Bed, Bath and Beyond 2001 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2001 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2001

11

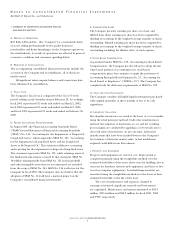

T. IMPAIRMENT OF LONG-LIVED ASSETS

The Company periodically reviews long-lived assets for

impairment by comparing the carrying value of the assets with

their estimated future undiscounted cash flows. If it is

determined that an impairment loss has occurred, the loss would

be recognized during that period. The impairment loss is

calculated as the difference between asset carrying values and the

present value of the estimated net cash flows. The Company does

not believe that any material impairment currently exists related

to its long-lived assets.

U. USE OF ESTIMATES

The preparation of financial statements in conformity with

accounting principles generally accepted in the United States of

America requires the Company to establish accounting policies

and to make estimates and judgments that affect the reported

amounts of assets and liabilities and disclosure of contingent

assets and liabilities as of the date of the consolidated financial

statements and the reported amounts of revenues and expenses

during the reporting period. The Company bases its estimates on

historical experience and on other assumptions that it believes to

be relevant under the circumstances, the results of which form

the basis for making judgments about the carrying value of

assets and liabilities that are not readily apparent from other

sources. In particular, judgment is used in areas such as the

provision for sales returns, inventory valuation using the retail

inventory method, and accruals for self insurance, litigation and

store relocations and closings. Actual results could differ from

these estimates.

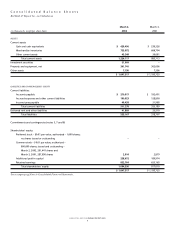

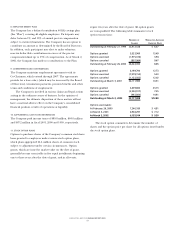

2. PROPERTY AND EQUIPMENT

Property and equipment consist of the following:

March 2, March 3,

(in thousands) 2002 2001

Land and building $ 5,173)$–)

Furniture, fixtures and

equipment 271,399)219,243)

Leasehold improvements 205,310)168,370)

Computer equipment 100,898)73,535)

582,780)461,148)

Less: Accumulated depreciation

and amortization (221,039) (158,492)

$ 361,741)$ 302,656)

3. LINE OF CREDIT

During fiscal 2001, the Company entered into a $50 million

uncommitted line of credit which replaced the Company’s

previous $25 million committed line of credit (“the Credit

Agreement”). The uncommitted line of credit, which expires in

September 2002, is intended to be used for letters of credit in the

ordinary course of business. During fiscal 2001, the Company had

no direct borrowings under the uncommitted line of credit or

the Credit Agreement; during fiscal 2000, the Company did not

borrow under the Credit Agreement. As of March 2, 2002 and

March 3, 2001, there were approximately $5.8 million and $2.9

million in outstanding letters of credit, respectively.

4. INVESTMENT SECURITIES

The Company’s investment securities consist of held-to-maturity

debt securities, which are stated at amortized cost, adjusted for

amortization of premium to maturity. The Company intends to

hold the securities to maturity and has classified the investment

as such. The amortized cost of the investment is $51.9 million at

March 2, 2002. The investment matures in February 2004.

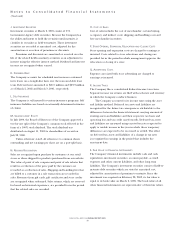

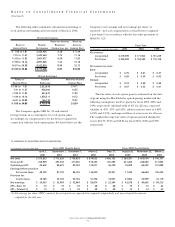

5. PROVISION FOR INCOME TAXES

The components of the provision for income taxes are as follows:

FISCAL YEAR

(in thousands) 2001 2000 1999

Current:

Federal $ 123,787 $ 102,178)$ 82,652)

State and local 11,953 11,678)9,446)

135,740 113,856)92,098)

Deferred:

Federal 1,188 (3,535) (7,356)

State and local 545 (404) (841)

1,733 (3,939) (8,197)

$ 137,473 $ 109,917)$ 83,901)