Airtran 2004 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2004 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 Annual Report

26

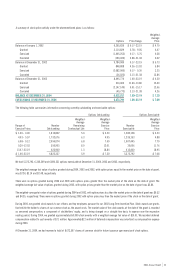

On September 21, 2001, President Bush signed into law the Stabilization Act which provided, in part, for qualifying U.S airlines and air cargo carriers

to receive: up to $5 billion in compensation for direct losses, including lost revenues, incurred as a direct result of the FAA ground stop order and for

incremental losses incurred through December 31, 2001 as a direct result of the terrorist acts of September 11, 2001; up to $10 billion in federal

government loan guarantees; reimbursement for certain insurance increases; and the extension in due dates for payment of certain excise taxes.

Each carrier was entitled to receive the lesser of its direct and incremental losses for the period September 11, 2001 to December 31, 2001 or its

available seat mile (ASM) allocation of the $5 billion compensation. We received compensation payments of $5.0 million during 2002. Related to

these payments, we recognized income of $0.6 million in 2002, which is included in Other (Income) Expenses—Government Grant on the

accompanying consolidated statements of income.

3. COMMITMENTS AND CONTINGENCIES

As of December 31, 2004, Airways had firm commitments with an aircraft manufacturer to purchase eight B717 aircraft in 2005 and 2006 and 44

B737 aircraft with delivery dates between 2005 and 2008. Additionally, Airways has options and purchase rights to acquire an additional 48 B737

aircraft with delivery dates between 2006 and 2010. In January 2005, we exercised options for the delivery of two additional B737 aircraft with

delivery dates in 2006. The B717 aircraft are to be financed through an affiliate of the aircraft manufacturer. Pursuant to Airways’ arrangement with

an aircraft leasing company, Airways entered into individual operating leases for 22 of the B737 aircraft of which six were delivered during 2004,

and has entered into sale/leaseback transactions with that aircraft leasing company with respect to six related spare engines, to be delivered

between 2005 and 2010. Additionally, Airways has obtained debt financing commitments for six B737 aircraft of which two were delivered during

2004. Airways has obtained financing commitments from an affiliate of the aircraft manufacturer for up to 80% of the purchase price of 16 of the

B737 aircraft should AirTran Airways be unable to secure financing from the financial markets on acceptable terms. During 2005, AirTran Airways is

scheduled to take delivery of six B717 aircraft to be leased through an affiliate of the aircraft manufacturer and 13 B737 aircraft with nine such

aircraft subject to individual operating leases mentioned above and four B737 aircraft financed through debt. There can be no assurance that

sufficient financing will be available for all B737 aircraft and other capital expenditures not covered by firm financing commitments.

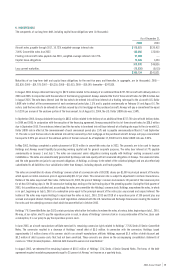

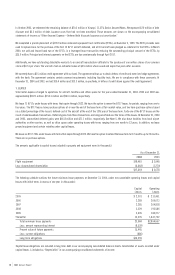

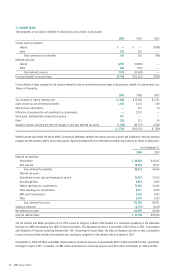

The following table details our firm orders for aircraft and options as of December 31, 2004.

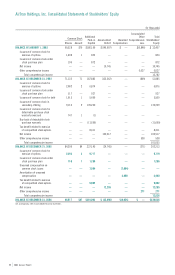

B737 Deliveries B717 Deliveries

Firm Options Firm Options

2005 13 —6—

2006 15 42—

2007 12 5——

2008 4 14 ——

Total* 44 23 8—

*We have purchase rights to acquire up to 25 B737 aircraft in addition to the totals shown above.

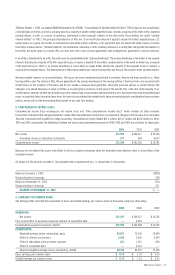

As of December 31, 2004, we had firm commitments for 52 aircraft with an aircraft manufacturer, with an estimated cost of approximately

$1.5 billion.

During 2004, in connection with Airways’ agreements with an aircraft manufacturer, Airways was refunded $7.7 million in previously paid aircraft

deposits and Airways paid $44.0 million in aircraft deposits under the new agreement with an aircraft manufacturer for the acquisition of B737 aircraft.

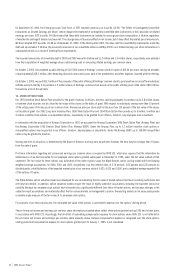

As of December 31, 2004, we had approximately 5,900 full-time equivalent employees. While there can be no assurance that our generally good labor

relations with our employees will continue, we have established as a significant component of our business strategy the preservation of good

relations with our employees, approximately 46 percent of whom are represented by unions.

The agreement with our mechanics and inspectors becomes amendable during 2005. The agreement with our pilots also becomes amendable during

2005. We are currently in negotiations with our flight attendants whose contract became amendable in 2002. We continue to believe that mutually

acceptable agreements can be reached with these employees, although the ultimate outcome of the negotiations is unknown at this time. Any labor

disruptions which result in a prolonged significant reduction in flights could have a material adverse impact on our results of operations and

financial conditions.

During 2003, we adopted the FASB Interpretation 45 (FIN 45), “Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including

Indirect Guarantees of Indebtedness of Others.” FIN 45 requires a guarantor to recognize, at the inception of a guarantee, a liability for the fair value

of the obligation undertaken in issuing the guarantee. FIN 45 also expanded the disclosures required to be made by a guarantor about its obligations

under certain guarantees that it has issued.

We are party to many routine contracts under which we indemnify third parties for various risks. We have not accrued any liability for any of these

indemnities, as the amount is not determinable or estimable. These indemnities consist of the following: