Bed, Bath and Beyond 2001 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2001 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2001

4

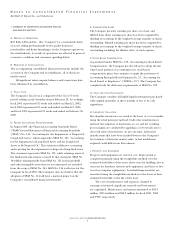

Approximately 55% and 45% of net sales in fiscal 2000

were attributable to sales of domestics merchandise and home

furnishings, respectively. The Company estimates that bed linens

accounted for approximately 21% of net sales during both fiscal

2000 and fiscal 1999. No other individual product category

accounted for 10% or more of net sales during either fiscal year.

Gross profit in fiscal 2000 was $986.5 million or 41.2% of

net sales, compared with $766.8 million or 41.3% of net sales

in fiscal 1999.

Comparable store sales for fiscal 2000 (52 weeks vs. 52

weeks) increased by approximately 5.0%, compared with an

increase of approximately 9.2% in fiscal 1999. The fiscal 2000

increase in comparable store net sales primarily reflected a strong

focus on customer service, as well as the continued consumer

acceptance of the Company’s merchandise offerings and the

continued success of the Company’s advertising program.

SG&A was $713.6 million or 29.8% of net sales in fiscal 2000

compared to $557.5 million or 30.0% of net sales in fiscal 1999.

The decrease in SG&A as a percentage of net sales primarily

reflected a decrease in occupancy costs and costs associated with

new store openings and expansions partially offset by an increase

in payroll and payroll related items. Store opening and expansion

costs were charged to earnings as incurred.

Interest income increased to $9.0 million in fiscal 2000

compared to $5.8 million in fiscal 1999 due to an increase in

invested cash and an increase in the average investment rate.

The effective tax rate remained consistent at 39.0% in fiscal

2000 and fiscal 1999 due to the consistent composition of states

in which the Company conducted business.

EXPANSION PROGRAM

The Company is engaged in an ongoing expansion program

involving the opening of new stores in both new and existing

markets and the expansion or replacement of existing stores with

larger stores. In the ten-year period from the beginning of fiscal

1992 to the end of fiscal 2001, the chain has grown from 34 stores

to 396 stores. Total square footage grew from 917,000 square feet

at the beginning of fiscal 1992 to 14,724,000 square feet at the

end of fiscal 2001.

The Company intends to continue its expansion program

and currently anticipates that in fiscal 2002 it will open

approximately 88 new Bed Bath & Beyond stores (see details

under “Liquidity and Capital Resources” below). The Company

believes that a predominant portion of any increase in its net

sales in fiscal 2002 will continue to be attributable to new store

net sales. Accordingly, the continued growth of the Company

is dependent, in large part, upon the Company’s ability to

execute its expansion program successfully, of which there can

be no assurance.

LIQUIDITY AND CAPITAL RESOURCES

The Company has been able to finance both its normal

operations and its expansion program through internally

generated funds. The Company’s merchandise inventories have

grown from $470.4 million at the end of fiscal 1999, to $606.7

million at the end of fiscal 2000 and to $754.0 million at the end

of fiscal 2001. The increases in inventory between the fiscal years

were primarily attributable to the addition of new store space.

The Company’s working capital increased from $360.6

million at the end of fiscal 1999, to $532.5 million at the end of

fiscal 2000, and to $715.4 million at the end of fiscal 2001. The

increases between the fiscal years were primarily the result of

increases in cash and cash equivalents and merchandise

inventories, which were partially offset by increases in accounts

payable and accrued expenses and other current liabilities.

The Company’s expansion program requires the Company

to make capital expenditures for furniture and fixtures, leasehold

improvements and computer equipment on an ongoing basis.

The Company’s total capital expenditures were $121.6 million,

$140.4 million and $90.1 million during fiscal 2001, 2000 and

1999, respectively.

During fiscal 2001, the Company entered into a $50 million

uncommitted line of credit which replaced the Company’s

previous $25 million committed line of credit (“the Credit

Agreement”). The uncommitted line of credit, which expires in

September 2002, is intended to be used for letters of credit in the

ordinary course of business. During fiscal 2001, the Company

had no direct borrowings under the uncommitted line of credit

or the Credit Agreement; during fiscal 2000 and 1999, the

Company did not borrow under the Credit Agreement. The

Company believes that during fiscal 2002, internally generated

funds will be sufficient to fund both its normal operations and its

expansion program.

The Company has contractual obligations consisting of all

operating leases for buildings, office facilities and equipment

which are payable as follows as of March 2, 2002:

LESS THAN 1AFTER 5

(in 000’s) TOTAL YEAR 1-3 YEARS 4-5 YEARS YEARS

Operating

Leases $2,141,947 $198,275 $611,716 $385,997 $945,959

As of May 3, 2002, the Company has leased sites for 61 new

Bed Bath & Beyond stores planned for opening in fiscal 2002,

including eleven new stores already opened in Encino

and Monrovia, California; Grand Junction, Colorado; Manchester,

Connecticut; Cumming, Georgia; Woodbury, Minnesota; Mount

Olive, New Jersey; Onslow, North Carolina; Eastgate, Ohio; Erie,

Pennsylvania; and Lynchburg, Virginia.

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

(Continued)