Bed, Bath and Beyond 2001 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2001 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2001

9

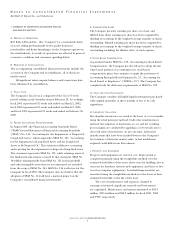

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

AND RELATED MATTERS

A. NATURE OF OPERATIONS

Bed Bath & Beyond Inc. (the “Company”) is a nationwide chain

of stores selling predominantly better quality domestics

merchandise and home furnishings. As the Company operates in

the retail industry, its results of operations are affected by general

economic conditions and consumer spending habits.

B. PRINCIPLES OF CONSOLIDATION

The accompanying consolidated financial statements include the

accounts of the Company and its subsidiaries, all of which are

wholly owned.

All significant intercompany balances and transactions have

been eliminated in consolidation.

C. FISCAL YEAR

The Company’s fiscal year is comprised of the 52 or 53 week

period ending on the Saturday nearest February 28. Accordingly,

fiscal 2001 represented 52 weeks and ended on March 2, 2002;

fiscal 2000 represented 53 weeks and ended on March 3, 2001;

and fiscal 1999 represented 52 weeks and ended on February 26,

2000.

D. RECENT ACCOUNTING PRONOUNCEMENT

In August 2001, the Financial Accounting Standards Board

(“FASB”) issued Statement of Financial Accounting Standards

(“SFAS”) No. 144, “Accounting for the Impairment or Disposal of

Long-Lived Assets,” which supersedes SFAS No. 121, “Accounting

for the Impairment of Long-Lived Assets and for Long-Lived

Assets to Be Disposed Of.” This statement addresses accounting

and reporting for the impairment or disposal of long-lived assets.

The statement supersedes SFAS No. 121, while retaining many of

the fundamental provisions covered by that statement. SFAS No.

144 differs fundamentally from SFAS No. 121 in that goodwill

and other intangible assets that are not amortized are excluded

from the scope of SFAS No. 144. SFAS No. 144 is effective for the

Company in fiscal 2002. The Company does not believe that the

adoption of SFAS No. 144 will have a material impact on the

Company’s consolidated financial statements.

E. EARNINGS PER SHARE

The Company presents earnings per share on a basic and

diluted basis. Basic earnings per share has been computed by

dividing net earnings by the weighted average number of shares

outstanding. Diluted earnings per share has been computed by

dividing net earnings by the weighted average number of shares

outstanding including the dilutive effect of stock options.

F. S TOCK-BASED COMPENSATION

As permitted under SFAS No. 123, “Accounting for Stock-Based

Compensation,” the Company has elected not to adopt the fair

value based method of accounting for its stock-based

compensation plans, but continues to apply the provisions of

Accounting Principles Board Opinion No. 25, “Accounting for

Stock Issued to Employees” (“APB No. 25”). The Company has

complied with the disclosure requirements of SFAS No. 123.

G. CASH AND CASH EQUIVALENTS

The Company considers all highly liquid instruments purchased

with original maturities of three months or less to be cash

equivalents.

H. INVENTORY VALUATION

Merchandise inventories are stated at the lower of cost or market,

using the retail inventory method. Under the retail inventory

method, the valuation of inventories at cost and the resulting

gross margins are calculated by applying a cost-to-retail ratio to

the retail value of inventories. At any one time, inventories

include items that have been marked down to the Company’s

best estimate of their fair market value. Actual markdowns

required could differ from this estimate.

I. PROPERTY AND EQUIPMENT

Property and equipment are stated at cost. Depreciation is

computed primarily using the straight-line method over the

estimated useful lives of the assets (forty years for building; five to

ten years for furniture, fixtures and equipment; and three to five

years for computer equipment). Leasehold improvements are

amortized using the straight-line method over the lesser of their

estimated useful life or the life of the lease.

The cost of maintenance and repairs is charged to

earnings as incurred; significant renewals and betterments

are capitalized. Maintenance and repairs amounted to $34.3

million, $28.4 million and $24.2 million for fiscal 2001, 2000

and 1999, respectively.

Notes to Consolidated Financial Statements

Bed Bath & Beyond Inc. and Subsidiaries