Air New Zealand 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

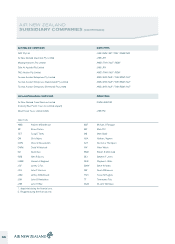

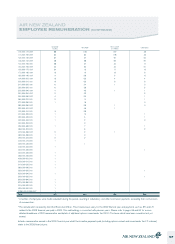

AIR NEW ZEALAND

EMPLOYEE REMUNERATION

REMUNERATION

In order to attract and retain talented individuals, Air New Zealand’s performance and reward strategy is intertwined with both the recruitment philosophy

- to source inspiring people, and our capability development agenda - to nurture future leaders and provide succession pipelines into key roles. Adopting

an holistic view of the employee experience, Air New Zealand provides a value proposition which is geared towards attracting high performing individuals,

providing rich developmental opportunities and recognising achievement through targeted, market premium, performance and reward initiatives.

Air New Zealand’s remuneration strategy is underpinned by a pay for performance philosophy and accordingly positions base pay below the market

median for all Individual Employee Agreements (IEAs) including the Chief Executive Officer (CEO) and uses annual performance incentives to create

opportunities for employees to achieve market median or superior remuneration levels.

The overall remuneration package for the CEO is designed to provide remuneration based on performance against agreed targets, align actions with

shareholder interests and balance competitiveness with affordability. The CEO’s total remuneration package is made up of three components:

• Fixed base salary;

• Annual performance incentive and

• Long term incentives.

FIXED BASE SALARY

Over the course of the 2009 financial year, CEO Rob Fyfe earned a base salary of $1,200,000 (2008 financial year: $1,200,000) paid in cash.

This has remained fixed since July 2007.

ANNUAL PERFORMANCE INCENTIVE

The annual performance incentive component is delivered through the Air New Zealand Short Term Incentive Scheme (STI). The measures used in

determining the quantum of the STI are set annually by the Board. Targets for the CEO relate to both company performance (70% weighting) and

individual targets (30% weighting).

The main factors for assessment are:

• Financial performance;

• Business performance, competition and revenue;

• Strategy development and implementation;

• Improve people, culture and leadership.

All other employees in the STI scheme have similar company and individual targets but their weighting is split 50:50.

The annual value of the STI scheme for the CEO is set at 55% of base salary if all performance targets are achieved. If less than 90% of target is

achieved, no STI is payable. Up to 110% of base salary is payable for outstanding performance.

For the 2009 financial year, Rob Fyfe earned a total STI payment to the value of $1,240,800 (2008 financial year: $287,100). This payment will be

made in the 2010 financial year.

At the beginning of each financial year the Board sets a financial target for the Company for incentive payments which in the 2009 financial year was

materially exceeded. Furthermore, whilst profit for the year was down on the prior year, the relative financial performance of Air New Zealand significantly

exceeded the industry peer group.

65