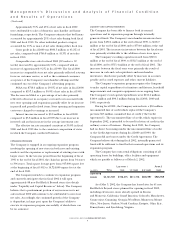

Bed, Bath and Beyond 2001 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2001 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2001

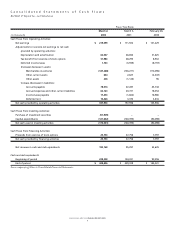

12

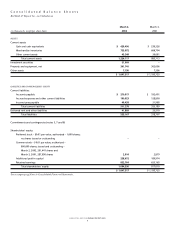

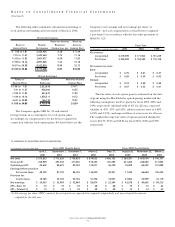

Included in other current assets and in deferred rent and

other liabilities is a net current deferred income tax asset of

$39.6 million and a net noncurrent deferred income tax liability

of $8.1 million, respectively, which reflect the net tax effects

of temporary differences between the carrying amounts of

assets and liabilities for financial reporting purposes and the

amounts used for income tax purposes. The significant

components of the Company’s deferred tax assets and liabilities

consist of the following:

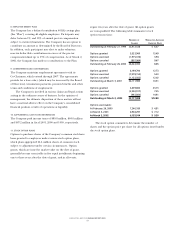

March 2, March 3,

(in thousands) 2002 2001

Deferred Tax Assets:

Inventories $ 14,827)$ 13,729)

Deferred rent 10,193)9,103)

Other 27,606)21,684)

Deferred Tax Liability:

Depreciation (21,122) (11,279)

$ 31,504)$ 33,237)

For fiscal 2001, the effective tax rate is comprised of the

Federal statutory income tax rate of 35.00% and the state income

tax rate, net of Federal benefit, of 3.50%. For fiscal 2000 and

1999, the effective tax rate was comprised of the Federal statutory

income tax rate of 35.00% and the state income tax rate, net of

Federal benefit, of 4.00%.

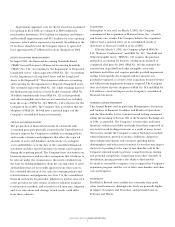

6. TRANSACTIONS AND BALANCES WITH RELATED PARTIES

A. The Company has an interest in certain life insurance policies

on the lives of its Co-Chairmen. The beneficiaries of these

policies are related to the aforementioned individuals. The

Company’s interest in these policies is equivalent to the net

premiums paid by the Company. At March 2, 2002 and March 3,

2001, other assets (noncurrent) include $5.0 million and $4.5

million, respectively, representing the Company’s interest in the

life insurance policies.

B. The Company obtained certain payroll services from a related

party through August 2001. The Company paid fees for such

services of $203,000, $366,000 and $557,000 for fiscal 2001, 2000

and 1999, respectively.

C. The Company made charitable contributions to the Mitzi and

Warren Eisenberg Family Foundation, Inc. (the “Eisenberg

Foundation”) and the Feinstein Family Foundation, Inc. (the

“Feinstein Foundation”) in the aggregate amounts of $761,000,

$634,000 and $488,000 for fiscal 2001, 2000 and 1999,

respectively. The Eisenberg Foundation and the Feinstein

Foundation are each not-for-profit corporations of which Messrs.

Eisenberg and Feinstein, the Co-Chairmen of the Company, and

their family members are the trustees and officers.

7. LEASES

The Company leases retail stores, as well as warehouses, office

facilities and equipment, under agreements expiring at various

dates through 2022. Certain leases provide for contingent rents

(which are based upon store sales exceeding stipulated amounts

and are immaterial in fiscal 2001, 2000 and 1999), scheduled rent

increases and renewal options generally ranging from five to

fifteen years. The Company is obligated under a majority of the

leases to pay for taxes, insurance and common area maintenance

charges.

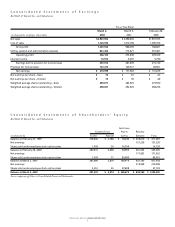

As of March 2, 2002, future minimum lease payments under

noncancelable operating leases are as follows:

FISCAL YEAR (in thousands) AMOUNT

2002 $ 198,275

2003 207,073

2004 203,493

2005 201,150

2006 197,032

Thereafter 1,134,924

Total future minimum lease payments $2,141,947

As of March 29, 2002, the Company had executed leases for

50 stores planned for opening in fiscal 2002.

Expenses for all operating leases were $178.7 million,

$142.6 million and $113.3 million for fiscal 2001, 2000 and 1999,

respectively.

Notes to Consolidated Financial Statements

(Continued)