Air New Zealand 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

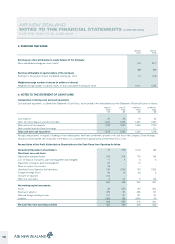

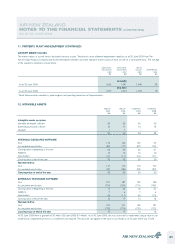

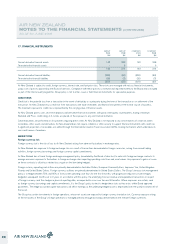

5. EARNINGS PER SHARE

GROUP

2009

GROUP

2008

Earnings per share attributable to equity holders of the Company

Basic and diluted earnings per share (cents) 2.0 20.7

$M $M

Earnings attributable to equity holders of the Company

Earnings for the purpose of basic and diluted earnings per share 21 218

Weighted average number of shares (in millions of shares)

Weighted average number of ordinary shares for basic and diluted earnings per share 1,061 1,055

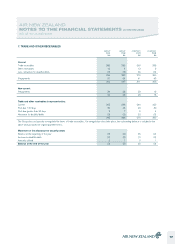

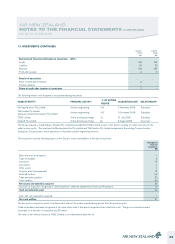

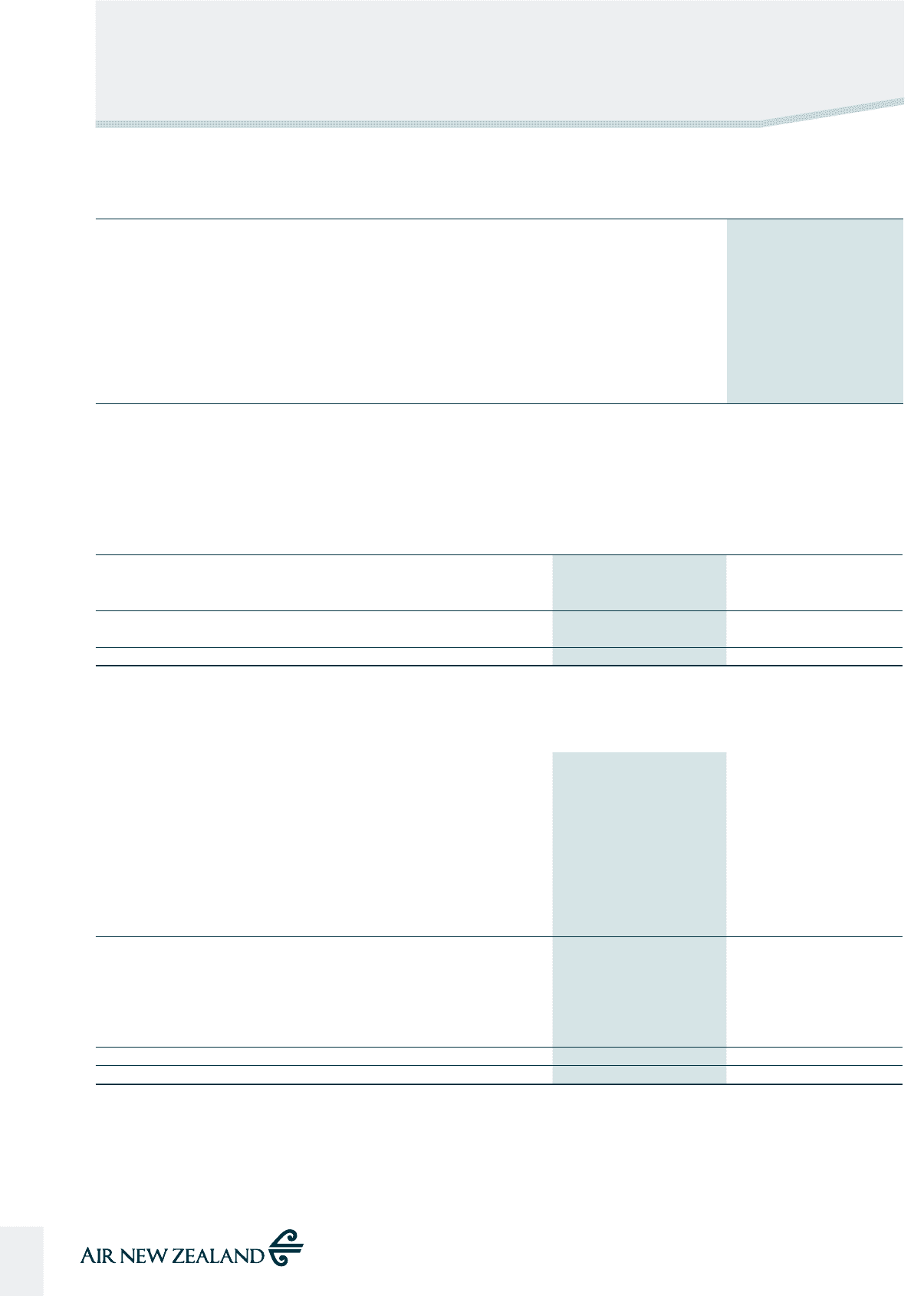

6. NOTES TO THE STATEMENT OF CASH FLOWS

Composition of closing cash and cash equivalents

Cash and cash equivalents, as stated in the Statement of Cash Flows, are reconciled to the related balances in the Statement of Financial Position as follows:

GROUP

2009

$M

GROUP

2008

$M

COMPANY

2009

$M

COMPANY

2008

$M

Cash balances 26 33 19 22

Other short term deposits and short term bills 1,547 1,256 1,547 1,257

Bank and short term deposits 1,573 1,289 1,566 1,279

Bank overdraft and short term borrowings - - - (1)

Total cash and cash equivalents 1,573 1,289 1,566 1,278

Receipts and payments in respect of funding to/from related parties have been combined to present a net cash flow in the Company. Given the large

amounts involved and the short maturities of the deals, it is considered more appropriate to present these flows as net.

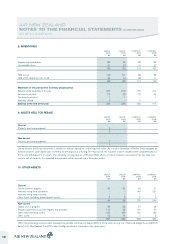

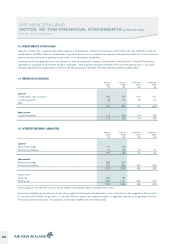

Reconciliation of Net Profit Attributable to Shareholders to Net Cash Flows from Operating Activities:

Net profit attributable to shareholders 21 218 (118) 184

Plus/(less) non-cash items:

Depreciation and amortisation 276 318 175 194

Loss on disposal of property, plant and equipment and intangibles 11 4 8 6

Impairment of property, plant and equipment 81 - 14 -

Share of surplus of associates (3) - - -

Unrealised losses/(gains)on fuel derivatives 130 (129) 130 (129)

Foreign exchange losses 36 16 34 2

Discount on aquisition (10) - - -

Other non-cash items 8 21 6 104

550 448 249 361

Net working capital movements:

Assets 83 (25) 157 (34)

Revenue in advance (96) 81 (98) 101

Deferred foreign exchange losses 131 81 131 81

Liabilities (182) 158 (209) 113

(64) 295 (19) 261

Net cash flow from operating activities 486 743 230 622

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

FOR THE YEAR TO 30 JUNE 2009

16