value exists from previous awards). See Note 12 for additional information on stock-based compensation. (V) Derivative Instruments and Hedging Activities We enter into derivative instruments to manage certain risks arising from both our business operations and economic conditions that... -

Page 53

... FASB issued an accounting pronouncement (FASB ASU 2015-11), which simplifies the subsequent measurement of inventory by replacing the lower of cost or market test with a lower of cost or net realizable value ("NRV") test. NRV is calculated as the estimated selling price less reasonably predictable... -

Page 54

... flows and sales while managing our reliance on third-party finance sources. Management regularly analyzes CAF's operating results by assessing profitability, the performance of the auto loan receivables including trends in credit losses and delinquencies, and CAF direct expenses. This information... -

Page 55

...Quality. When customers apply for financing, CAF's proprietary scoring models rely on the customers' credit history and certain application information to evaluate and rank their risk. We obtain credit histories and other credit data that includes information such as number, age, type of and payment... -

Page 56

...for accounting purposes. Our derivative instruments are used to manage (i) differences in the amount of our known or expected cash receipts and our known or expected cash payments principally related to the funding of our auto loan receivables, and (ii) exposure to variable interest rates associated... -

Page 57

... about the assumptions market participants would use in pricing the asset or liability (including assumptions about risk). Level 2 Level 3 Our fair value processes include controls that are designed to ensure that fair values are appropriate. Such controls include model validation, review of key... -

Page 58

... and third-party valuation services. Quotes from third-party valuation services and quotes received from bank counterparties project future cash flows and discount the future amounts to a present value using market-based expectations for interest rates and the contractual terms of the derivative... -

Page 59

... 28, 2015 Level 2 Total $ - - 1,201 1,201 0.3% -% $ $ (1,064) (1,064) -% $ $ $ 380,100 9,242 1,201 390,543 100.0% 3.0% (1,064) (1,064) -% Assets: Money market securities Mutual fund investments Derivative instruments Total assets at fair value Percent of total assets at fair value Percent of total... -

Page 60

... 28, 2015, the current portion of cancellation reserves was $54.4 million and $44.8 million, respectively. In fiscal 2014, the company reviewed the assumptions used in developing its cancellation reserves for EPP products and incorporated additional data into a more sophisticated model as part... -

Page 61

... 12 months; however, we do not expect the change to have a significant effect on our results of operations, financial condition or cash flows. As of February 28, 2015, we had $25.0 million of gross unrecognized tax benefits, $9.6 million of which, if recognized, would affect our effective tax rate... -

Page 62

... expected future service and increased compensation levels. As a result of the freeze of plan benefits under our pension and restoration plans, the ABO and PBO balances are equal to one another at all subsequent dates. Funding Policy. For the pension plan, we contribute amounts sufficient to meet... -

Page 63

...these assumptions at least once a year and make changes as necessary. The discount rate used for retirement benefit plan accounting reflects the yields available on high-quality, fixed income debt instruments. For our plans, we review high quality corporate bond indices in addition to a hypothetical... -

Page 64

... company-funded contribution to the associates meeting the same age and service requirements. This plan is unfunded with lump sum payments to be made upon the associate's retirement. The total cost for this plan was not significant in fiscal 2016, fiscal 2015 and fiscal 2014. (D) Executive... -

Page 65

...of the lease payments being applied to interest expense in the initial years following the modification. See Note 15 for information on future minimum lease obligations. Non-Recourse Notes Payable. The non-recourse notes payable relate to auto loan receivables funded through term securitizations and... -

Page 66

... for future grants under the long-term incentive plans was 6,738,122 as of that date. The majority of associates who receive share-based compensation awards primarily receive cash-settled restricted stock units. Senior management and other key associates receive awards of nonqualified stock options... -

Page 67

... associated with RSUs is recognized over their vesting period (net of estimated forfeitures) and is calculated based on the volume-weighted average price of our common stock on the last trading day of each reporting period. The total costs for matching contributions for our employee stock purchase... -

Page 68

... by the recipients of share-based awards. Assumptions Used to Estimate Option Values Years Ended February 29 or 28 2016 Dividend yield Expected volatility factor (1) Weighted average expected volatility Risk-free interest rate (2) Expected term (in years) (1) (3) 2015 0.0% 0.0% 25.2% 0.01% 32.7% 31... -

Page 69

... as of February 28, 2015 Stock units granted Stock units vested and converted Stock units cancelled Outstanding as of February 29, 2016 Stock-Settled Market Stock Unit Information 2016 Stock units granted Weighted average grant date fair value per share Realized tax benefits from vesting (in... -

Page 70

... grant date fair value per share Realized tax benefits from vesting (in millions) $ $ Years Ended February 29 or 28 2015 19,070 68.16 0.7 $ $ 22,860 51.18 - $ $ 2014 - - - (E) Employee Stock Purchase Plan We sponsor an employee stock purchase plan for all associates meeting certain eligibility... -

Page 71

... 2016, fiscal 2015 and fiscal 2014, options to purchase 1,243,383 shares, 1,409,809 shares and 1,231,382 shares of common stock, respectively, were not included. 14. ACCUMULATED OTHER COMPREHENSIVE LOSS Changes in Accumulated Other Comprehensive Loss By Component Total Net Accumulated Unrecognized... -

Page 72

... and building leases related to CarMax store locations. Our lease obligations are based upon contractual minimum rates. Most leases provide that we pay taxes, maintenance, insurance and operating expenses applicable to the premises. The initial term of most real property leases will expire within... -

Page 73

...in the lawsuit regarding the sales consultant putative class are: (1) failure to provide meal and rest breaks or compensation in lieu thereof; (2) failure to pay wages of terminated or resigned employees related to meal and rest breaks; (3) unfair competition; and (4) California's Labor Code Private... -

Page 74

.... As part of our customer service strategy, we guarantee the used vehicles we retail with at least a 30-day limited warranty. A vehicle in need of repair within this period will be repaired free of charge. As a result, each vehicle sold has an implied liability associated with it. Accordingly, based... -

Page 75

... 2nd Quarter 3rd Quarter (In thousands, except per share data) Net sales and operating revenues Gross profit CarMax Auto Finance income Selling, general and administrative expenses Net earnings Net earnings per share: Basic Diluted (1) 2015 3,750,196 501,731 94,615 313,446 169,653 0.77 0.76... -

Page 76

... and reported within the time periods specified in the U.S. Securities and Exchange Commission's rules and forms. Disclosure controls are also designed to ensure that this information is accumulated and communicated to management, including the chief executive officer ("CEO") and the chief financial... -

Page 77

... the section titled "Director Compensation" in our 2016 Proxy Statement. Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. The information required by this Item is incorporated by reference to the section titled "CarMax Share Ownership" and the... -

Page 78

... FOLLIARD Thomas J. Folliard Chief Executive Officer April 22, 2016 By: /s/ THOMAS W. REEDY Thomas W. Reedy Executive Vice President and Chief Financial Officer April 22, 2016 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed by the following persons... -

Page 79

.... * CarMax, Inc. 2002 Employee Stock Purchase Plan, as amended and restated June 23, 2009, filed as Exhibit 10.1 to CarMax's Quarterly Report on Form 10-Q, filed July 9, 2009 (File No. 1-31420), is incorporated by this reference. Credit Agreement dated August 24, 2015, among CarMax Auto Superstores... -

Page 80

... other executive officers, effective January 1, 2009, filed as Exhibit 10.1 to CarMax's Quarterly Report on Form 10-Q, filed January 8, 2009 (File No. 1-31420), is incorporated by this reference. * Form of Directors Stock Option Grant Agreement between CarMax, Inc. and certain non-employee directors... -

Page 81

..., Inc. and certain executive officers, filed as Exhibit 10.17 to CarMax's Annual Report on Form 10-K, filed May 13, 2005 (File No. 1-31420), is incorporated by this reference. * Form of Incentive Award Agreement between CarMax, Inc. and certain non-employee directors of the CarMax, Inc. board of... -

Page 82

... COMPANY OFFICERS SENIOR MANAGEMENT TEAM Tom Folliard Chief Executive Officer Bill Nash President Cliff Wood EVP, Chief Operating Officer Tom Reedy EVP, Chief Financial Officer Ed Hill EVP, Strategy and Business Transformation Jon Daniels SVP, CarMax Auto Finance Jim Lyski SVP, Chief Marketing... -

Page 83

... Jon Geske RVP, Service Operations Los Angeles Region Terry Glass RVP, General Manager Chicago Region Corey Haire RVP, General Manager Richmond Region Tracy Hanson RVP, Service Operations Chicago Region Cherri Heart AVP, Chief Information Security Officer Veronica Hinckle AVP, Assistant Controller... -

Page 84

[This Page Intentionally Left Blank] -

Page 85

[This Page Intentionally Left Blank] -

Page 86

[This Page Intentionally Left Blank] -

Page 87

...OR M ATION HOME OFFICE FINANCIAL INFORMATION CarMax, Inc. 12800 Tuckahoe Creek Parkway Richmond, Virginia 23238 Telephone: (804) 747-0422 WEBSITE For quarterly sales and earnings information, ï¬nancial reports, ï¬lings with the Securities and Exchange Commission, news releases and other investor... -

Page 88

CA RM AX , C IN 1 . • 0 28 0T U A CK HO E E CR EK RK PA Y WA • RI CH N MO D, V G IR IN IA 2 23 38 • 4 80 7• • 74 2 04 2 • W .C WW AR X MA .C OM