Airtran 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

2004 Annual Report

Effective October 1, 2003, we adopted FASB Interpretation 46 (FIN 46), “Consolidation of Variable Interest Entities.” FIN 46 requires the consolidation

of certain types of entities in which a company absorbs a majority of another entity’s expected losses, receives a majority of the other entity’s expected

residual returns, or both, as a result of ownership, contractual or other financial interests in the other entity. These entities are called “variable

interest entities” or “VIEs.” The principal characteristics of VIEs are (1) an insufficient amount of equity to absorb the entity’s expected losses, (2)

equity owners as a group are not able to make decisions about the entity’s activities, or (3) equity that does not absorb the entity’s losses or receive

the entity’s residual returns. “Variable interests” are contractual, ownership or other monetary interests in an entity that change with fluctuations in

the entity’s net asset value. As a result, VIEs can arise from items such as lease agreements, loan arrangements, guarantees or service contracts.

If an entity is determined to be a VIE, the entity must be consolidated by the “primary beneficiary.” The primary beneficiary is the holder of the variable

interests that absorb a majority of the VIE’s expected losses or receive a majority of the entity’s residual returns in the event no holder has a majority

of the expected losses. There is no primary beneficiary in cases where no single holder absorbs the majority of the expected losses or receives a

majority of the residual returns. The determination of the primary beneficiary is based on projected cash flows at the inception of the variable interest.

We have variable interests in our aircraft leases. The lessors are trusts established specifically to purchase, finance and lease aircraft to us. These

leasing entities meet the criteria of VIEs. We are generally not the primary beneficiary of the leasing entities if the lease terms are consistent with

market terms at the inception of the lease and do not include a residual value guarantee, fixed-price purchase options or similar feature that

obligates us to absorb decreases in value or entitles us to participate in increases in the value of the aircraft. This is the case in the majority of our

aircraft leases; however, we have two aircraft leases that contain fixed-price purchase options that allow us to purchase the aircraft at predetermined

prices on specified dates during the lease term. We have not consolidated the related trusts because even taking into consideration these purchase

options, we are still not the primary beneficiary based on our cash flow analysis.

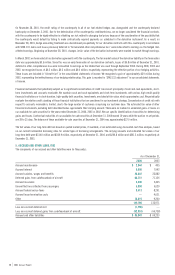

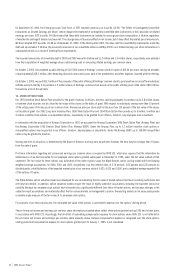

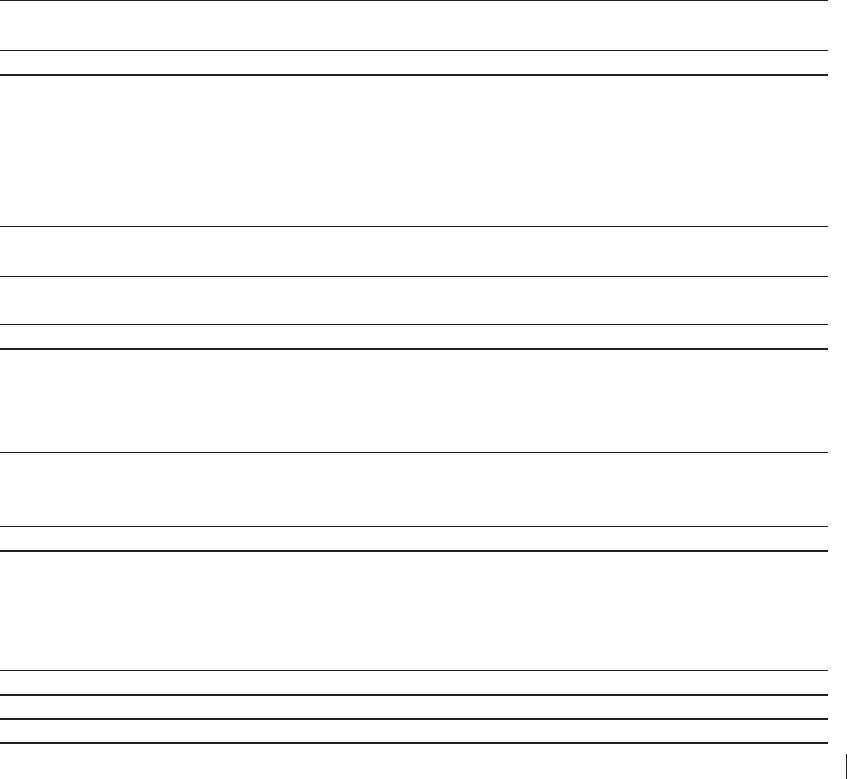

8. COMPREHENSIVE INCOME (LOSS)

Comprehensive income (loss) encompasses net income (loss) and “other comprehensive income (loss),” which includes all other nonowner

transactions and events that change stockholders’ equity. Other comprehensive income (loss) is composed of changes in the fair value of our derivative

financial instruments that qualified for hedge accounting. Comprehensive income totaled $12.5 million, $101.1 million and $16.8 million for 2004,

2003 and 2002, respectively. The differences between net income and comprehensive income for 2004, 2003 and 2002 are as follows (in thousands):

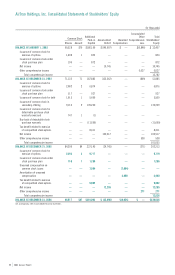

2004 2003 2002

Net income $12,255 $100,517 $10,745

Unrealized income on derivative instruments 271 538 6,037

Comprehensive income $12,526 $101,055 $16,782

Because our net deferred tax assets were offset in full by a valuation allowance when the derivatives were effective, there is no tax effect of the

unrealized income.

An analysis of the amounts included in “Accumulated other comprehensive loss,” is shown below (in thousands):

Balance at January 1, 2003 $(809)

Reclassification to earnings 538

Balance at December 31, 2003 (271)

Reclassification to earnings 271

BALANCE AT DECEMBER 31, 2004 $ —

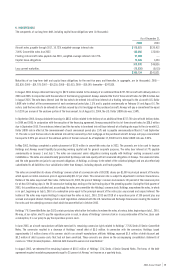

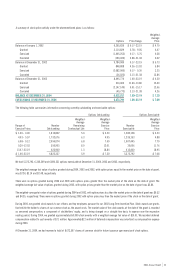

9. EARNINGS PER COMMON SHARE

The following table sets forth the computation of basic and diluted earnings per common share (in thousands, except per share data):

2004 2003 2002

NUMERATOR:

Net income $12,255 $100,517 $10,745

Plus income effect of assumed conversion-interest on convertible debt —4,565 —

Income before assumed conversion, diluted $12,255 $105,082 $10,745

DENOMINATOR:

Weighted-average shares outstanding, basic 85,261 75,345 70,409

Effect of dilutive stock options 3,639 3,936 2,344

Effect of detachable stock purchase warrants 623 1,216 400

Effect of convertible debt —6,110 —

Adjusted weighted-average shares outstanding, diluted 89,523 86,607 73,153

Basic earnings per common share $ 0.14 $ 1.33 $ 0.15

Diluted earnings per common share $ 0.14 $ 1.21 $ 0.15