Bed, Bath and Beyond 2001 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2001 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2001

10

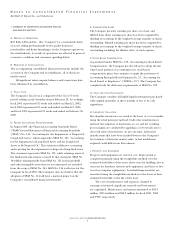

J. INVESTMENT SECURITIES

Investment securities at March 2, 2002 consist of U.S.

Government Agency debt securities. Because the Company has

the ability and intent to hold the securities until maturity, it

classifies its securities as held-to-maturity. These investment

securities are recorded at amortized cost, adjusted for the

amortization or accretion of premiums or discounts.

Premiums and discounts are amortized or accreted over the

life of the related held-to-maturity securities as an adjustment to

interest using the effective interest method. Dividend and interest

income are recognized when earned.

K. DEFERRED RENT

The Company accounts for scheduled rent increases contained

in its leases on a straight-line basis over the noncancelable lease

term. Deferred rent amounted to $26.5 million and $23.3 million

as of March 2, 2002 and March 3, 2001, respectively.

L. SELF INSURANCE

The Company is self insured for various insurance programs. Self

insurance liabilities are based on actuarially determined estimates

of claims.

M. SHAREHOLDERS’ EQUITY

In July 2000, the Board of Directors of the Company approved a

two-for-one split of the Company’s common stock effected in the

form of a 100% stock dividend. The stock dividend was

distributed on August 11, 2000 to shareholders of record on

July 28, 2000.

Unless otherwise stated, all references to common shares

outstanding and net earnings per share are on a post-split basis.

N. REVENUE RECOGNITION

Sales are recognized upon purchase by customers at our retail

stores or when shipped for products purchased from our website.

The value of point of sale coupons and point of sale rebates that

result in a reduction of the price paid by the customer are

recorded as a reduction of sales. Shipping and handling fees that

are billed to a customer in a sale transaction are recorded in

sales. Revenues from gift cards, gift certificates and store credits

are recognized when redeemed. Sales returns, which are reserved

for based on historical experience, are provided for in the period

that the related sales are recorded.

O. COST OF SALES

Cost of sales includes the cost of merchandise; certain buying,

occupancy and indirect costs; shipping and handling costs and

free merchandise incentives.

P. S TORE OPENING, EXPANSION, RELOCATION AND CLOSING COSTS

Store opening and expansion costs are charged to earnings as

incurred. Costs related to store relocations and closings are

provided for in the period in which management approves the

relocation or closing of a store.

Q. ADVERTISING COSTS

Expenses associated with store advertising are charged to

earnings as incurred.

R. INCOME TAXES

The Company files a consolidated Federal income tax return.

Separate income tax returns are filed with each state and territory

in which the Company conducts business.

The Company accounts for its income taxes using the asset

and liability method. Deferred tax assets and liabilities are

recognized for the future tax consequences attributable to the

differences between the financial statement carrying amounts of

existing assets and liabilities and their respective tax bases and

operating loss and tax credit carryforwards. Deferred tax assets

and liabilities are measured using enacted tax rates expected to

apply to taxable income in the year in which those temporary

differences are expected to be recovered or settled. The effect

on deferred tax assets and liabilities of a change in tax rates

is recognized in earnings in the period that includes the

enactment date.

S. FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company’s financial instruments include cash and cash

equivalents, investment securities, accounts payable, accrued

expenses and other current liabilities, and other long term

liabilities. The Company’s investment securities consist of held-to-

maturity debt securities which are stated at amortized cost,

adjusted for amortization of premium to maturity. Since the

investment was acquired on February 28, 2002, its fair value is

equal to its book value on March 2, 2002. The book value of all

other financial instruments are representative of their fair values.

Notes to Consolidated Financial Statements

(Continued)