Airtran 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE YEAR OF NEW.

Table of contents

-

Page 1

THE YEAR OF NEW. -

Page 2

-

Page 3

...entire fleet) was unveiled last June during a delivery ceremony at Seattle's Museum of Flight. Crew Members from AirTran Airways and employees of the Boeing Corporation joined kids and chaperones from CHRIS Kids, Inc., an Atlanta-based children's organization, to "pull" the new aircraft into service... -

Page 4

-

Page 5

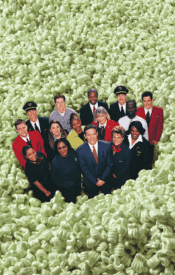

...were able to serve 13,170,230 customers this year! We're taking our Crew Members more places than ever. And they are taking us exactly where we intend to go. Picture opposite: Robert L. Fornaro, President and Chief Operating Officer (front row center), along with Crew Members. 2004 Annual Report 5 -

Page 6

... delivery of . 400 enthusiastic Crew Members efficient planes allow us th strategy. These remarkably grow key a is t flee our to tomers, this means more Adding the 737 aircraft range of service. For our cus our g ndin exte tly grea le our advanced 717s, will to keep our costs low whi e. The new 737s... -

Page 7

... MILLIONS 2000 2001 REVENUE PASSENGER MILES 2002 2003 2004...BILLIONS 2000 2001 AIRCRAFT IN FLEET 2002 2003 2004...New determination. 2000 2001 OPERATING COST PER AVAILABLE SEAT MILE (CASM) 2002 2003 2004...2000 2001 NON-FUEL OPERATING COST PER AVAILABLE SEAT MILE (CASM) 2002 2003 2004...2004 Annual Report ... -

Page 8

... Equity And Related Stockholder Matters MARKET INFORMATION Our common stock, $.001 par value per share, is traded on the New York Stock Exchange under the symbol "AAI." The following table sets forth the reported high and low sale prices for our common stock for each quarterly period during 2004... -

Page 9

... (miles) 628 Average cost of aircraft fuel per gallon, including fuel taxes 120.42¢ Average daily utilization (hours:minutes)(12) 10:54 Number of operating aircraft in fleet at end of period 87 Note: All special items listed below are pre-tax. (1) (2) (3) (4) Includes a $1.3 million credit related... -

Page 10

... of low fares, excellent customer service, an affordable Business Class product and one of the youngest all-Boeing aircraft fleets will equip us with the assets necessary to accomplish our plans for the upcoming year. YEAR IN REVIEW We concluded the 2004 year as one of only a few domestic passenger... -

Page 11

... our AirTran Airways branded credit card issued by a third party financial institution, in addition to change and cancellation fees derived from our overall increase in traffic. OPERATING EXPENSES Our operating expenses for the year increased $176.9 million (21.3 percent) on an available seat mile... -

Page 12

.... Aircraft insurance and security services increased $3.2 million (16.3 percent overall or a decrease of 5.0 percent on a CASM basis). The addition of fourteen new aircraft to our fleet during the year increased our total insured hull value and related insurance premiums. Marketing and advertising... -

Page 13

... our unit costs, or operating expenses per ASM, for 2003 and 2002: Year Ended December 31, 2003 Salaries, wages and benefits Aircraft fuel Aircraft rent Maintenance, materials and repairs Distribution Landing fees and other rents Aircraft insurance and security services Marketing and advertising... -

Page 14

... commission for sales transacted through the travel agent section of our website. Our commission cost savings was partially offset by increased computer reservation system and credit card fees. The additional transaction volume derived from our growth in revenue passengers generated the escalation... -

Page 15

..., aircraft purchase deposits required for aircraft scheduled for delivery in future periods and an increase in available-for-sale securities. The primary increase in our investing activities for 2004 was related to the acquisition of support equipment, building improvements and upgrades to... -

Page 16

... us to purchase the aircraft at predetermined prices on specified dates during the lease term. We have not consolidated the related trusts because even taking into consideration these purchase options, we are still not the primary beneficiary based on our cash flow analysis. 16 2004 Annual Report -

Page 17

... the use of APB 25 and the intrinsic value method of accounting for stock-based compensation, and requires companies to recognize the cost of employee services received in exchange for awards of equity instruments based on the grant date fair value of those awards, in the financial statements. The... -

Page 18

... We have not yet determined which model we will use to measure the fair value of employee stock options upon the adoption of SFAS 123R. See Note 10 to the Consolidated Financial Statements for further information. SFAS 123R also requires that the benefits associated with the tax deductions in excess... -

Page 19

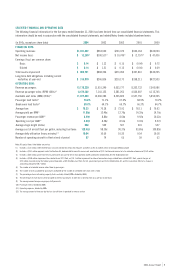

... data) Year ended December 31, OPERATING REVENUES: Passenger Other Total operating revenues OPERATING EXPENSES: Salaries, wages and benefits Aircraft fuel Aircraft rent Maintenance, materials and repairs Distribution Landing fees and other rents Aircraft insurance and security services Marketing and... -

Page 20

... and equipment OTHER ASSETS: Intangibles resulting from business acquisition Trademarks and trade names Debt issuance costs Deferred income taxes-noncurrent Other assets TOTAL ASSETS LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES: Accounts payable Accrued and other liabilities Air traffic... -

Page 21

... fuel Prepaid aircraft rent Other assets Accounts payable, accrued and other liabilities Air traffic liability NET CASH PROVIDED BY OPERATING ACTIVITIES INVESTING ACTIVITIES: Purchases of property and equipment Aircraft purchase deposits (payments) refunds Increase in available-for-sale securities... -

Page 22

... stock under stock purchase plan Issuance of common stock for debt Issuance of common stock in secondary offering Issuance of common stock for detachable purchase stock warrants exercised Buy back of detachable stock purchase warrants Tax benefit related to exercise of nonqualified stock options Net... -

Page 23

... as available-for-sale securities and stated at fair value. ACCOUNTS RECEIVABLE Accounts receivable are due primarily from major credit card processors, travel agents, co-branded credit card arrangements, overpayments made to a wet-lease partner, and from municipalities related to guaranteed... -

Page 24

...financial statements. During 2004 and 2003, we adjusted our tax valuation allowance based on current profitability and future forecasts and on the realization of net operating loss carryforwards and credits, as judged by us, to be more likely than not. STOCK-BASED COMPENSATION We grant stock options... -

Page 25

...disclosures, the estimated fair value of stock compensation plans and other options are amortized to expense primarily over the vesting period. In December 2004, the Financial Accounting Standards Board (FASB) issued Statement of Financial Standards 123R, (SFAS 123R) "Share-Based Payment." SFAS 123R... -

Page 26

...80% of the purchase price of 16 of the B737 aircraft should AirTran Airways be unable to secure financing from the financial markets on acceptable terms. During 2005, AirTran Airways is scheduled to take delivery of six B717 aircraft to be leased through an affiliate of the aircraft manufacturer and... -

Page 27

... derivative instruments used to hedge fuel costs as cash flow hedges in accordance with SFAS 133. Therefore, all changes in fair value that were considered to be effective were recorded in "Accumulated other comprehensive loss" until the underlying aircraft fuel was consumed. 2004 Annual Report 27 -

Page 28

...these available-for-sale securities at December 31, 2004 was approximately $27.0 million. The fair values of our long-term debt are based on quoted market prices, if available, or are estimated using discounted cash flow analyses, based on our current incremental borrowing rates for similar types of... -

Page 29

... rights related to Holdings' 7.75% Series B Senior Convertible Notes. The conversion resulted in a decrease of Holdings' overall debt of $5.5 million. In connection with the conversion, Holdings issued approximately 1.0 million shares of its common stock to an aircraft manufacturer affiliate... -

Page 30

...the end of the lease term at fair market value, and two have purchase options based on a stated percentage of the lessor's defined cost of the aircraft at the end of the 13th year of the lease term. Forty-one of the B717 leases are the result of sale/leaseback transactions. Deferred gains from these... -

Page 31

... and events that change stockholders' equity. Other comprehensive income (loss) is composed of changes in the fair value of our derivative financial instruments that qualified for hedge accounting. Comprehensive income totaled $12.5 million, $101.1 million and $16.8 million for 2004, 2003 and 2002... -

Page 32

... accounted for our employee stock options granted subsequent to December 31, 1994, under the fair value method of that statement. The fair value for these options was estimated at the date of grant using the Black-Scholes option pricing model with the following weighted-average assumptions for 2004... -

Page 33

...2002 with option prices less than the market price of the stock on the date of grant. During 2004, we granted stock awards to our officers and key employees pursuant to our 2002 Long-Term Incentive Plan. Stock awards are grants that entitle the holder to shares of our common stock as the award vests... -

Page 34

...): 2004 Tax computed at federal statutory rate State income tax, net of federal tax benefit Debt discount amortization Utilization of preacquisition net operating loss carryforwards Stock grant, nondeductible compensation expense Other Valuation reserve, including the effect of changes to prior year... -

Page 35

... market value on the offering date. The Board of Directors determines the discount rate, which was increased to 10 percent from 5 percent effective November 1, 2001. We are authorized to issue up to 4 million shares of common stock under this plan. During 2004, 2003 and 2002, the employees purchased... -

Page 36

... other locations. The results of the second quarter of 2003 included a reimbursement of security fees of $38.1 million under the Wartime Act and a charge of $1.8 million related to the write off of the unamortized portion of debt discount and issuance costs when an aircraft manufacturer affiliate... -

Page 37

... in relation to the basic financial statements taken as a whole, present fairly in all material respects the information set forth therein. We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of AirTran Holdings... -

Page 38

... 13a-15(f) under the Securities Exchange Act of 1934. Our internal control over financial reporting is designed to provide reasonable assurance to management and board of directors regarding the preparation and fair presentation of published financial statements. Because of its inherent limitaitons... -

Page 39

..., in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of AirTran Holdings, Inc. as of December 31, 2004 and 2003, and the related consolidated statements of income, stockholders' equity, and cash flows for each of the... -

Page 40

Notes 40 2004 Annual Report -

Page 41

Notes 2004 Annual Report 41 -

Page 42

... Company's Form 10-K and other Exchange Act filings made with the Securities and Exchange Commission are available free of charge on our website, aritran.com, or upon request by writing: AirTran Holdings, Inc. Attn: Investor Relations 9955 AirTran Blvd. Orlando, FL 32827 Corporate Governance Copies... -

Page 43

...) Newport News / Williamsburg Kansas City Las Vegas Wichita Raleigh / Durham Charlotte Memphis Los Angeles (LAX) Atlanta Myrtle Beach Savannah / Hilton Head Dallas / Ft. Worth Jacksonville Gulfport / Biloxi New Orleans Pensacola Orlando Tampa Sarasota / Bradenton Ft. Myers Grand Bahama Island... -

Page 44

AirTran Holdings, Inc. Annual Report 2004 airtran.com