Airtran 2004 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2004 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 Annual Report

18

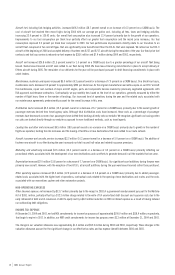

We currently utilize a standard option pricing model, Black-Scholes, to measure the fair value of the stock options granted to employees. While SFAS

123R permits entities to continue to use such a model, the standard also permits the use of a lattice model. We have not yet determined which model

we will use to measure the fair value of employee stock options upon the adoption of SFAS 123R. See Note 10 to the Consolidated Financial

Statements for further information.

SFAS 123R also requires that the benefits associated with the tax deductions in excess of recognized compensation cost be reported as a financing

cash flow, rather than as an operating cash flow as under the current literature. This requirement will reduce net operating cash flows and increase

net financing cash flows in periods after the effective date. These amounts cannot be estimated because they depend on, among other things, when

employees exercise stock options.

We currently expect to adopt SFAS 123R effective July 1, 2005, however, we have not yet determined which of the aforementioned adoption methods

we will use. Subject to the methodology we select to calculate the cost associated with implementing the provisions in SFAS 123R, the pro-forma

disclosure disclosed in Note 10 to the Consolidated Financial Statements may not be indicative of the actual cost to be incurred by us upon

implementation. See Note 10 to the Consolidated Financial Statements for further information.

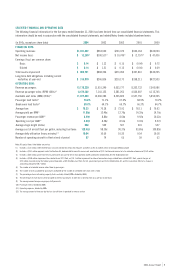

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

MARKET RISK-SENSITIVE INSTRUMENTS AND POSITIONS

We are subject to certain market risks, including interest rates and commodity prices (i.e., aircraft fuel). The adverse effects of changes in these

markets pose a potential loss as discussed below. The sensitivity analyses do not consider the effects that such adverse changes may have on

overall economic activity, nor do they consider additional actions we may take to mitigate our exposure to such changes. Actual results may differ.

See the Notes to the Consolidated Financial Statements for a description of our financial accounting policies and additional information.

INTEREST RATES

As of December 31, 2004 and 2003, the fair value of our long-term debt was estimated to be $344.9 million and $241.3 million, respectively, based

upon discounted future cash flows using current incremental borrowing rates for similar types of instruments or market prices. Market risk, estimated

as the potential increase in fair value resulting from a hypothetical 100 basis point decrease in interest rates, was approximately $11.2 million as

of December 31, 2004, and approximately $6.0 million as of December 31, 2003. Our long-term debt obligations that bear fixed rates of interest and

may be prepaid without penalty prior to their respective maturity dates and, therefore, a change in market interest rates generally would not affect

our financial position, results of operations or cash flows. If interest rates average 10 percent higher in 2005 than in 2004, for our variable rate debt,

our interest expense would increase by approximately $3.1 million.

AVIATION FUEL

Our results of operations are impacted by changes in the price of aircraft fuel. Aircraft fuel accounted for 24.6 percent and 21.5 percent of our

operating expenses in 2004 and 2003, respectively. Based on our 2005 projected fuel consumption, a 10 percent increase in the average price per

gallon of aircraft fuel for the year ended December 31, 2004, would increase fuel expense for the next twelve months by approximately $22.6 million,

including the effects of our fuel hedges. Comparatively, based on 2004 fuel usage, a 10 percent increase in fuel prices would have resulted in an

increase in fuel expense of approximately $24.8 million, including the effects of our fuel hedges. In 2002, we terminated our fuel-hedging contracts

consisting of swap agreements and entered into fixed-price fuel contracts and fuel cap contracts to partially protect against significant increases

in aircraft fuel prices. At December 31, 2004, we had hedged approximately 23 percent of our projected fuel requirements for 2005, as compared to

approximately 29 percent of our projected fuel requirements for 2004 at December 31, 2003. During the first quarter of 2005, we entered into

additional fixed-price fuel contracts and fuel cap contracts that increased our fuel commitments to approximately 28 percent of our estimated fuel

needs for 2005.