Airtran 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 Annual Report

28

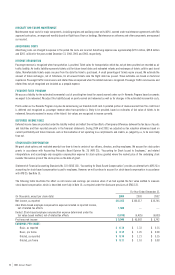

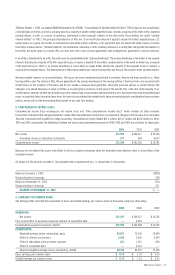

On November 28, 2001, the credit rating of the counterparty to all of our fuel-related hedges was downgraded and the counterparty declared

bankruptcy on December 2, 2001. Due to the deterioration of the counterparty’s creditworthiness, we no longer considered the financial contracts

with the counterparty to be highly effective in offsetting our risk related to changing fuel prices because of the consideration of the possibility that

the counterparty would default by failing to make contractually required payments as scheduled in the derivative instrument. As a result, on

November 28, 2001, hedge accounting treatment was discontinued prospectively for our derivative contracts with this counterparty in accordance

with SFAS 133. Gains and losses previously deferred in “Accumulated other comprehensive loss” were reclassified to earnings as the hedged item

affected earnings. Beginning on November 28, 2001, changes in fair value of the derivative instruments were marked to market through earnings.

In March 2002, we terminated all our derivative agreements with the counterparty. The fair market value of the derivative liability on the termination

date was approximately $0.5 million. Since this was an early termination of our derivative contracts, losses of $6.8 million at December 31, 2001,

deferred in other comprehensive loss were reclassified to earnings as the related fuel was used through September 2004. During 2004, 2003 and

2002, we recognized losses of $0.3 million, $0.5 million and $6.0 million, respectively, representing the effective portion of our hedging activities.

These losses are included in “Aircraft fuel” in the consolidated statements of income. We recognized a gain of approximately $5.9 million during

2002, representing the ineffectiveness of our hedging relationships. This gain is recorded in “SFAS 133 adjustment” in our consolidated statements

of income.

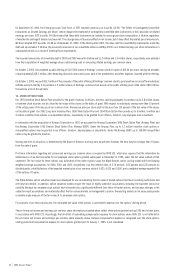

Financial instruments that potentially subject us to significant concentrations of credit risk consist principally of cash and cash equivalents, short-

term investments and accounts receivable. We maintain cash and cash equivalents and short-term investments with various high credit-quality

financial institutions or in short-duration, high-quality debt securities. Investments are stated at fair value, which approximates cost. We periodically

evaluate the relative credit standing of those financial institutions that are considered in our investment strategy. Concentration of credit risk with

respect to accounts receivable is limited, due to the large number of customers comprising our customer base. The estimated fair value of other

financial instruments, excluding debt described below, approximate their carrying amount. There were no realized or unrealized gains or losses on

our available-for-sale securities for the years ended December 31, 2004, 2003 or 2002. We use specific identification of securities for determining

gains and losses. Contractual maturities of our available-for-sale securities at December 31, 2004 exceed 10 years while the auction re-set periods

are 28 to 35 days. The balance of these available-for-sale securities at December 31, 2004 was approximately $27.0 million.

The fair values of our long-term debt are based on quoted market prices, if available, or are estimated using discounted cash flow analyses, based

on our current incremental borrowing rates for similar types of borrowing arrangements. The carrying amounts and estimated fair values of our

long-term debt were $314.0 million and $344.9 million, respectively, at December 31, 2004, and $246.8 million and $241.3 million, respectively, at

December 31, 2003.

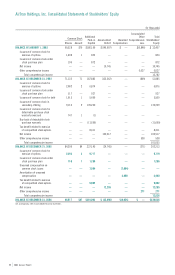

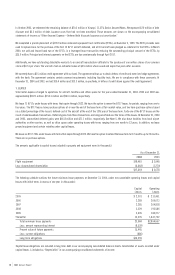

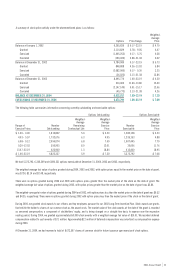

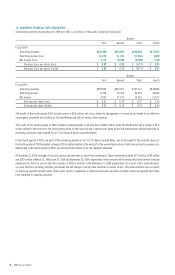

5. ACCRUED AND OTHER LIABILITIES

The components of our accrued and other liabilities were (in thousands):

As of December 31,

2004 2003

Accrued maintenance $ 2,644 $ 405

Accrued interest 9,890 7,942

Accrued salaries, wages and benefits 33,042 25,882

Deferred gains from sale/leaseback of aircraft 66,751 71,136

Accrued insurance 3,848 3,465

Unremitted fees collected from passengers 5,659 5,629

Accrued federal excise taxes 8,513 8,291

Accrued lease termination costs —4,021

Other 18,819 9,200

149,166 135,971

Less non-current deferred rent (1,766) —

Less non-current deferred gains from sale/leaseback of aircraft (62,353) (66,738)

Accrued and other liabilities $ 85,047 $ 69,233