Bed, Bath and Beyond 2001 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2001 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2001

14

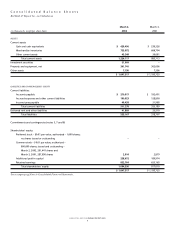

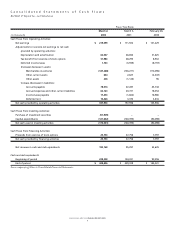

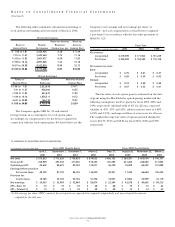

12. SUMMARY OF QUARTERLY RESULTS (UNAUDITED)

(in thousands, except per share data) FISCAL 2001 QUARTER ENDED FISCAL 2000 QUARTER ENDED

June 2, September 1, December 1, March 2, May 27, August 26, November 25, March 3,

2001 2001 2001 2002 2000 2000 2000 2001

Net sales $ 575,833 $ 713,636 $ 759,438 $ 879,055 $ 459,163 $ 589,381 $ 602,004 $ 746,107

Gross profit 234,959 291,342 311,030 370,235 187,293 241,284 246,080 311,802

Operating profit 45,602 84,672 83,749 132,077 36,339 70,009 64,592 101,898

Earnings before provision

for income taxes 48,792 87,730 86,120 134,430 38,301 71,440 66,664 105,434

Provision for

income taxes 18,785 33,776 33,156 51,756 14,937 27,862 25,999 41,119

Net earnings $ 30,007 $ 53,954 $ 52,964 $ 82,674 $ 23,364 $ 43,578 $ 40,665 $ 64,315

EPS – Basic (1) $ .10 $ .19 $ .18 $ .28 $ .08 $ .15 $ .14 $ .22

EPS – Diluted (1) $ .10 $ .18 $ .18 $ .28 $ .08 $ .15 $ .14 $ .22

(1) Net earnings per share (“EPS”) amounts for each quarter are required to be computed independently and may not equal the amount

computed for the total year.

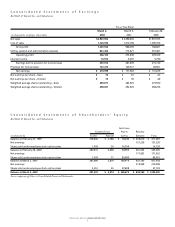

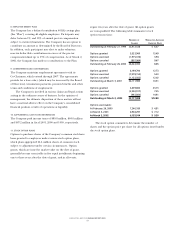

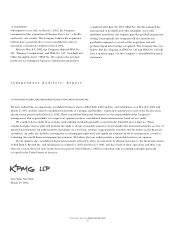

The following tables summarize information pertaining to

stock options outstanding and exercisable at March 2, 2002:

OPTIONS OUTSTANDING

WEIGHTED-AVERAGE WEIGHTED

RANGE OF NUMBER REMAINING AVERAGE-

EXERCISE PRICES OUTSTANDING CONTRACTUAL LIFE EXERCISE PRICE

$ 1.06 to 7.81 5,542,956 4.38 $ 5.39

7.91 to 11.47 5,445,560 7.73 11.16

11.83 to 11.83 3,067,477 6.24 11.83

11.94 to 16.16 4,897,065 7.32 15.18

16.81 to 34.88 4,163,950 8.99 22.72

$ 1.06 to 34.88 23,117,008 6.87 $12.80

OPTIONS EXERCISABLE

RANGE OF NUMBER WEIGHTED-AVERAGE

EXERCISE PRICES EXERCISABLE EXERCISE PRICE

$1.06 to 7.81 2,823,836 $ 4.71

7.91 to 11.47 958,000 10.55

11.83 to 11.83 601,637 11.83

11.94 to 16.16 1,626,311 14.72

16.81 to 34.88 146,130 19.07

$ 1.06 to 34.88 6,155,914 $ 9.30

The Company applies APB No. 25 and related

interpretations in accounting for its stock option plans.

Accordingly, no compensation cost has been recognized in

connection with the stock option plans. Set forth below are the

Company’s net earnings and net earnings per share “as

reported,” and as if compensation cost had been recognized

(“pro-forma”) in accordance with the fair value provisions of

SFAS No. 123:

FISCAL YEAR

(in thousands, except per share data) 2001 2000 1999

NET EARNINGS:

As reported $ 219,599 $ 171,922 $ 131,229

Pro forma $ 200,009 $ 154,540 $ 119,158

NET EARNINGS PER SHARE:

Basic:

As reported $ 0.76 $ 0.61 $ 0.47

Pro forma $ 0.69 $ 0.54 $ 0.43

Diluted:

As reported $ 0.74 $ 0.59 $ 0.46

Pro forma $ 0.67 $ 0.53 $ 0.41

The fair value of each option grant is estimated on the date

of grant using the Black-Scholes option-pricing model with the

following assumptions used for grants for fiscal 2001, 2000 and

1999, respectively: dividend yield of 0% for all years; expected

volatility of 45%, 45% and 42%; risk-free interest rates of 4.80%,

6.58% and 5.95%; and expected lives of seven years for all years.

The weighted-average fair value of options granted during the

year is $12.77, $7.25 and $8.34 for fiscal 2001, 2000 and 1999,

respectively.

Notes to Consolidated Financial Statements

(Continued)