Bed, Bath and Beyond 2001 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2001 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2001

5

Approximate aggregate costs for the 61 leased stores planned

for opening in fiscal 2002 are estimated at $88.6 million for

merchandise inventories, $54.3 million for furniture and fixtures

and leasehold improvements and $13.4 million for store opening

expenses (which will be expensed as incurred). In addition to the

61 locations already leased, the Company expects to open and

lease approximately 27 additional locations during fiscal 2002.

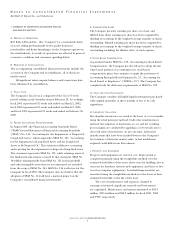

RECENT ACCOUNTING PRONOUNCEMENT

In August 2001, the Financial Accounting Standards Board

(“FASB”) issued Statement of Financial Accounting Standards

(“SFAS”) No. 144, “Accounting for the Impairment or Disposal of

Long-Lived Assets,” which supersedes SFAS No. 121, “Accounting

for the Impairment of Long-Lived Assets and for Long-Lived

Assets to Be Disposed Of.” This statement addresses accounting

and reporting for the impairment or disposal of long-lived assets.

The statement supersedes SFAS No. 121, while retaining many of

the fundamental provisions covered by that statement. SFAS No.

144 differs fundamentally from SFAS No. 121 in that goodwill

and other intangible assets that are not amortized are excluded

from the scope of SFAS No. 144. SFAS No. 144 is effective for the

Company in fiscal 2002. The Company does not believe that the

adoption of SFAS No. 144 will have a material impact on the

Company’s consolidated financial statements.

CRITICAL ACCOUNTING POLICIES

The preparation of financial statements in conformity with

accounting principles generally accepted in the United States of

America requires the Company to establish accounting policies

and to make estimates and judgments that affect the reported

amounts of assets and liabilities and disclosure of contingent

assets and liabilities as of the date of the consolidated financial

statements and the reported amounts of revenues and expenses

during the reporting period. The Company bases its estimates on

historical experience and on other assumptions that it believes to

be relevant under the circumstances, the results of which form

the basis for making judgments about the carrying value of assets

and liabilities that are not readily apparent from other sources.

For a detailed discussion of our critical accounting policies and

related estimates and judgments, see Note 1 to the consolidated

financial statements. In particular, judgment is used in areas such

as the provision for sales returns, inventory valuation using the

retail inventory method, and accruals for self insurance, litigation

and store relocations and closings. Actual results could differ

from these estimates.

ACQUISITION

Subsequent to year end, on March 5, 2002, the Company

consummated the acquisition of Harmon Stores, Inc., a health

and beauty care retailer. The Company believes the acquisition

will not have a material effect on its consolidated results of

operations or financial condition in fiscal 2002.

Effective March 3, 2002, the Company adopted SFAS No.

141, “Business Combinations” and SFAS No. 142, “Goodwill and

Other Intangible Assets.” SFAS No. 141 requires the purchase

method of accounting for business combinations initiated or

completed after June 30, 2001. SFAS No. 142 discontinued the

amortization of goodwill and other intangible assets with

indefinite useful lives and requires periodic goodwill impairment

testing. Consequently, the Company will not amortize any

goodwill recognized as a result of the acquisition described below

and will perform impairment testing as required. The Company

does not believe that the adoption of SFAS No. 141 and SFAS No.

142 will have a material impact on the Company’s consolidated

financial statements.

FORWARD LOOKING STATEMENTS

This Annual Report and, in particular, Management’s Discussion

and Analysis of Financial Condition and Results of Operations,

and the Shareholder Letter, contain forward looking statements

within the meaning of Section 21E of the Securities Exchange Act

of 1934, as amended. The Company’s actual results and future

financial condition may differ materially from those expressed in

any such forward looking statements as a result of many factors

that may be outside the Company’s control. Such factors include,

without limitation: general economic conditions, changes in

the retailing environment and consumer spending habits,

demographics and other macroeconomic factors that may impact

the level of spending for the types of merchandise sold by the

Company; unusual weather patterns; competition from existing

and potential competitors; competition from other channels of

distribution; pricing pressures; the ability to find suitable

locations at reasonable occupancy costs to support the Company’s

expansion program; and the cost of labor, merchandise and other

costs and expenses.

SEASONALITY

Bed Bath & Beyond stores exhibit less seasonality than many

other retail businesses, although sales levels are generally higher

in August, November and December, and generally lower in

February and March.