Airtran 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 Annual Report

24

AIRCRAFT AND ENGINE MAINTENANCE

Maintenance repair costs for major components, including engines and auxiliary power units (APU), covered under maintenance agreements with FAA

approved contractors, are expensed monthly based on flight hours flown or landings. Maintenance on airframes and other components are expensed

as incurred.

ADVERTISING COSTS

Advertising costs are charged to expense in the period the costs are incurred. Advertising expense was approximately $27.0 million, $22.8 million

and $20.1 million for the years ended December 31, 2004, 2003 and 2002, respectively.

REVENUE RECOGNITION

Passenger revenue is recognized when transportation is provided. Ticket sales for transportation which has not yet been provided are recorded as air

traffic liability. Air traffic liability represents tickets sold for future travel dates and estimated refunds and exchanges of tickets sold for past travel

dates. Nonrefundable tickets expire one year from the date the ticket is purchased. A small percentage of tickets expire unused. We estimate the

amount of future exchanges, net of forfeitures, for all unused tickets once the flight date has passed. These estimates are based on historical

experience. Passenger traffic commissions and related fees are expensed when the related revenue is recognized. Passenger traffic commissions and

related fees not yet recognized are included as a prepaid expense.

FREQUENT FLYER PROGRAM

We accrue a liability for the estimated incremental cost of providing free travel for awards earned under our A+ Rewards Program based on awards

we expect to be redeemed. We adjust this liability based on points earned and redeemed as well as for changes in the estimated incremental costs.

Points under our A+ Rewards Program may also be earned using our branded credit card. A prorated portion of revenue earned from this credit card

is deferred and recognized as passenger revenue when transportation is likely to be provided, based on estimates of fair value of tickets to be

redeemed. Amounts received in excess of the tickets’ fair values are recognized in income currently.

DEFERRED INCOME TAXES

Deferred income taxes are provided under the liability method and reflect the net tax effects of temporary differences between the tax basis of assets

and liabilities and their reported amounts in the financial statements. During 2004 and 2003, we adjusted our tax valuation allowance based on

current profitability and future forecasts and on the realization of net operating loss carryforwards and credits, as judged by us, to be more likely

than not.

STOCK-BASED COMPENSATION

We grant stock options and restricted awards from time to time to certain of our officers, directors, and key employees. We account for stock option

grants in accordance with Accounting Principles Board Opinion No. 25 (APB 25), “Accounting for Stock Issued to Employees,” and related

interpretations and accordingly only recognize compensation expense for stock options granted where the market price of the underlying stock

exceeds the exercise price of the stock option on the date of grant.

Statement of Financial Accounting Standards No. 123 (SFAS 123), “Accounting for Stock-Based Compensation,” provides an alternative to APB 25 in

accounting for stock-based compensation issued to employees. However, we will continue to account for stock-based compensation in accordance

with APB 25. See Note 10.

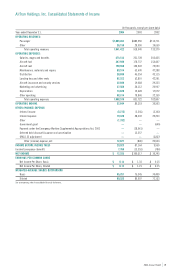

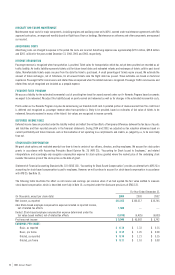

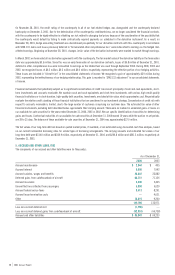

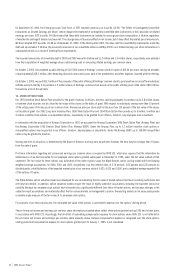

The following table illustrates the effect on net income and earnings per common share if we had applied the fair value method to measure

stock-based compensation, which is described more fully in Note 10, as required under the disclosure provisions of SFAS 123.

For Year Ended December 31,

(In thousands, except per share data) 2004 2003 2002

Net income, as reported $12,255 $100,517 $10,745

Add: Stock-based employee compensation expense included in reported income,

net of related tax effects 1,500 ——

Deduct: Stock-based employee compensation expense determined under the

fair value based method, net of related tax effects (3,815) (5,425) (5,003)

Pro forma net income $ 9,940 $ 95,092 $ 5,742

EARNINGS PER SHARE:

Basic, as reported $ 0.14 $ 1.33 $ 0.15

Basic, pro forma $ 0.12 $ 1.26 $ 0.08

Diluted, as reported $ 0.14 $ 1.21 $ 0.15

Diluted, pro forma $ 0.11 $ 1.10 $ 0.08